Federal Spending Odds & Ends, Why DOGE is necessary

9 videos

Updated 5 months ago

In short, these videos will chronicle the federal spending tsunami & why we need to put an end to it. #DOGE

They might focus on overall federal spending or just a specific facet of it. We need to start chiseling away at this national debt posthaste or your grandchildren might live in a county that resembles a dystopian hell-scape.

The Soviet Union collapsed because of government mismanagement & a fiat currency that was worthless. It could happen here, we have run out of other peoples' money

-

Federal Spending Odds & Ends: Interest Payments/Transfer Payments to Individuals

UTubekookdetectorFederal Spending Odds & Ends: Washington is a giant ATM machine #DOGE Federal Spending data https://web.archive.org/web/20240705083452/https://www.whitehouse.gov/omb/budget/historical-tables/ https://web.archive.org/web/20241130122049/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist_fy2025.zip https://web.archive.org/web/20241208132545/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z2_fy2025.xlsx https://web.archive.org/web/20241222225328/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist11z1_fy2025.xlsx *** U.S. Population Data https://www.census.gov/data/datasets/time-series/demo/popest/2020s-counties-total.html https://www.census.gov/data/datasets/time-series/demo/popest/2010s-counties-total.html https://www2.census.gov/library/publications/2011/compendia/statab/131ed/2012-statab.pdf U.S. Population 2000 = 282,172,000 * 2001 = 285,082,000 * 2002 = 287,804,000 * 2003 = 290,326,000 * 2004 = 293,046,000 * 2005 = 295,753,000 * 2006 = 298,593,000 * 2007 = 301,580,000 * 2008 = 304,375,000 * 2009 = 307,007,000 * 2010 = 308,745,538 * 2011 = 311,556,874 * 2012 = 313,830,990 * 2013 = 315,993,715 * 2014 = 318,301,008 * 2015 = 320,635,163 * 2016 = 322,941,311 * 2017 = 324,985,539 * 2018 = 326,687,501 * 2019 = 328,239,523 * 2020 = 331,464,948 * 2021 = 332,048,977 * 2022 = 333,271,411 * 2023 = 334,914,895 * Grand Total = 7,473,134,960 *** In this edition I’m going to cover payments to individuals by our federal government & interest payments on our debt (net interest). Head over to Table 11.1 kids & we’re going to first tally “Payments for individuals & “As Percentages of Total Outlays.” FY (Fiscal Year) 1970-2023 average = 56.59% of ALL federal outlays * FY 2000-2023 average = 66.095% of ALL federal outlays. Our federal government has become a giant ATM machine. Now let’s look at some other time frames & this will demonstrate to you the jam we are in. I should also mention, one of the reasons the Democrats want to nationalize so many programs (and get GOP help, all too often) is to crash the economy (Ron Paul said as much on the House floor in circa 2011 – said this POTUS & Congress are trying to crash the economy), give states less autonomy & the states cannot create a fiat currency. If California were responsible for its unemployment programs, it would be more difficult during a COVID-style plandemic to pay much of the state to sit on its ass & do nothing. When Leviathan is in control, California can lock down & get Iowa (which did not lock down & has a higher % of people participating in the labor force) to pay for it. The same goes for food stamps/SNAP, Medicaid, etc. I digress. “Payments for individuals,” “As Percentages of Total Outlays” FY 1954-1961 (Eisenhower) average = 23.325% * FY 1962-1969 (JFK/LBJ) = 28.437% * FY 1978-1981 (Carter) = 47.275% * FY 1982-89 (Ronald Reagan) = 48.012% * FY 1994-2001 (Bill Clinton) = 59.437% * FY 2002-09 (George W. Bush) = 61.762% * FY 2010-17 (Barry Obongo) = 69.437% * FY 2018-2023 (Trump & Biden) = 69.283% Do you see how this is not sustainable? Do you want an economic collapse? A fiat currency is Collectivist wet dream & that’s part of the reason this spending continues unabated. Karl Marx would LOVE the Federal Reserve https://mises.org/mises-wire/why-marx-loved-central-banks “Chronic monetary inflation, for instance, discourages savings; running into ever greater amounts of debt gets cultivated; by central banks’ downward manipulation of the interest rate, the future needs get debased compared to present needs; the favoring of a sort of monetary “Deep State” comes at the expense of demolishing civil and entrepreneurial liberties.” “Today’s world depends on the fiat US dollar issued by the Fed more than ever. Effectively all other major currencies are built upon the Greenback, and it is the Fed that determines the credit and liquidity conditions in international financial markets. It effectively presides over a world central bank cartel which, if it is allowed to continue unimpededly, will eventually steer and control the world economy through its unassailable money production monopoly, effectively removing one of the most critical roadblocks against unrestricted state tyranny.” We need #DOGE more than ever! Once you see how much the federal budget en masse has grown https://rumble.com/v6qiakw-lyin-brian-tyler-cohen-is-really-worried-about-medicaid-spending.html this is even more disheartening. Now let’s run that spending (“Payments for individuals,” Table 11.1) adjusted for inflation & per capita. FY 2000-2023 (7,473,134,960 population & $61,100,000,000,000 spent) = $8,175.95 per capita FY 2002-09 ($15,361,500,000,000 & 2,378,484,000 population) = $6,458.52 per capita FY 2010-17 ($21,058,600,000,000 & 2,536,990,138 population) = $8,300.62 per capita FY 2018-2023 (1,986,627,255 population & $21,716,300,000,000 spent) = $10,931.24 per capita This is NOT sustainable, my friends. Transfer Payments to Individuals on a per capita basis & adjusted for inflation were >69% HIGHER FY 2018-23 than they were when George W. Bush was President. Dwell on that for a few minutes before you call (or write) your elected officials & politely raise hell over this profligate spending. We’re talking about the younger Bush president, not a guy who has been in the ground for decades & lived to a ripe old age. What Leviathan has done to the middle class is criminal. #DOGE Now go to Table 8.3 & we’re going to examine “Net Interest” outlays as a % of all federal outlays. Don’t forget how much federal spending has grown since the 1970s. This is a ticking time bomb. “Net Interest” outlays as a percentage of all federal outlays, FY 1970-2023 = 9.663% * “Net Interest” outlays as a percentage of all federal outlays, FY 2000-2023 = 7.487%. Now for some other time frames to give you a better idea. “Net Interest” outlays as a percentage of all federal outlays, FY 1982-89 = 13.225% * “Net Interest” outlays as a percentage of all federal outlays, FY 1994-2001 = 13.937% * Net Interest” outlays as a percentage of all federal outlays, FY 2002-09 = 7.625% * Net Interest” outlays as a percentage of all federal outlays, FY 2010-17 = 6.25% * “Net Interest” outlays as a percentage of all federal outlays, FY 2018-23 = 7.516% Bill Clinton was actually a pretty decent POTUS (especially after he got slapped down by the voters in 1994) & his spending increases minus “net interest” payments look really good. George W. Bush did a poor job on spending. Clinton