Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Taxes and IRS

TheFreedomFighter

- 7 / 46

1

The location of the United States

JoeLustica

I'm showing you piece by piece the truth behind your imprisonment. Get yourself out of the bond.

Here is the link to the page. https://www.law.cornell.edu/ucc/9/9-307

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

2

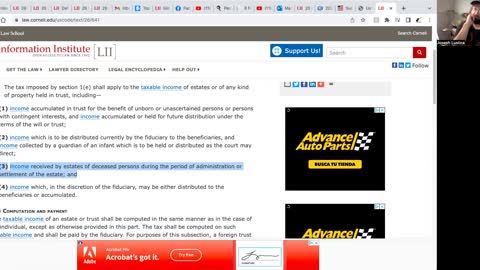

The United States corporation is taxed exempt!!!

JoeLustica

Here is the evidence that the United States is a tax exempt corporation.

This is a huge subchapter. Take your time and you'll find a treasure of tax exemptions. I'm sure you can find something that will fit your needs.

Link: https://www.law.cornell.edu/uscode/text/26/501

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2

comments

3

A Nonresident alien doesn't have to pay taxes.

JoeLustica

Who is a nonresident alien?

Definition: https://www.law.cornell.edu/cfr/text/43/426.8

Exemption code: https://www.law.cornell.edu/cfr/text/26/31.3402(f)(6)-1

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.7K

views

1

comment

4

The government IS liable for any vaccination injury

JoeLustica

In this video I show you the u.s. code that breaks down that you are entitled to compensation for any injury or death related to a vaccination. They have been hiding this data from you but it is there.

Link: https://www.law.cornell.edu/uscode/text/26/9510

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

5

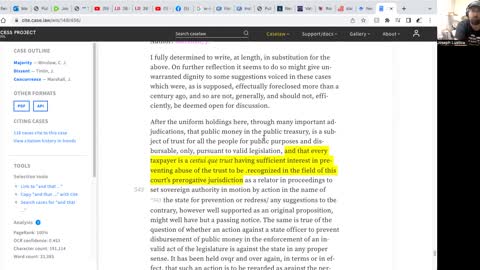

taxpayer and legal non-taxpayer

JoeLustica

The government recognizes taxpayers and legal non-taxpayers here's the proof: https://casetext.com/case/economy-plumbing-heating-v-united-states-2

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.68K

views

1

comment

6

You are not a taxpayer and you didn't even know it

JoeLustica

In this video I break down exactly why you are not a taxpayer. Unless you want to pay taxes you can opt out of this.

Links: https://www.irs.gov/individuals/international-taxpayers/nonresident-spouse

https://www.law.cornell.edu/uscode/text/26/7701

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3

comments

IRS code has no legality

JoeLustica

In this video I go over the IRS code that says specifically that it has no legal effect.

https://www.law.cornell.edu/uscode/text/26/7806

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.86K

views

9

comments

8

Tax exemptions

JoeLustica

In this video I go over what things can be tax exempt. Read this for yourself. Be sure to do your own due diligence.

https://www.law.cornell.edu/uscode/text/31/3124

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.57K

views

3

comments

9

Taxes are voluntary

JoeLustica

Here is the Code of Federal Regulations that clearly states that taxes are voluntary. Read it got yourself: https://www.law.cornell.edu/cfr/text/26/601.602

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.08K

views

10

comments

10

What taxes does a nonresident alien pay?

JoeLustica

In this video I go over the laws that make a nonresident alien pay taxes. (it's still voluntary so you don't have to anyways) This was another little big project.

https://www.law.cornell.edu/cfr/text/26/1.1-1

https://www.law.cornell.edu/cfr/text/26/1.989(a)-1#:~:text=A%20QBU%20is%20any%20separate,A%20corporation%20is%20a%20QBU.

https://www.law.cornell.edu/uscode/text/26/877

https://www.law.cornell.edu/uscode/text/26/872#a

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.91K

views

5

comments

11

The law that says you do not have to pay taxes

JoeLustica

In this video I show you the US code that says that you do not have to pay taxes and how they trick you into paying taxes. Also once you revoke your taxpayer status you are no longer able to join back into the taxpayer status.

