Premium Only Content

The Ultimate Guide To Retirement Investing - Managing Your Money - Wells Fargo

https://rebrand.ly/Goldco6

Get More Info Now

The Ultimate Guide To Retirement Investing - Managing Your Money - Wells Fargo, retirement savings investment plan

Goldco helps customers protect their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or other professional retirement account to a Gold IRA. ... To find out just how safe haven rare-earth elements can assist you develop and safeguard your wealth, and also also secure your retired life call today retirement savings investment plan.

Goldco is one of the premier Precious Metals IRA business in the United States. Safeguard your wealth as well as resources with physical rare-earth elements like gold ...retirement savings investment plan.

When upon a time, a pension and Social Security advantages sufficed to cover costs during retirement. Today, not so much. Rather, many people fund their own post-work years with different retirement strategies that offer tax breaks and other advantages. Here's an appearance at different scenarios and aspects to consider when you come to choose a financial investment account.

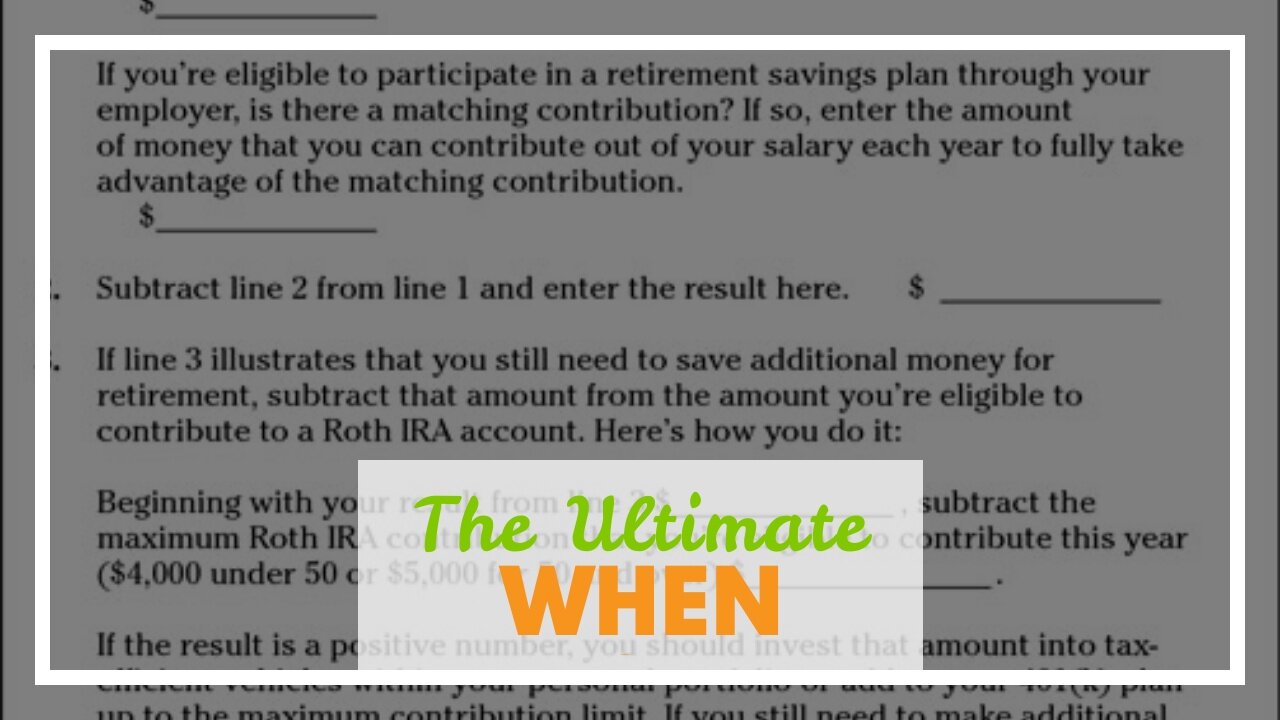

If you can only buy one type of retirement account, your cash may grow fastest in a 401(k) plan with an employer match. If you can invest in more than one kind of pension, think about how to get the maximum match and most beneficial tax treatment. Roth IRA vs.

There are two main types of IRAs: standard and Roth. You should have earned incomewages, salaries, and the liketo contribute to either. The limits and the tax advantages for IRAs are set by the Irs (IRS). The contribution limitations for traditional Individual retirement accounts and Roth IRAs are the very same.

You should take required minimum distributions (RMDs) from a standard IRA, which are computed yearly withdrawals. The passage of the SECURE Act by the U.S. Congress increased the age of when you require to start taking RMDs from 70 to 72 years old since 2020. On The Other Hand, Roth IRAs have no RMDs during the owner's lifetime.

Nevertheless, the IRS made modifications to the required minimum circulation rules for designated recipients following the death of the IRA owner after Dec. 31, 2019. All of the funds should be distributed by the end of the 10th year after the death of the IRA owner. There are exceptions for certain eligible designated beneficiaries, such as a partner.

Traditional Individual Retirement Account Income Limits With a conventional individual retirement account, you get an upfront tax breakyou can subtract your contributionsbut you pay taxes on withdrawals in retirement. One caution: You can constantly deduct your contributions in complete only if you and your partner don't have a 401(k) or some other retirement plan at work., retirement savings investment plan

#goldco#bestcryptocurrencytoinvestin#purchasebitcoin

retirement savings investment plan

South Carolina, South Dakota, Tennessee, Texas, U.S. Virgin Islands, Utah, Vermont, Virginia, Washington,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MP,

-

8:25

8:25

Hollywood Exposed

12 hours agoRob Schneider DESTROYS De Niro After His Anti-Trump Meltdown

3.42K15 -

1:43

1:43

GreenMan Studio

14 hours agoWEAK MEN W/Greenman Reports

2.63K3 -

LIVE

LIVE

BEK TV

1 day agoTrent Loos in the Morning - 11/28/2025

119 watching -

20:39

20:39

Forrest Galante

12 hours agoCatching A Giant Crab For Food With Bare Hands

115K30 -

26:01

26:01

MetatronHistory

4 days agoThe REAL History of Pompeei

11.6K3 -

15:42

15:42

Nikko Ortiz

1 day agoPublic Freakouts Caught On Camera...

117K36 -

21:57

21:57

GritsGG

17 hours agoHigh Kill Quad Dub & Win Streaking! Most Winning CoD Player of All Time!

12.1K -

5:44

5:44

SpartakusLIVE

20 hours agoARC BOUNTY HUNTER #arcraiders

19.9K2 -

15:50

15:50

MetatronCore

2 days agoMy Statement on Charlie Kirk's Shooting

14.9K8 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

687 watching