got hit w/ higher interest rates & George lucked out. Now let’s run those numbers on an inflation-adjusted basis & average it for various time frames (Table 8.2). “Net Interest” outlays adjusted for inflation, FY 1970-2023 yearly average = $238.5 BILLION * “Net Interest” outlays adjusted for inflation, FY 2000-23 yearly average = $277.891 Billion. Now for some other time frames. “Net Interest” outlays adjusted for inflation, FY 2002-09 = $237.15 Billion per year * “Net Interest” outlays adjusted for inflation, FY 2010-17 = $239.037 Billion per year * “Net Interest” outlays adjusted for inflation, FY 2018-23 = $379.283 Billion per year. Does that make you cringe? Now let’s run those numbers on a per capita basis. “Net Interest” outlays adjusted for inflation per capita FY 2000-2023 = (7,473,134,960 population & $6,669,400,000,000) $892.45 “Net Interest” outlays adjusted for inflation per capita FY 2002-09 (2,378,484,000 population & $1,897,200,000,000) = $797.65 “Net Interest” outlays adjusted for inflation per capita FY 2010-17 ($1,912,300,000,000 & 2,536,990,138 population) = $753.76 “Net Interest” outlays adjusted for inflation per capita FY 2018-23 (1,986,627,255 population & $2,275,700,000,000) = $1,145.50. Does that demonstrate the yoke that this government is placing on your grandchildren? That bill will have to be paid, so we can engage in some spending cuts now (and real cuts, not cuts in growth) or we can continue down this primrose path & some of you will get to live through an economic catastrophe, comparable & maybe even worse than The Great Depression. “Net Interest” payments, adjusted for inflation per capita are 43.5% HIGHER FY 2018-23 when compared to FY 2002-09. Again, if you have not written your elected officials do so now. Tell them you support #DOGE & Congressional rescission packages so we can start paying down our national debt. Otherwise, there will be a reckoning & the Democrats have NO intention of cutting any spending. They want us to go off a cliff. That’s why they defend this frivolous NIH spending, a bloated HHS & all this ridiculous spending that has been going on for decades. They don’t want to cut any spending, get it? The GOP needs more Rand Paul & less Chuck Grassley & Mitch McConnell. I had to vote for Grassley because the other guy was even crazier. Hopefully this series of videos https://rumble.com/playlists/IIv11M6lVOE has helped out & helped you see the economic collapse we’re going to have if we don’t do something. It’s depressing, but the discussion needs to happen. I do this so you don’t have to – Mr. Chairman, I Yield Back!173 views 6 comments -

Lyin' Brian Tyler Cohen is really worried about Medicaid spending

UTubekookdetectorVanilla Midget Brian Tyler Cohen is really worried about Medicaid spending Sources: https://web.archive.org/web/20240705083452/https://www.whitehouse.gov/omb/budget/historical-tables/ https://web.archive.org/web/20250116091700/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z2_fy2025.xlsx https://web.archive.org/web/20250116091702/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z6_fy2025.xlsx https://web.archive.org/web/20250116091706/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z3_fy2025.xlsx https://web.archive.org/web/20241130122049/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist_fy2025.zip (new page location is https://www.govinfo.gov/app/collection/budget) *** U.S. Population Data https://www.census.gov/data/datasets/time-series/demo/popest/2020s-counties-total.html https://www.census.gov/data/datasets/time-series/demo/popest/2010s-counties-total.html https://www2.census.gov/library/publications/2011/compendia/statab/131ed/2012-statab.pdf *** This mental midget is afraid Republicans are going to cut Medicaid, after they find out the vast amounts of fraud involved in the program. Medicaid should be left over to the states, this way when California uses ObamaCare https://www.youtube.com/watch?v=vJsCeGjI-vc (which was just a vehicle to expand the permanent underclass via Medicaid expansion & get us a step closer to single-payer health care, as well as outlawing any non-government insurance) to put much of their state on Medicaid & 49 other states get to pay for it. Democrats often classify America’s health care system as “capitalistic” or “for-profit”, when that is far from the truth, https://rumble.com/v69yiaj-brian-tyler-cohen-supporters-luigi-mangione-and-shamsud-din-jabbar.html their arguments are from ignorance. Much like a drug-addled lunatic has imaginary enemies chasing him, all the problems in America emanate from the tiny brain pan of the typical Pedocrat. They’re angry at American Health Care & instead of being mad at the government, they go out & murder CEOs that are simply operating under a set of rules given to them by politicians, most of which who have never had a decent job in the private sector. Let’s use Federal Government Spending Data & see how much (I’ve done this before, let’s do it again https://www.youtube.com/watch?v=r6x5naQwXRw & no Pedocrats could give me any details on the trajectory of Medicaid spending, they would probably think it’s been cut massively, but that would be a lie) Medicaid spending has exploded since it was foisted upon us. Using Table 8.3 at the old archived OMB site, here’s Medicaid as a % of all federal spending outlays (and look at how federal spending has rocketed-up over the past 60+ years, that would be Table 8.2) since 1970. [NOTE: Congress changed the beginning & end of the FY back in 1976, beginning on October 1 instead of July 1, which still stands today. A new POTUS takes office in January, but his first full FY will not begin until October 1. E.G. Barack Obama became POTUS on 1/20/09, but his first full FY (FY2010) did not begin until 10/1/09. NOTE: Pertaining to Total Federal Spending, they technically spend more than is totaled, because they subtract “Undistributed Offsetting Receipts” from the en masse total, but I’m going to leave it as it is. In addition, I will start the clock at the BEGINNING of the new POTUS’ first FULL FY. This will avoid the invariable “that’s my economy” crap we heard from Obama, trying to take credit for the Trump economy prior to COVID] Medicaid spending as a % of all federal outlays FY 1970-2023 = 5.325% Medicaid spending as a % of all federal outlays 1978-81 (Jimmy Carter) = 2.425% Medicaid spending as a % of all federal outlays 1982-89 (Ronald Reagan) = 2.562% Medicaid spending as a % of all federal outlays FY 1994-2001 (Bill Clinton) = 6.162% Medicaid spending as a % of all federal outlays 2002-09 (George W. Bush) = 7.187% Medicaid spending as a % of all federal outlays 2010-2017 (Barack Obama) = 8.425% **ObamaCare was the Medicaid Expansion Act & nothing more, these numbers illustrate that** Medicaid spending as a % of all federal outlays 2018-2021 (Donald J. Trump) = 8.325% Medicaid spending as a % of all federal outlays FY 2022-23 (“Kid Sniffer” Joe Biden) = 9.7% [NOTE: You could for example, see Medicaid spending as a % of all federal outlays declining, but that wouldn’t necessarily mean Medicaid spending is being cut, just that the federal