https://www.law.cornell.edu/uscode/text/26/6013

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.77K

views

5

comments

12

You volunteered to have your taxes taken from your paycheck

JoeLustica

In this video I show you the code of federal regulations that shows that you are voluntarily having your taxes withheld from your paycheck and that your employer is acting as an agent for the IRS to take money from you.

https://www.law.cornell.edu/cfr/text/26/31.3402(p)-1

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.87K

views

2

comments

13

How to peacefully end the W-4 agreement with your employer

JoeLustica

In this video I show you the code of federal regulations that says you can legally and the W-4 agreement with your employer and a form that you could use or at least borrow from in order to ease the tension of the employer feeling any kind of worry regarding the W-4 agreement ending.

https://www.law.cornell.edu/cfr/text/26/31.3402(p)-1

https://famguardian.org/TaxFreedom/Forms/Employers/w-4t.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.69K

views

6

comments

14

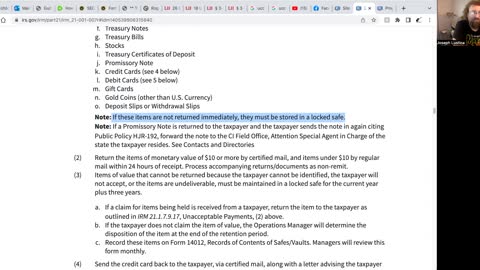

Don't cite HJR 192 when trying to pay taxes with a negotiable instrument

JoeLustica

In this video I show you that the IRS is well aware of HJR 192 and they do not like the fact that people are using it to pay their taxes.

https://www.irs.gov/irm/part21/irm_21-001-007r#idm140539908315840

https://www.irs.gov/compliance/criminal-investigation/program-and-emphasis-areas-for-irs-criminal-investigation

Here's the video that explains why they should be able to accept any of these forms of payment.

https://rumble.com/v13i9l3-when-a-business-refuses-your-payment.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.71K

views

6

comments

15

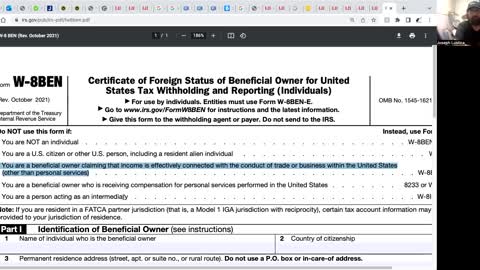

W-8BEN not accepted by your job? Maybe this can help

JoeLustica

In this video I show you the code of federal regulations that shows who is a beneficial owner according to the W-8BEN and that they legally can't refuse it as it pertains to you. (If it does pertain to you) remember this is for people living in the private a.k.a. state nationals a.k.a. non-resident aliens.

Yes it's confusing.

Disclaimer: The IRS does not recognize any status other than the following three: US citizen, resident alien, non-resident alien. If you are to claim anything other than that with your job you will be rejected. (I forgot to mention that in the video)

https://www.law.cornell.edu/cfr/text/26/1.1471-6

https://www.law.cornell.edu/uscode/text/26/1471

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

7.15K

views

4

comments

16

Cestui que trust and taxes

JoeLustica

In this video I go over how the cestui que trust is the taxpayer. Not you. But I go over a few definitions as well to clarify what that really means.

https://cite.case.law/wis/148/456/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.33K

views

5

comments

17

Treasury Decision

JoeLustica

In this video I show you a Treasury Decision (TD) that talks about a nonresident alien who is living in the USA. Evidence that the nonresident alien label has nothing to do with location but jurisdiction

http://www.supremelaw.org/td/Treasury.Decision.2313.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.97K

views

1

comment

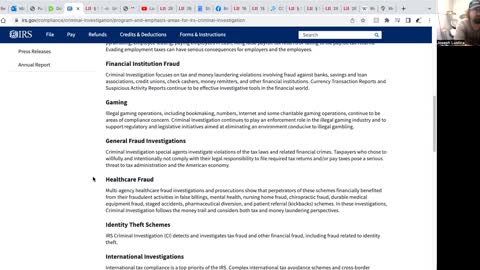

18

What does the IRS Criminal Investigation (CI) do?

