Premium Only Content

The Great Crash Of 2022

The Great Crash Of 2022

The wealthy are now dumping assets before the recession so they can buy them back at 50% later. Today we have the news of yet Another Hedge Fund Giant Biting the Dust . Louis Moore Bacon is stepping away from Moore Capital Management, which will return money to investors . Bacon made his name exploiting the discrepancies between global interest rates and bond yields. But if the world’s major central banks are moving in lockstep and bond yields are becalmed at low levels, there’s less opportunity to make money. World’s Largest Hedge Fund Manager Ray Dalio also believes the U.S. is at risk of a recession in 2022 .From his side Hedge Fund Manager Seth Klarman, who has been called “the next Warren Buffett,” is warning that both the U.S. and global economies were at risk of a recession. Klarman, who runs Baupost Group, which manages $27 billion in assets, voiced concerns about rising debt, global tensions, and the widening political divide in the U.S. and other countries in a note to investors. Quote: “It can’t be business as usual amid constant protests, riots, shutdowns, and escalating social tensions,” he wrote. “The seeds of the next major financial crisis (or the one after that) may well be found in today’s sovereign debt levels.” end of quote . Hedge fund manager , founder and chief investment officer at Hayman Capital Management , Kyle Bass , from his side sees a shallow recession potentially in 2020 . Also adding that he thinks U.S. interest rates will follow the global interest rates all the way down to zero. Kyle Bass told the Financial Times that he believes that U.S. interest rates will plummet toward zero in 2022 as the country’s economy heads for recession and the Federal Reserve slashes borrowing costs dramatically more than expected. Welcome to The Atlantis Report. One of the most basic recession indicators is the stock market itself. When the stock market experiences a bear market (a decline of 20% or more), that is typically a sign that the economy is rolling over into a recession. It can unravel very quickly due to how inflated it currently is. They are going to run the system until it blows and then have a gigantic default around the globe. This will be affecting too many people. It will be very bad. People need to prepare and do not listen to Mainstream Media . With central banks easing again, it’s no surprise that hedge funds are getting ready for a recession. With the world economy in a coordinated funk, central banks are once again easing monetary conditions. The Fed has cut borrowing costs three times this year. The ECB has driven its deposit rate even more in-depth into sub-zero territory, and has resumed bond purchases. Negative yielding debt is once again above $12 trillion, albeit down from a peak three months ago of $17 trillion. Financial repression is alive and kicking. The system is deeply rigged. 25 trillion printed since 2008 and it hasn’t worked.mere socialism for the rich. In a sane world, less than 4% unemployment would call for higher wages. It’s simple supply/demand economics. The very fact that wages have NOT gone up and in some cases went down relative to inflation. If jobs were plenty, employers would try to attract workers with higher wages. Is that happening? NO! . as governments and central banks deliberately promote specific indicators “to present a rosy picture of the economy” while ignoring a whole host of other fundamentals that do not fit their “recovery”narrative” . And if their “chosen indicators” begin to tell a different story … they then rig the numbers in their favor . like simply lying that the inflation is 2% when it is actually 10% . We all see were we are headed but too many just bury their head in the sand not to notice. We are going to War, we are going to Zero Interest Rates, we are going to QE to Infinity and we are going to a Zimbabwe Economy Traders See a looming Recession Ahead Due to Inverted Yield Curve as Interest Rates on Short-Term Treasuries Exceed Returns on Longer-Term T-Bonds; for First Time Since 2007 on Eve of Subprime Panic. Massive Flight to Safety as Long Bond Yield Hits Record Low of 2.015%.

-

8:55

8:55

Crowder Bits

3 years agoThe GREAT MONKEY CRASH of 2022!

25.4K30 -

1:00

1:00

PPGGrandpa

3 years agoGreat launch… great crash. No injuries reported

26 -

2:01:08

2:01:08

LFA TV

1 day agoTHE RUMBLE RUNDOWN LIVE @9AM EST

129K11 -

1:28:14

1:28:14

On Call with Dr. Mary Talley Bowden

4 hours agoI came for my wife.

9.33K12 -

1:06:36

1:06:36

Wendy Bell Radio

9 hours agoPet Talk With The Pet Doc

44.4K24 -

30:58

30:58

SouthernbelleReacts

2 days ago $6.77 earnedWe Didn’t Expect That Ending… ‘Welcome to Derry’ S1 E1 Reaction

24.4K8 -

13:51

13:51

True Crime | Unsolved Cases | Mysterious Stories

5 days ago $16.11 earned7 Real Life Heroes Caught on Camera (Remastered Audio)

40.7K10 -

LIVE

LIVE

Total Horse Channel

15 hours ago2025 IRCHA Derby & Horse Show - November 1st

126 watching -

4:19

4:19

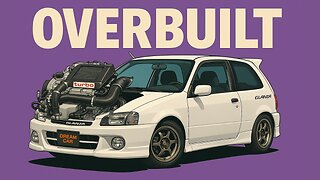

PistonPop-TV

6 days ago $7.18 earnedThe 4E-FTE: Toyota’s Smallest Turbo Monster

36.6K -

43:07

43:07

WanderingWithWine

6 days ago $4.01 earned5 Dreamy Italian Houses You Can Own Now! Homes for Sale in Italy

27.5K9