budget outside of it is growing so much faster, keep that in mind] Now, using Table 8.2 at old school OMB, let us tally Medicaid spending adjusted for inflation (and from 2000 on, I will tally that per capita, just to make you see the explosion in spending) from 1970-2023 Medicaid spending adjusted for inflation (FY2017$) FY 1970-2023 per FY average = $169.629 (Billions) Medicaid spending adjusted for inflation (FY2017$) 1978-81 (Jimmy Carter) = $36.625 Medicaid spending adjusted for inflation (FY2017$) 1982-89 (Ronald Reagan) = $48.1 Medicaid spending adjusted for inflation (FY2017$) 1994-2001 (Bill Clinton) = $144.125 Medicaid spending adjusted for inflation (FY2017$) 2002-09 (George W. Bush) = $223.537 Medicaid spending adjusted for inflation (FY2017$) 2010-2017 (Barack Obama) = $319.662 Medicaid spending adjusted for inflation (FY2017$) 2018-2021 (Donald J. Trump) = $424.075 Medicaid spending adjusted for inflation (FY2017$) FY 2022-23 per FY average (“Kid Sniffer” Joe Biden) = $513.8 (Billions) Adjusting for inflation, Medicaid spending was >220% HIGHER under Barry Obama than it was under Bill Clinton & it has rocketed up ever further since then, just to give you some context when these mentally ill goofballs screech about “Medicaid being cut.” Medicaid’s growth could be limited to whatever inflation is (and there would be a fight over what yardstick we use to determine the inflation rate, as well as whether it should simply rise at the inflation rate, trust me) & Democrats would scream that it’s being cut. Medicaid is a runaway freight train, it needs to be reined-in & the best way to do that would be to block grant it to the states for one https://web.archive.org/web/20250120061010/http://c3244172.r72.cf0.rackcdn.com/wp-content/uploads/2011/10/RestoreAmericaPlan.pdf (like Ron Paul wanted to do) & eventually give it over to the states. This way, California cannot take advantage of states that have much higher labor force participation rates & aren’t looking to enlarge the permanent underclass. U.S. Population 2000 = 282,172,000 * 2001 = 285,082,000 * 2002 = 287,804,000 * 2003 = 290,326,000 * 2004 = 293,046,000 * 2005 = 295,753,000 * 2006 = 298,593,000 * 2007 = 301,580,000 * 2008 = 304,375,000 * 2009 = 307,007,000 * 2010 = 308,745,538 * 2011 = 311,556,874 * 2012 = 313,830,990 * 2013 = 315,993,715 * 2014 = 318,301,008 * 2015 = 320,635,163 * 2016 = 322,941,311 * 2017 = 324,985,539 * 2018 = 326,687,501 * 2019 = 328,239,523 * 2020 = 331,464,948 * 2021 = 332,048,977 * 2022 = 333,271,411 * 2023 = 334,914,895 * Grand Total = 7,473,134,960 Now, let’s run the numbers, Medicaid spending per capita & see how it has exploded using that metric: FY 2000-23 average (7,473,134,960 population & $7,402,300,000,000 in cumulative, inflation adjusted Medicaid spending during that time frame, or $308,429,166,666.666 per year) = $990.52 per person. Medicaid Spending Per Capita FY 2002-09 (2,378,484,000 population & $1,788,300,000,000 Medicaid spending) = $751.86 per person. Medicaid spending per capita FY 2010-2017 (2,536,990,138 population & $2,557,300,000,000 Medicaid spending) = $1,008 per person. Medicaid spending per capita FY 2018-2021 (1,318,440,949 population & $1,696,300,000,000 Medicaid Spending) = $1,286.59 per person. Medicaid Spending Per Capita FY 2022-23 (668,186,306 population & $1,027,600,000,000 Medicaid spending) = $1,537.89 per person. You can see how Medicaid spending on an inflation-adjusted basis & per capita has absolutely rocketed-up since 1970 & we saw a massive spike under Obama due to ObamaCare. Even those spending levels are chump change compared to the massive growth in the program since Obama left office. Yet, [X] we constantly hear about Medicaid being on the chopping block, it’s like a rite of passage – trust funder & Low-testosterone troglodyte Sam Seder #samseder #majorityreport & vanilla midget Brian Tyler Cohen dutifully repeat, “The Republicans are going to cut Social Security, the Republicans are going to cut Medicare.” Yet, no reform ever happens, it’s a scare tactic. If David Pakman said it, it would sound like “Wepubwicans are gonna cut your Medicare.” For the record, I think David Pakman is a little slow. It’s time to block grant this program & set it on a trajectory to give it to the states, much like Education should be left to the states, not a federal task. Medicaid is on a trajectory to absolutely blow a hole in the budget, Democrats are going to keep asking for more & if you slow the rate of growth, that will be adjudged as “a cut.” [X] None of Sam Seder’s autistics or the underemployed lunch meat slicers on Brian Tyler Cohen’s channel know any of this. They’ve been duped. My job is to inform those on the fence, so they don’t get fooled. They don’t want Medicaid reform, they want Medicaid expansion so they can increase the permanent underclass, but I doubt the trust fund daddy left Sam Seder (and he only got his job at Err America because of daddy, but daddy couldn’t force people to listen, which is why it went belly-up) will be affected. How about the trajectory of “other means tested entitlements”? (Table 8.3) We’ll run it the same way we did Medicaid. If you want to know encompasses “Other Means Tested Entitlements”, https://web.archive.org/web/20240714175210/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist_intro_fy2025.pdf that will assist you. “Other Means Tested Entitlements” as a % of all Federal Outlays FY 1970-2023 = 6.472% “Other Means Tested Entitlements” as a % of all Federal Outlays FY 1978-81 (Jimmy Carter) = 5.2% “Other Means Tested Entitlements” as a % of all Federal Outlays FY 1982-89 (Ronald Reagan) = 4.45% “Other Means Tested Entitlements” as a % of all Federal Outlays FY 1994-2001 (Bill Clinton) = 6.35% “Other Means Tested Entitlements” as a % of all Federal Outlays FY 2020-09 (George W. Bush) = 6.787% “Other Means Tested Entitlements” as a % of all Federal Outlays FY 2010-17 (Barack Obama) = 8.425% “Other Means Tested Entitlements” as a % of all Federal Outlays FY 2018-21 (Donald J. Trump) = 10.25% [NOTE: As you may have noticed, much of the spike under Trump was due to COVID & the spendathon that started in late FY 2020 & into FY 2021] “Other Means Tested Entitlements” as a % of all Federal Outlays FY 2022-23 (Joe “The Nonce” Biden) = 9.2% Now another metric, “Other Means Tested Entitlements” spending (Table 8.2) adjusted for inflation: “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 1970-2023 per year average = $192.461 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 1978-81 average (Jimmy Carter) = $79.45 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 1982-89 average (Ronald Reagan) = 82.75 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 1994-01 average (Bill Clinton) = $147.625 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 2002-09 average (George W. Bush) = $211.687 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 2010-17 average (Barack Obama) = $319.275 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 2018-21 average (Donald J. Trump) = $561.425 (Billions) “Other Means Tested Entitlements” spending adjusted for inflation (FY2017$) FY 2022-23 average (“Creepy” Joe Biden) = $487.9 (Billions) [NOTE: Prior to WWII, when spending levels would spike because of a “crisis” or a war, soon after they would taper-off & the pols would at least try to get them back close to pre-crisis levels. Look at the spending under Biden & even Donald Trump, it’s well beyond Obama-era levels, they don’t want to go back, so they’re autistically repeating, “Medicaid is being cut, Republicans are cutting the welfare safety net.” It’s all B.S] Now, let’s run the numbers, “Other Means Tested Entitlements” spending per capita: “Other Means Tested Entitlements” spending per capita FY 2000-23 average (7,473,134,960 population & $7,783,200,000,000 in inflation-adjusted spending) = $1,041.49 per person “Other Means Tested Entitlements” spending per capita FY 2002-09 average (2,378,484,000 population & $1,693,500,000,000 inflation-adjusted spending) = $712 per person “Other Means Tested Entitlements” spending per capita FY 2010-17 (2,536,990,138 population & $2,554,200,000,000 inflation-adjusted spending) average = $1,006.78 per person “Other Means Tested Entitlements” spending per capita FY 2018-21 (1,318,440,949 population & $2,245,700,000,000 inflation-adjusted spending) = $1,703.29 per person “Other Means Tested Entitlements” spending per capita FY 2022-23 (668,186,306 population & $975,800,000,000 inflation-adjusted spending) = $1,460.37 per person I realize some of the gargantuan spending increases during COVID in FY2021 were signed by Joe Biden, but I’m not going through the rigmarole to try & separate it – unfortunately Trump was hoodwinked by Congress & the screeching from lunatics who wanted to use COVID to institute a Chinese-style totalitarian society & spending went into overdrive. Medicaid & “Other Means Tested Entitlements” are 18.9% of all federal outlays currently & were only one-eighth (12.512%) of all federal outlays during the Bill Clinton regime. Can you see how this is not sustainable? Bill Clinton left the Oval Office only 24 years ago, he’s still alive – we are not talking about Presidents who lived to a ripe old age & have been in the ground for decades. Get it? We’re not even talking about Social Security, Medicare, the Pentagon Base Budget (Plus OCO) & interest payments on the debt……. Yet. The Bernie Sanders’ & Elizabeth Warren’s of the world do not care, they have an agenda & I wonder if that includes lot of canned goods when the dollar collapses? Both of those relics will likely be in the ground when that happens, but the rest of us would rather not have that experience. This is why Medicaid should be block-granted to the states & eventually turned over to them entirely to stifle the Democrat plan to create a permanent underclass large enough to vote them into power long enough to stack the SCOTUS, take away firearms & have ballots mailed out to everyone willy-nilly. How much has federal spending en masse increased? This will further show you how much Medicaid & like programs have exploded & you’ll either laugh or get pissed off when you hear a GroomerCrat lie about “Republicans cutting these programs.” Total Federal Outlays (Table 8.2) adjusted for inflation (FY2017$) FY 1970-2023 per year average = $2,696.741 (Billions) Total Federal Outlays adjusted for inflation (FY2017$) FY 1978-81 = $1,655.875 Total Federal Outlays adjusted for inflation (FY2017$) FY 1982-89 = $1,960 Total Federal Outlays adjusted for inflation (FY2017$) FY 1994-01 = $2,416.212 [NOTE: This is still well below the 1970-2023 average; the following will demonstrate the explosion in spending by Washington] Total Federal Outlays adjusted for inflation (FY2017$) FY 2002-09 = $3,151.125 Total Federal Outlays adjusted for inflation (FY2017$) FY 2010-17 = $3,788.562 Total Federal Outlays adjusted for inflation (FY2017$) FY 2018-21 = $5,200.475 Total Federal Outlays adjusted for inflation (FY2017$) FY 2022-23 = $5,260.95 (Billions) That’s 5 TRILLION & a lot of change! That should be an eye-opener, now for Total Federal Outlays per capita (Table 8.2), adjusted for inflation, 2000-2023: FY 2000-23 average (7,473,134,960 population & $91,926,200,000,000 in spending) = 12,300.88 per person in FY 2017 constant dollars. Total Federal Outlays per capita, adjusted for inflation FY 2002-09 (2,378,484,000 population & $25,209,000,000,000 spending) = $10,598.76 per person Total Federal Outlays per capita, adjusted for inflation FY 2010-17 (2,536,990,138 population & $30,308,500,000,000 spending) = $11,946.63 per person Total Federal Outlays per capita, adjusted for inflation FY 2018-21 (1,318,440,949 population & $20,801,900,000,000 spending) = $15,777.65 per person Total Federal Outlays per capita, adjusted for inflation FY 2022-23 (668,186,306 population & $10,521,900,000,000 spending) = $15,746.95 per person in FY 2017 constant dollars. **Federal Spending Per Capita, adjusted for inflation is >48.5% HIGHER than during the FY 2002-2009 period. Think about that for a minute ** Democrats don’t even want to return us to FY 2019 spending, that will be seen as “a cut” & that would be a lie – most of them know it’s a lie, but they have an agenda. Now do you see the massive growth in Medicaid & “Other Means Tested Entitlements” spending in relation to the entire budget? The entire budget has exploded, those two spending categories have sprinted past that growth rate. Why have those programs grown so rapidly? Part of the reason is the breakdown of the nuclear family https://rumble.com/playlists/JaxVTLucdl0 in these United States, which has led to a lot of people (I know, there are a lot of kids that grow up & succeed in a single-parent household, but it’s not the way it was intended. My father knows a guy that was a meth addict at one time & got out of that, but it’s not an ideal path to take) not participating in the labor force, enlarging the permanent underclass. That brings us to our next metric, the Labor Force Participation Rate. https://data.bls.gov/timeseries/LNS11300061 Let’s start w/ 25-54 Year Old Men: The Labor Force Participation Rate for Men 25-54, January 1950-December 1959 average = 97.135% Labor Force Participation Rate for Men 25-54, January 1970-December 1979 = 94.753% Labor Force Participation Rate for Men 25-54, January 1982-December 1988 = 93.82% Labor Force Participation Rate for Men 25-54, January 1994-December 2000 = 91.725% Labor Force Participation Rate for Men 25-54, January 2002-December 2008 average = 90.648% Labor Force Participation Rate for Men 25-54, January 2010-December 2016 = 88.573% Labor Force Participation Rate for Men 25-54, January 2018-December 2020 = 88.675% (The average was 89.03% from October 2017-February 2020, Trump had a good thing going & COVID-19 ruined it. Barack Obama’s first full calendar year in office (2010) the average was 89.233%) Labor Force Participation Rate for Men 25-54 January 2022-December 2024 average = 89.008% [NOTE: I did this in a way so there was no bridge between presidencies & started effectively a year into their term, so they can’t blame the last guy in office.] How about Men Aged 25-34? https://data.bls.gov/dataViewer/view/timeseries/LNS11300164Q