JoeLustica

In this video I go over what the CI unit actually addresses. I know a lot of people are concerned and I honestly don't know what they are planning but I think that people are worried about nothing. But You never really know for sure.

https://www.irs.gov/compliance/criminal-investigation/program-and-emphasis-areas-for-irs-criminal-investigation

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.57K

views

1

comment

19

Why get a foreign EIN number?

JoeLustica

In this video I show you a good reason why you should get a for an EIN number. Your decision you don't have to do it if you don't want to but it looks like a good reason.

https://www.law.cornell.edu/uscode/text/26/641

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.39K

views

7

comments

20

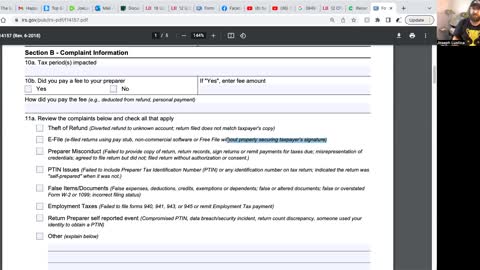

Getting the W-8BEN accepted by your job

JoeLustica

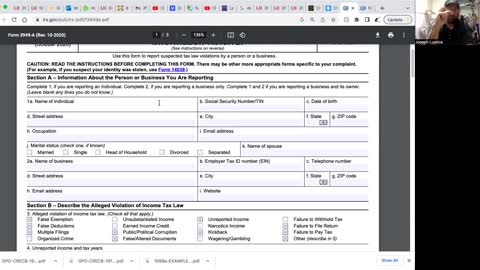

In this video I show you the form that you can use to report the person who is refusing to file your W-8BEN. This form can do a lot of good for a lot of other people it's not just limited to the W8-BEN so please share this with other people so that way they can address their own issues with this form.

https://www.irs.gov/pub/irs-pdf/f14157.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

8.2K

views

3

comments

21

How to enforce the coupon payment

JoeLustica

In this video I show you how you can use the form 39 49–8 to enforce your payment using the coupon that they send you.

https://www.irs.gov/pub/irs-pdf/f3949a.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

15.6K

views

58

comments

22

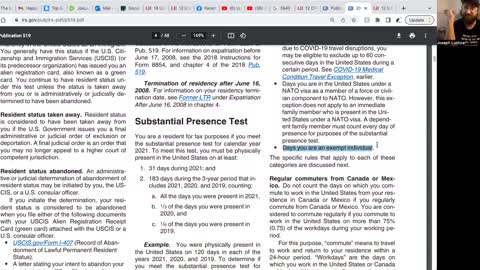

Why your status change isn't retroactive for taxes

JoeLustica

In this video I show you an IRS publication that breaks down exactly what a non-resident alien actually is. Good news is you can fit the criteria of being a non-resident alien as long as you are a national and not a citizen of the United States.

https://www.irs.gov/pub/irs-pdf/p519.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.44K

views

12

comments

23

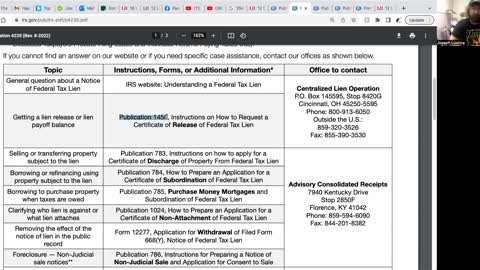

How to release a federal tax lien

JoeLustica

In this video I go over the process of how to release the United States government from redeeming property from its federal tax lien and getting rid of the lien completely. They will reject it if you have a tax liability still. I forgot to mention that in the video.

https://www.irs.gov/pub/irs-pdf/p487.pdf

https://www.irs.gov/pub/irs-pdf/p4235.pdf

https://www.irs.gov/pub/irs-pdf/p783.pdf

https://www.irs.gov/pub/irs-pdf/p1450.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.61K

views

14

comments

24

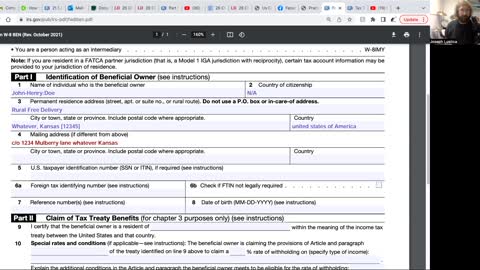

How to fill out the W-8BEN form

JoeLustica

In this video I show you how to fill out the W-8BEN form. you can fill it out right on the computer and then print it out after filling it out as such. sign it after you print it out.

https://www.irs.gov/pub/irs-pdf/fw8ben.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

10.1K

views

31

comments

25

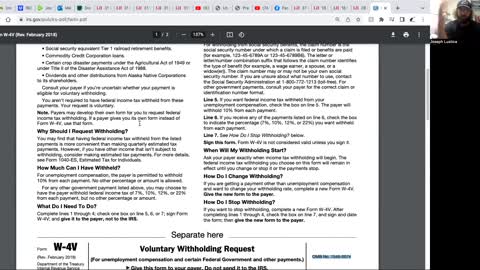

How to fill out the W-4V form

JoeLustica

In this video I show you how to fill out the W-4V form.

https://www.irs.gov/pub/irs-pdf/fw4v.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.85K

views

6

comments

26

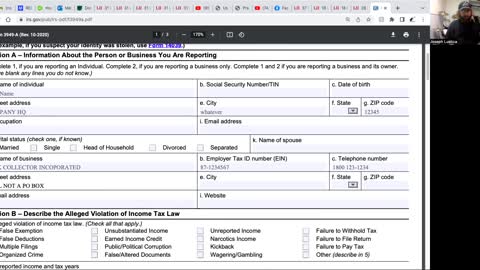

How to fill out the 3949a form

JoeLustica

In this video I show you how to fill out the 3949 form in order to report a business not claiming the income from the coupon payment that you sent them. As you'll see in this video is very important to keep track and records of what you are sending to companies..

https://www.irs.gov/pub/irs-pdf/f3949a.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.11K

views

22

comments

27

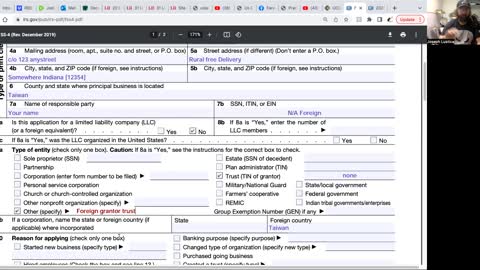

How to get the 98 EIN number (foreign grantor trust)

JoeLustica

Yes I put it back up.This was in popular demand so, here it is, haters can exit please.

In this video I go over how to get the EIN number for the foreign grantor trust also called the 98 number. I called them and did the entire process over the phone but yes I did fill out the SS4 form before calling them. They did recommend that I fax it over but I never did. They gave me the number right over the phone the phone call was about five minutes just be professional and to the point with them.

Here is their number:

1-267-941-1099

https://www.irs.gov/pub/irs-pdf/fss4.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

18.1K

views

164

comments

28

Filling out the 3949a form for the W4 sandwich

JoeLustica

In this video I go into how to use this form specifically for a W-4 sandwich rather than for the coupon payment that I showed in the earlier video.

I always recommend if you're really going to report on a judge for a court case make sure you do it with a W-4 sandwich don't do this form without doing that W-4 sandwich.

Here is the form: https://www.irs.gov/pub/irs-pdf/f3949a.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

7.56K

views

40

comments

29

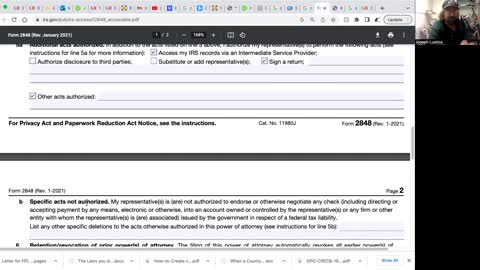

Filling out the 2848 form

JoeLustica

In this video I show you how to fill out the 2848 form in order to give your self power of attorney over your tax payer legal entity. I personally have not done this but I may do this in the future because I might find that this may help and getting certain instruments to be accepted.

https://www.law.cornell.edu/cfr/text/31/10.7

https://www.irs.gov/pub/irs-access/f2848_accessible.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.39K

views

6

comments

30

Private banker EIN

JoeLustica

In this video I go over how to get a private banker EIN that way you can do business as a private bank that is a nonprofit tax exempt organization.

https://www.irs.gov/pub/irs-pdf/fss4.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