Labor Force Participation Rate Men 25-34, Quarter 1 1950-Quarter 4 1959 average = 97.167% Labor Force Participation Rate Men 25-34, Q1 1970-Q4 1979 = 95.58% Labor Force Participation Rate Men 25-34, Q1 1982-Q4 1988 = 94.485% Labor Force Participation Rate Men 25-34, Q1 1994-Q4 2000 = 93.085% Labor Force Participation Rate Men 25-34, Q1 2002-Q4 2008 = 91.91% Labor Force Participation Rate Men 25-34, Q1 2010-Q4 2016 = 89.11% Labor Force Participation Rate Men 25-34, Q1 2018-Q4 2020 = 88.45% (It was 89.2% in the time frame comprising calendar years 2018 & 2019) Labor Force Participation Rate Men 25-34, Q1 2022-Q4 2024 average = 89.133% https://data.bls.gov/dataViewer/view/timeseries/LNS11300062 Labor Force Participation Rate, Women 25-54, January 1970-December 1979 average = 55.087% Labor Force Participation Rate, Women 25-54, January 1982-December 1988 = 69.517% Labor Force Participation Rate, Women 25-54, January 1994-December 2000 = 76.251% Labor Force Participation Rate, Women 25-54, January 2002-December 2008 = 75.526% Labor Force Participation Rate, Women 25-54, January 2010-December 2016 = 74.308% Labor Force Participation Rate, Women 25-54, January 2018-December 2020 = 75.486% (The rate was 75.675% from October 2017-February 2020) Labor Force Participation Rate, Women 25-54, January 2022-December 2024 = 77.244% You might be thinking, “Joe Biden did pretty good on Labor Force Participation.” I’ll have some data later demonstrating that’s not really true. Look at all that government spending & how it hasn’t done much to our flagging labor force participation rates since the 1950s. Let’s add, amend & update something I did years ago https://web.archive.org/web/20220801231231/https://professor_enigma.webs.com/sam-seder-aoc-tax-the-rich & calculate spending (Table 8.2) per 100,000 NONFARM Employment https://data.bls.gov/toppicks?survey=bls (Select “Total Nonfarm Employment - Seasonally Adjusted - CES0000000001”) Total Federal Inflation-Adjusted Outlays FY 1970-75 = $7,399,400,000,000 & Total Nonfarm Employment (in Thousands) during the same time frame (July 1, 1969 to June 30, 1975) was 5,343,489 – which equals 5,343,489,000 Total Nonfarm Jobs. That’s $138,475,067 spent per 100,000 Nonfarm jobs. We’ll use that as a baseline for this exercise. [NOTE: THIS IS FISCAL YEARS, keep that in mind!] Total Federal Inflation-Adjusted Outlays ($15,680,000,000,000) per 100,000 Nonfarm jobs (9,392,325,000) FY 1982-89 (10/1/81 to 9/30/89) = $166,944,819 Total Federal Inflation-Adjusted Outlays ($19,329,700,000,000) per 100,000 Nonfarm jobs (10,624,606,000) FY 1994-01 = $181,933,334 Total Federal Inflation-Adjusted Outlays ($25,209,000,000,000) per 100,000 Nonfarm jobs (11,400,659,000) FY 2002-09 = $221,118,796 Total Federal Inflation-Adjusted Outlays ($30,308,500,000,000) per 100,000 Nonfarm jobs (11,639,330,000) FY 2010-17 = $260,397,290 Total Federal Inflation-Adjusted Outlays ($20,801,900,000,000) per 100,000 Nonfarm jobs (7,053,343,000) FY 2018-21 = $294,922,563 (For FY 2018-19 that total was $231,588,908 per 100,000 nonfarm jobs: 3,584,714,000 jobs & $8,301,800,000,000. COVID did a lot of damage) Total Federal Inflation-Adjusted Outlays ($10,521,900,000,000) per 100,000 Nonfarm jobs (3,678,424,000) FY 2022-23 = $286,043,696 Now, let us https://www.bls.gov/charts/employment-situation/employment-levels-by-industry.htm utilize another metric to illustrate for you even more how much of a clusterfunk we’re in. We’re going to tally inflation-adjusted total federal outlays per 100,000 PRIVATE jobs. This will show us that creating paper-pushing jobs at government agencies will create jobs, but it doesn’t create wealth. We could raise the labor force participation rate by creating a few more Cabinet-level agencies in Washington, filling them w/ useless people like Sam Seder, but it wouldn’t do the economy much good. We could also have a few million unemployed people completely drop out of the labor force & that would raise the labor force participation rate, but it wouldn’t make the economy better. Using this metric, if you’re able to slow the growth of federal spending & have job creation in the private sector going well, you’ll have good results. Citing the unemployment rate is bogus, as well as using a high watermark for federal spending (as the Dems did in the first year of Obama) & claiming, “We’re reducing the deficit” is a façade. This metric only goes back to February 2005, so I’ll begin in FY 2006, beginning October 2005. Total Federal Inflation-Adjusted Outlays (Table 8.2) FY 2006-23 ($75,291,000,000,000) per 100,000 PRIVATE jobs (25,665,472,000) = $293,355,213 Total Federal Inflation-Adjusted Outlays ($30,308,500,000,000) FY 2010-17 per 100,000 PRIVATE jobs (11,078,724,000) = $273,573,924 Total Federal Inflation-Adjusted Outlays ($20,801,900,000,000) FY 2018-21 per 100,000 PRIVATE jobs (5,984,197,000) = $347,613,890 Total Federal Inflation-Adjusted Outlays ($8,301,800,000,000) FY 2018-19 per 100,000 PRIVATE jobs (3,044,917,000) = $272,644,542 Again, COVID-19 did a lot of damage, Trump had a great trajectory going prior to it. Total Federal Inflation-Adjusted Outlays ($10,521,900,000,000) FY 2022-23 per 100,000 PRIVATE jobs (3,141,568,000) = $334,925,107 Just to give you an idea of how much damage COVID-19 & the lockdowns did to our country (and Trump made some errors on that, he signed legislation putting spending into overdrive, he & Congress own it. Biden/Harris doubled-down on that) & anyone who cries about “Spending being cut” if out of their mind: Total Federal Inflation-Adjusted Outlays ($52,269,000,000,000) FY 2006-2019 per 100,000 PRIVATE jobs (19,584,624,000) = $266,887,942 If the Trump economy had been allowed to continue (and again, he owns some of it, but I think Trump 2.0 is a lot more savvy) we were on a trajectory to have a lot less spending per 100,000 PRIVATE jobs. If Joe Biden & his Congress had spent a few trillion more to have full-employment & most of those job were paper-pushers at the Pentagon, the Dept. of Education & a Federal Ministry of Truth – would that be a success? Much of this spending is baked into the budget, so even when Republicans win, the Democrats don’t lose because of baseline budgeting & so-called Mandatory Spending basically being on autopilot. We have to address this (so-called “Means Tested Entitlements” & #DOGE has to find & eliminate much of this fraud, waste & erroneous payments attached to many federal programs) or we are headed for a financial catastrophe. Now, back to the game. Now let’s use another metric, courtesy of the BEA. We’ll tally spending (with the limited data I have) per 100,000 FTEs (Full Time Equivalent Employees) in “PRIVATE INDUSTRIES.” https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&1921=survey&_gl=1*1jbksft*_ga*NDc5NTAyMTExLjE3NDE2MDU3NzU.*_ga_J4698JNNFT*MTc0MTYwNTc3NS4xLjEuMTc0MTYwNTgxMy4yMi4wLjA.#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJDYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCIxOTUiXV19 archived https://archive.is/VvXOj 1980-1987 Table 6.5B. Full-Time Equivalent Employees by Industry https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&1921=survey&_gl=1*1jbksft*_ga*NDc5NTAyMTExLjE3NDE2MDU3NzU.