10.7K

views

48

comments

31

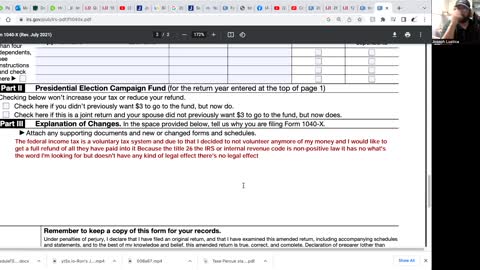

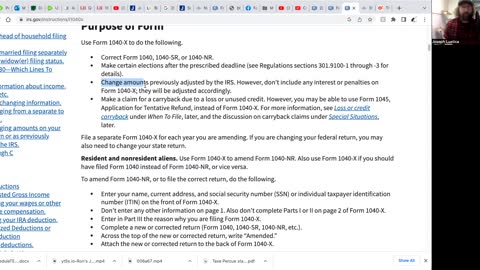

How to get back all your tax money for the year

JoeLustica

In this video I go over the 1040 X form which is a form that you can use the refund as much of the money that you've had taken out of your pay that you want.

I have not tried this myself so I do not know how far this goes or how efficient this works.

https://www.irs.gov/pub/irs-pdf/f1040x.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

7.14K

views

13

comments

32

More on the 1040 X form

JoeLustica

In this video I go over more information about the 1040 X form how it's used and successes that someone had using that form.

https://www.irs.gov/pub/irs-pdf/f1040x.pdf

https://www.irs.gov/instructions/i1040x

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

8.59K

views

12

comments

33

Revocation of election (part 1)

JoeLustica

In this video I go over the actual code that breaks down what a revocation of election actually is and that you actually have the right to do it and that once you do it it cannot be undone.

https://www.law.cornell.edu/uscode/text/26/6013

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

10.5K

views

41

comments

34

Revocation of election (part 2)

JoeLustica

In this video I go over the legislative intent of the 16th amendment as written by the President of the United States at the time William H. Taft. Taft was not the president who got the 16th amendment signed into the constitution but he is the one that set it up for to happen later on down the road with this legislative intent in this congressional record of the Senate.

This congressional record is from June 16, 1909

https://www.congress.gov/bound-congressional-record/1909/06/16/senate-section

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.09K

views

12

comments

35

Revocation of election (part 3) Nonresident alien

JoeLustica

In this video I go over exactly what a non-resident alien actually is. This is a vital part of the revocation of election process because you need to correctly assign your status and inform the IRS exactly what your status is. I don't know if you can do a revocation of election without becoming a national first I'm sure there's a way but I don't know what it is and I would recommend that if you want to do a revocation of election that you probably want to change your status to national anyway because you don't want to be connected to the federal corporation.

https://www.law.cornell.edu/uscode/text/8/1101

https://www.law.cornell.edu/cfr/text/26/1.1-1

https://www.law.cornell.edu/uscode/text/26/7701

Sorry I don't have a link for Black's law dictionary but if you would like to download it you can join my Telegram group and download it from there:

https://t.me/+nfvBqEzQqDA2ZjEx

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.47K

views

10

comments

36

Revocation of election (part 4)

JoeLustica

In this video I go over the legality of the IRS code title 26. It has no legal affect whatsoever. Read all this stuff for yourself!

https://uscode.house.gov/codification/legislation.shtml

https://www.law.cornell.edu/uscode/text/26/7806

https://www.lawinsider.com/dictionary/legal-effect

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.26K

views

14

comments

37

Revocation of election (part 5)

JoeLustica

When can you do a revocation of election? And how can you do it?

https://www.law.cornell.edu/cfr/text/26/1.6014-2

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.2K

views

15

comments

38

The difference between W-4V, W-8BEN, W-8BEN-E and the 1040-NR

JoeLustica

In this video I go over the difference between these IRS forms and their separate purposes.