*_ga_J4698JNNFT*MTc0MTYwNTc3NS4xLjEuMTc0MTYwNTgxMy4yMi4wLjA.#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJDYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCIxOTYiXV19 archived https://archive.ph/pVoo9 1993-2000 Table 6.5C. Full-Time Equivalent Employees by Industry (SEE NOTES!) https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&1921=survey&_gl=1*1jbksft*_ga*NDc5NTAyMTExLjE3NDE2MDU3NzU.*_ga_J4698JNNFT*MTc0MTYwNTc3NS4xLjEuMTc0MTYwNTgxMy4yMi4wLjA.#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJDYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCIxOTciXV19 archived https://archive.ph/EX3BB (it’s not exactly archiving correctly) Table 6.5D. Full-Time Equivalent Employees by Industry 2016-2023. If you want to look at years in smaller chunks & going back further than 1998 This is the one I will use & will include screenshots from the Excel for you https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&1921=survey&_gl=1*1jbksft*_ga*NDc5NTAyMTExLjE3NDE2MDU3NzU.*_ga_J4698JNNFT*MTc0MTYwNTc3NS4xLjEuMTc0MTYwNTgxMy4yMi4wLjA.#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDMsM10sImRhdGEiOltbIkNhdGVnb3JpZXMiLCJTdXJ2ZXkiXSxbIk5JUEFfVGFibGVfTGlzdCIsIjE5NyJdLFsiRmlyc3RfWWVhciIsIjE5OTgiXSxbIkxhc3RfWWVhciIsIjIwMjMiXSxbIlNjYWxlIiwiLTMiXSxbIlNlcmllcyIsIkEiXSxbIlNlbGVjdF9hbGxfeWVhcnMiLCIxIl1dfQ== 1998-2023 & from everything I was able to read from the BEA regarding reporting requirements, I believe this is done under the auspices of Federal Government Fiscal Years, ending September 30. https://archive.is/ZzvyT https://archive.is/ZzvyT/271aae678d8b255ae4b619b5ad0f10c1055940a3.jpg Total Federal Inflation-Adjusted Outlays ($96,809,900,000,000) FY 1998-2023 (Table 8.2) per 100,000 PRIVATE Full-Time Equivalent Employees (2,829,639,000) = $3,421,280,947 Total Federal Inflation-Adjusted Outlays FY 2002-09 ($25,209,000,000,000) per 100,000 PRIVATE Full-Time Equivalent Employees (837,921,000) = $3,008,517,509 Total Federal Inflation-Adjusted Outlays FY 2010-17 ($30,308,500,000,000) per 100,000 PRIVATE Full-Time Equivalent Employees (864,701,000) = $3,505,084,416 Total Federal Inflation-Adjusted Outlays FY 2018-21 ($20,801,900,000,000) per 100,000 PRIVATE Full-Time Equivalent Employees (469,269,000) = $4,432,830,636 Total Federal Inflation-Adjusted Outlays FY 2018-19 ($8,301,800,000,000) per 100,000 PRIVATE Full-Time Equivalent Employees (238,913,000) = $3,474,821,378 Total Federal Inflation-Adjusted Outlays ($10,521,900,000,000) FY 2022-2023 per 100,000 PRIVATE Full-Time Equivalent Employees (247,790,000) = $4,246,297,267 The COVID-19 spendathon did a lot of damage kids & the Democrats are going to try & categorize a rolling-back of that spending as “a cut”, when it is not. Joe Biden was spending 771 million more taxpayer dollars per 100,000 FTEs than Trump was when the economy was humming, prior to COVID bringing it to a screeching halt for about half of 2020. We dug ourselves a big hole. Let us run more experiments to hammer this home & you will see. Table 8.3 will be utilized again & let’s see what the % of all federal outlays is so-called DISCRETIONARY SPENDING. FY 1970-2023 average % of all Federal Outlays that is Discretionary Spending = 39.745% FY 1978-81 average % of all Federal Outlays that are Discretionary Spending = 46.875% FY 1982-89 average % of all Federal Outlays that are Discretionary Spending = 43.825% FY 1994-01 average % of all Federal Outlays that are Discretionary Spending = 34.675% FY 2002-09 average % of all Federal Outlays that are Discretionary Spending = 37.837% FY 2010-17 average % of all Federal Outlays that are Discretionary Spending = 34.2% FY 2018-21 average % of all Federal Outlays that are Discretionary Spending = 27.4% FY 2018-19 average % of all Federal Outlays that is Discretionary Spending = 30.4% FY 2022-23 average % of all Federal Outlays that is Discretionary Spending = 27.25% [NOTE: There are federal programs that bridge MANDATORY & DISCRETIONARY spending. E.G. “National Defense” has some small outlays under the Mandatory category. In addition, there’s likely a lot of waste under “Discretionary” spending, so it needs to be seriously evaluated as well.] The massive growth in Federal Spending has been fueled largely by so-called “Mandatory Programs.” Many of those could be block-granted & eventually left to the states, so jurisdictions that take advantage of economic downturns (COVID, housing crash) wouldn’t be sucking off the federal teat & costing everyone else a lot of money we don’t have. #DOGE *** [X] Medicaid is always being cut, even when it isn’t & other Communist caterwauling https://www.americanhealthlaw.org/content-library/journal-health-law/article/1ace7226-252b-43c8-a52d-960a4dd3df8f/The-Ongoing-Racial-Paradox-of-the-Medicaid-Program Medicaid is racist, there’s never enough funding & I’d wager to make it anti-racist will cost a lot more money. Medicaid spending per capita, adjusted for inflation has only more than doubled since the George W. Bush Administration & adjusting for inflation, Medicaid spending was >220% HIGHER under Barry Obama than it was under Bill Clinton. Since Obama, Medicaid spending adjusted for inflation has increased >60% under Biden. Yet, it’s being cut. They think you’re stupid. https://link.springer.com/article/10.1007/s40615-015-0113-z More whining about racial disparities, all this government spending has only benefitted White folks. I guess the COVID virus was also racist, it avoided Asian folks (and largely, White folks too), but sought out Blacks & AI/AN people. https://rumble.com/v2rgw38-covid-19-lockdowns-get-nuked.html No funding is ever enough, they intend to keep spending until your dollar is worthless, they intend to make you a ward of the state by demolishing your nest egg. They want Medicaid to be a catch-all for all their programs – paying for everyone’s birth control & gender reassignment/.transgender lunacy https://www.ama-assn.org/practice-management/medicare-medicaid/federal-funding-medicaid-program-should-not-be-capped-ama https://www.kff.org/medicaid/report/the-cost-of-not-expanding-medicaid/ https://www.nytimes.com/roomfordebate/2015/07/13/birth-control-on-demand/publicly-funded-birth-control-is-crucial https://healthlaw.org/resource/10-advocacy-steps-to-support-a-medicaid-expansion-in-your-state/ Leo Cuello needs an economics class, Medicaid expansion is not free dummy. Get a load of this: “Some state leaders will try and throw out big cost numbers instead of talking about the small percentage of spending that the costs represents. So instead of saying our state will only pay 4% more. They’ll say something like: this will cost the state $10 billion dollars over the next decade. That number sounds big, but it doesn’t tell you how much money that is compared to the overall budget. For example, $10 billion over a decade is only $ 1 billion a year. And if the state’s Medicaid budget is $25 billion a year, than $1 billion would only be a 4% increase.” That’s precisely why we are in the mess we’re in right now. 10 billion here, 10 billion there, 5 billion here. He also says this, “You will probably hear complaints that providing Medicaid Expansion coverage is too expensive. But, know the facts. Fact: Medicaid is the least expensive health insurance program in the country. Fact: Medicaid is by far the least expensive way to cover low income individuals, and is far less expensive than providing coverage in the Exchange.” Yes, even the Gulf of Mexico, er Gulf of America looks small when compared to the Pacific Ocean. I guess Leo Cuello doesn’t think Medicaid is racist though, that’s encouraging. Lastly, he says, “It is true that the Medicaid Expansion, by covering new people, will create some new costs to states. However, a lot of conservative state leaders are using fuzzy math to exaggerate the cost. For example, one thing they are doing is counting people who are already eligible for Medicaid in the Medicaid Expansion costs. Any time a new program starts, it generates attention, and some people who are already eligible but somehow weren’t enrolled for existing programs may try and enroll. This is not a cost of the Medicaid Expansion it’s the result of the state under-enrolling the existing Medicaid program to begin with! And note: no matter what, the state Exchanges will also be starting up in 2014, so all of these lost individuals will be identified at that time and end up entering the Medicaid program even if the state doesn’t take the Medicaid Expansion. Another popular trick is to assume that 100% of eligible individuals will enroll (meaning higher costs), even though in reality statistics show that on average 63% of individuals in programs such as this actually enroll. 5 You will need to correct the false information:The Governor quotes a cost of $3 billion dollars, but that includes $1 billion dollars for people who were already eligible and the state had simply failed to enroll.” It must not be that great a program if a third of those eligible don’t even bother. And if the Medicaid Expansion is going to cost less because some of those eligible will finally enroll, why the hell is the money being doled out then? Leo has no business sense whatsoever. https://www.healthinsurance.org/blog/the-inevitable-expansion-of-the-medicaid-expansion/ The ObamaCare Medicaid Expansion was a road to single-payer health care & the federal government makes it essentially free to all 50 states, so why not? https://www.americanprogress.org/article/medicaid-give-it-another-40/ I guess Medicaid isn’t racist? The piece talks about cuts to Medicaid, which are simply cuts in growth – not a new talking point from collectivists. And of course, it’s a single-payer Trojan Horse. https://www.commonwealthfund.org/publications/other-publication/2005/sep/medicaid-next-40-years This piece inadvertently points out that government health care has caused a cultural crisis, why is it celebrated that one-third of births (at that time) are to mothers are covered by Medicaid? It’s an expansion of the permanent underclass, which is what the Democrats want. The author says Medicaid spending surpasses Medicare, not sure where that’s coming from. He also says Medicaid is “chronically underfunded” & that is a lie. He may be so stupid he doesn’t know this. No spending is ever enough! Next… https://www.cbpp.org/sites/default/files/archive/2-18-05health.htm https://www.nbcnews.com/id/wbna11237564 https://www.cbsnews.com/news/medicaid-cut-to-balance-budgets/ https://www.npr.org/2005/02/08/4490212/budget-plan-would-dramatically-cut-medicaid-costs Again, Medicaid reductions in growth (baseline budgeting) masquerading as “cuts” to the program. Again, NO spending is enough, it will never be enough. https://psychiatryonline.org/doi/10.1176/pn.43.3.0007a With Leviathan footing the majority of the bill, why not expand Medicaid? https://www.cbpp.org/research/losing-out-states-are-cutting-12-to-16-million-low-income-people-from-medicaid-schip-and https://www.nytimes.com/2003/04/21/us/states-facing-budget-shortfalls-cut-the-major-and-the-mundane.html Aren’t we always in a budget crisis & aren’t states always cutting budgets? It’s oft-repeated scaremongering. States can’t print money & desecrate the fiat currency, Leviathan can – and Leviathan will dangle carrots (we’ll pay for the full expansion for the fist 3 years, it’s free!) to get you to bend the knee. What happens when Leviathan runs out of money? Essentially, we’ve been out of money for a very long time & there will be consequences if we do not reverse course. DOGE, are you listening? https://www.nytimes.com/2003/03/03/nyregion/new-york-which-made-medicaid-big-looks-to-cut-it-back.html Sometimes the pols find out when you engage in vote-buying schemes, the money will run out & states cannot print money. https://www.healthaffairs.org/content/forefront/myths-medicaid-expansion-and-able-bodied Argues that few Medicaid recipients are in good health but not working, but Dems still oppose work requirements for those that can289 views 22 comments -

Federal Spending Odds & Ends (Defense, Entitlements, Foreign Aid) #DOGE

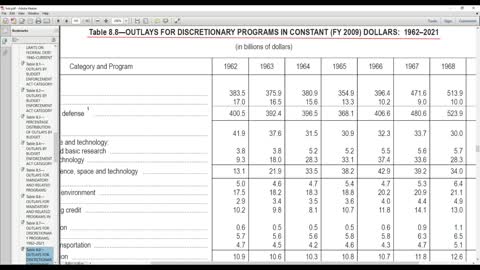

UTubekookdetectorFederal Spending Odds & Ends (Defense, Entitlements, Foreign Aid) #DOGE DOGE you know how to cut federal spending? Federal Spending data https://web.archive.org/web/20240705083452/https://www.whitehouse.gov/omb/budget/historical-tables/ https://web.archive.org/web/20241130122049/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist_fy2025.zip https://web.archive.org/web/20241228032104/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z3_fy2025.xlsx https://web.archive.org/web/20241229072453/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z8_fy2025.xlsx https://web.archive.org/web/20241208132545/https://www.whitehouse.gov/wp-content/uploads/2024/03/hist08z2_fy2025.xlsx *** U.S. Population Data https://www.census.gov/data/datasets/time-series/demo/popest/2020s-counties-total.html https://www.census.gov/data/datasets/time-series/demo/popest/2010s-counties-total.html https://www2.census.gov/library/publications/2011/compendia/statab/131ed/2012-statab.pdf *** In this edition I’m going to cover Defense Spending, Medicare & Social Security spending Let’s go to Table 8.3 first & tally what % of all federal outlays (if you want to see how much federal outlays have grown adjusted for inflation & other data, see https://rumble.com/playlists/IIv11M6lVOE) are “National Defense.” FY 1970-2023 average = 21.414% * FY 1982-89 average = 26.75% * FY 1994-2001 = 17.1% * FY 2002-09 = 19.35% * FY 2010-17 = 17.4% * FY 2018-2023 = 12.883% You can see how it plummeted relative to the Ronald Reagan era & if you followed my series on this, you know that before I posted it. That doesn’t mean there isn’t substantial waste at the Pentagon. I’d wager there are a lot of redundancies & a lot of paper-pushers that are unnecessary, it just means spending on “National Defense” is NOT growing as fast as the budget en masse. I would also negate ALL foreign aid, as Ron Paul has wanted to do since… forever. How about Social Security & Medicare spending combined as a percentage of the entire budget (Table 8.3)? FY 1970-2023 average = 30.132% * FY 1982-89 