https://www.irs.gov/pub/irs-pdf/fw4v.pdf

https://www.irs.gov/pub/irs-pdf/fw8ben.pdf

https://www.irs.gov/pub/irs-pdf/fw8bene.pdf

https://www.irs.gov/pub/irs-pdf/f1040nr.pdf

https://www.law.cornell.edu/cfr/text/26/1.1-1

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

10.6K

views

29

comments

39

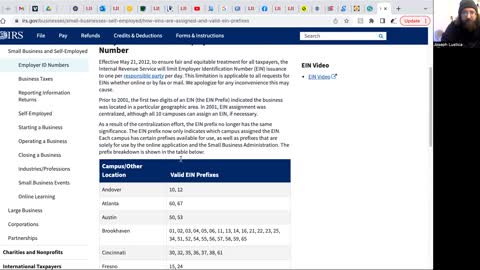

How the EIN prefixes are assigned

JoeLustica

In this video I go over how the EIN prefix numbers are assigned. People get hung up about 98 or 99 or 88 or 92 and all I'm doing is showing you what those numbers actually mean. I'm sure there's more to it than this but as simple as we can keep it it's just the campus.

https://www.irs.gov/businesses/small-businesses-self-employed/how-eins-are-assigned-and-valid-ein-prefixes

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joelustica

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: [email protected]

4.72K

views

2

comments

40

W4s, W2s, 1099s are all gift and Estate tax

JoeLustica

This video I go over the tax classes and how majority of the tax forms that people are using with their employer are gifting the state taxes and not an income tax.

https://www.irs.gov/pub/irs-utl/6209_section%202_2014.pdf

https://www.irs.gov/pub/irs-utl/6209_section%204_2014.pdf

https://www.irs.gov/privacy-disclosure/2022-document-6209-adp-and-idrs-information

Telegram: https://t.me/thefreedomfighters1

https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joelustica

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: [email protected]

5.81K

views

9

comments

41

Sales tax exemption

JoeLustica

This video I go over state sales tax exemption. There is no document to share because there are 50 states and not all 50 states have sales tax so I'm not going to go through each and every state to find out your particular states sales tax exemptions. I want you to be able to do the research yourself.

But this is just to let you know that you can use your passport number as your taxpayer number for the exemption. It absolutely works it's already run through the system and been accepted by a few different companies already.

Telegram: https://t.me/thefreedomfighters1

https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.22K

views

9

comments

42

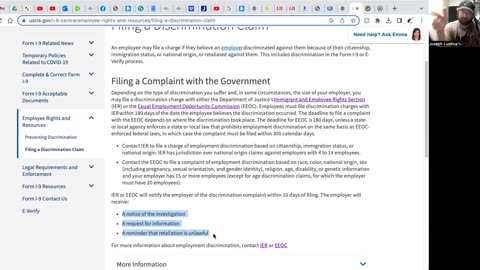

Your W8-BEN will be taken now

JoeLustica

In this video I go over exactly how to fully completely handle getting the W8-BEN form accepted by your employer and if you've been fired for trying to use that form how to get remedy for being fired.

W8-BEN: https://www.irs.gov/pub/irs-pdf/fw8ben.pdf

I-9: https://www.uscis.gov/sites/default/files/document/forms/i-9-paper-version.pdf

Filing: https://www.uscis.gov/i-9-central/employee-rights-and-resources/filing-a-discrimination-claim

Justice: https://www.justice.gov/crt/immigrant-and-employee-rights-section

EEOC: https://www.eeoc.gov/filing-charge-discrimination

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joelustica

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: [email protected]

16.6K

views

87

comments

43

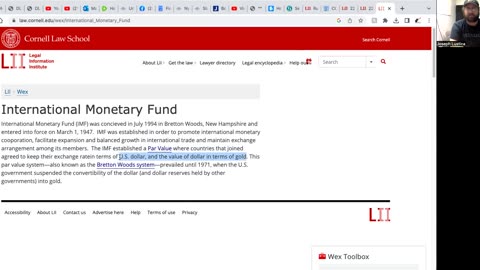

Who gets paid by the international monetary fund

JoeLustica

This video I go over who are the people who get their checks signed by the international monetary fund.

https://www.govinfo.gov/content/pkg/COMPS-10334/pdf/COMPS-10334.pdf

https://www.law.cornell.edu/uscode/text/5/part-III/subpart-D/chapter-53/subchapter-II

Telegram: https://t.me/+nfvBqEzQqDA2ZjEx

https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joelustica

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: [email protected]

4.79K

views

10

comments

44

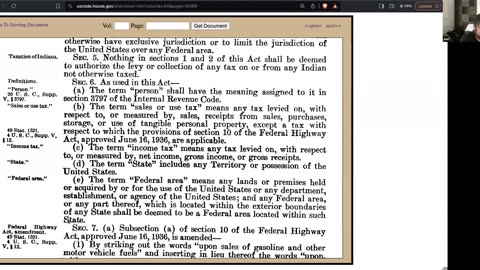

The Buck Act of 1940

JoeLustica

In this video I go over the Buck Act of 1940

https://uscode.house.gov/statviewer.htm?volume=54&page=1058#

Telegram: https://t.me/+nfvBqEzQqDA2ZjEx

https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to schedule a private meeting you can here: https://calendly.com/jlustica247/30min

If you'd like to donate you can here:

cashapp: https://cash.app/$joeguitar1

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: [email protected]

8.03K

views

23

comments

45

Is my EIN Foreign?

JoeLustica

In this video I go over the document locator to clear up the confusion about the 98 EIN and other EINs to clarify what is proof that it is foreign.

https://www.irs.gov/pub/irs-6209/section_4_2023.pdf

For One on One: https://calendly.com/jlustica247/60min

https://linktr.ee/joelustica

Telegram: https://t.me/+nfvBqEzQqDA2ZjEx

https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joeguitar1

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: [email protected]

5.76K

views

19

comments

46

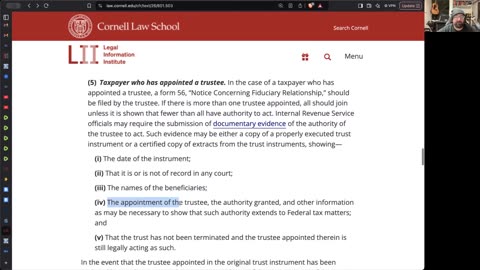

Understanding the form 56

JoeLustica

In this video I go over what the Form 56 is actually used for. Too many people have a confusion on this form and I hope this clears up this form and the confusion surrounding it.

https://www.law.cornell.edu/cfr/text/26/601.503

https://www.ssa.gov/oact/tr/trustees.html

https://www.irs.gov/pub/irs-pdf/f56.pdf

For One on One: https://calendly.com/jlustica247/60min

https://linktr.ee/joelustica

Telegram: https://t.me/+nfvBqEzQqDA2ZjEx

https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joeguitar1

venmo: https://venmo.com/code?user_id=1690

6.99K

views

14

comments

IRS code has no legality

3 years ago

1.86K

In this video I go over the IRS code that says specifically that it has no legal effect.

https://www.law.cornell.edu/uscode/text/26/7806

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

Loading 9 comments...

-

6:27

6:27

GreenMan Studio

12 hours agoTHE RUMBLE COLLAB SHOW Ep. 15 w/ GreenMan Reports

665 -

25:33

25:33

marcushouse

22 hours ago $21.18 earnedDid SpaceX’s Starship Version 3 Pass Its First Big Test?

132K19 -

15:23

15:23

Sideserf Cake Studio

21 hours ago $0.92 earnedI Tried to Make a functional Rubik's Cube Cake.

11.7K11 -

6:59:51

6:59:51

Rallied

11 hours ago $7.31 earnedSolo Challenges + High Vibrations

110K6 -

3:13:39

3:13:39

BlackDiamondGunsandGear

8 hours agoAfter Hours Armory / Customer Story Time

24.6K4 -

2:00:29

2:00:29

Badlands Media

23 hours agoDevolution Power Hour Ep. 430: Psyops, Distractions, and Reading the Week Between the Lines

132K34 -

10:39:33

10:39:33

GritsGG

16 hours ago#1 Warzone Victory Leaderboard 1280+ Ws!!🔥

64.1K5 -

4:32:12

4:32:12

Akademiks

9 hours agoNothing is Real! J Cole album FULL breakdown! Drake & Kendrick otw? 50 cent unleases on TI n JAY Z

112K6 -

3:26:30

3:26:30

IcyFPS

8 hours agoLIVE 🔴Highguard NEW UPDATES! | RUMBLE SHORTS IS LIVE!! - !wallet !shorts !arc !hug

25.8K3 -

8:51:59

8:51:59

Spartan

12 hours agoPro Halo Player | Valorant Ranked Ascendant 1

28.7K2