average = 27.112% * FY 1994-01 average = 33.424% * FY 2002-09 = 33.162% * FY 2010-17 average = 36.7% * FY 2018-23 average = 32.966% I tallied them together, but if you do this yourself, you’ll see that Medicare is catching-up w/ Social Security as a % of all spending. The only reason those programs collectively fell from FY 2018-23, relative to Barack Obama (FY2010-17) was the growth in “other means-tested entitlements” & other federal giveaways that began during the COVID-19 plandemic in FY 2020. Not turn to Table 8.8 & we will tally “Total National Defense” (“DoD-Military (051)” and “Other Defense”) outlays, adjusted for inflation. FY 1970-2023 average = $533.51 Billion * FY 1982-89 average = $547.737 Billion * FY 1994-2001 average = $455.287 * FY 2002-09 average = $614.287 Billion * FY 2010-17 average = $654.312 Billion * FY 2018-23 average = $654.966 Billion See how it declined under Bill Clinton (FY 1994-01) & then exploded again? However, those who say defense spending has done nothing but grow (relative to inflation) & insinuate it’s the biggest part of the budget are mistaken. I’ll be generous & say they’re retarded. Let’s look at “National Defense” spending per capita, FY 2000-2023 (Table 8.2, adjusted for inflation). [NOTE: Table 8.2 & Table 8.8 have the same data, just broken down differently] FY 2000-23 average = (7,473,134,960 population & $14,986,500,000,000 spending) $2,005.38 per capita. FY 2002-09 average = (2,378,484,000 population & $4,914,300,000,000 spending) $2,066.14 per capita FY 2010-17 average = (2,536,990,138 population & $5,234,500,000,000) $2,063.27 per capita FY 2018-2023 average = (1,986,627,255 population & $3,929,800,000,000) $1,978.12 per capita. Well golly gee, I thought the Pentagon was the only portion of the federal budget rising faster than inflation & everything else was falling. I thought Medicaid was being eradicated, along w/ our generous (and ineffective) welfare state. Well, I guess that’s not true. It’s akin to polls taken during the early 2000s & years following – the plebs usually thought crime was rising, but that’s not true. Perception does not equal reality. U.S. Population 2000 = 282,172,000 * 2001 = 285,082,000 * 2002 = 287,804,000 * 2003 = 290,326,000 * 2004 = 293,046,000 * 2005 = 295,753,000 * 2006 = 298,593,000 * 2007 = 301,580,000 * 2008 = 304,375,000 * 2009 = 307,007,000 * 2010 = 308,745,538 * 2011 = 311,556,874 * 2012 = 313,830,990 * 2013 = 315,993,715 * 2014 = 318,301,008 * 2015 = 320,635,163 * 2016 = 322,941,311 * 2017 = 324,985,539 * 2018 = 326,687,501 * 2019 = 328,239,523 * 2020 = 331,464,948 * 2021 = 332,048,977 * 2022 = 333,271,411 * 2023 = 334,914,895 * Grand Total = 7,473,134,960 Let’s tally Social Security & Medicare spending per capita (Table 8.2), 2000-2023 & see what we find, eh? FY 2000-2023 average (7,473,134,960 population & $31,155,900,000,000 spending) = $4,169.05 per capita. Oh noes, that’s >200% higher than the Pentagon, how can that be? FY 2002-09 average (2,378,484,000 population & $8,223,200,000,000 spending) = $3,457.32 per capita FY 2010-17 average (2,536,990,138 population & $11,122,100,000,000 spending) = $4,383.97 per capita FY 2018-2023 average (1,986,627,255 population & $10,150,000,000,000 spending) = $5,109.16 per capita. Who’d thunk it? Social Security & Medicare, combined with Medicaid & “Other Means Tested Entitlements” are roughly 53% of the entire federal budget by themselves. But “we don’t take care of people; we just build missiles.” Yes, there is waste at the Pentagon & our Founders were not fans of a standing army (our Navy needs to be robust enough to make 99% of evil actors say, “we don’t want any trouble”), but to say we spend the bulk of our taxpayer money on the Pentagon is beyond insane. It comes from people who just read headlines & never actually look. Shut off MSLSD & read something. Take your Ritalin too! Since I’m going to debunk some anti-Semites in the near future (I’m with Ron Paul, ALL foreign aid should be axed. It’s one of the main reasons I voted for him in the 2012 Iowa Caucus – there are a lot of screeching banshees who can’t name any foreign aid recipients, except for Israel), let’s take a gander at spending on “International Affairs.” I will be utilizing Table 8.8 for this. [NOTE: Table 3.2 is NOT adjusted for inflation but will give you an idea as to what encompasses foreign aid/international affairs. In addition, Table 3.2 adjusts the total by subtracting “International Financial Programs” receipts, I will just include the totals in Table 8.8 for this exercise] International Affairs FY 1970-2023 average yearly spending, adjusted for inflation = $40.115 BILLION International Affairs FY 2000-23 average yearly spending, adjusted for inflation = $48.508 BILLION International Affairs FY 2010-17 average yearly spending, adjusted for inflation = $51 BILLION International Affairs FY 2018-23 average yearly spending, adjusted for inflation = $56.683 BILLION Now let’s see that per capita, shall we? We’re still on Table 8.8 kids. International Affairs spending per capita, adjusted for inflation FY 2000-2023 (7,473,134,960 population & $1,164,200,000,000 spending) = $155.78 per capita International Affairs spending per capita, adjusted for inflation FY 2002-09 (2,378,484,000 population & $350,300,000,000 spending) = $147.27 per capita International Affairs spending per capita, adjusted for inflation FY 2010-2017 (2,536,990,138 population & $408,000,000,000 spending) = $160.82 per capita International Affairs spending per capita, adjusted for inflation FY 2018-2023 (1,986,627,255 population & $340,100,000,000 spending) = $171.19 per capita Not a big chunk of the budget & whatever direct foreign aid to Israel in the form of munitions, etc. is a tiny portion of that (but when you’re mentally ill, Israel is the hammer & everything looks like a nail) just so you know. However, as I said earlier, there are a bevy of “it’s not much of the federal budget” programs that have gotten us into this mess. Do you want the dollar to collapse? Do you want to travel to the store & find empty shelves, as happened in the Soviet Union & Yugoslavia, two entities that no longer exist? If not, then write to your elected officials NOW if you haven’t & tell them you support #DOGE finding this waste & Congressional rescission packages to end this. There’s a lot of low-hanging fruit (no offence intended Sam Seder) & a lot of unconstitutional spending that needs to end now. Do you want your grandchildren to experience an economic collapse? Me neither. In my (hopefully? Maybe?) final video in this Federal Spending #DOGE series, I’m going to look at another economic harbinger – interest payments on the debt. If you find this worthy, pass it on! Mr. Chairman, I Yield Back! Here are the two votes Senator Rand Paul was talking about https://www.senate.gov/legislative/LIS/roll_call_votes/vote1191/vote_119_1_00132.htm https://www.senate.gov/legislative/LIS/roll_call_votes/vote1191/vote_119_1_00077.htm see how your Senators voted I think it's time Chuck Grassley retired85 views 1 comment -

Mariannette Miller-Meeks triggers mentally ill Iowa City Democrats #DOGE