Premium Only Content

TradeStation EasyLanguge Tutorial 184 | SuperTrend strategy framework and indicator

Tutorial 184 is based on the Markplex SuperTrend indicator which is a stop and reverse (SAR) indicator that trails price action (See the original indicator here: https://markplex.com/free-tutorials/tutorial-173-markplex-supertrend/ )

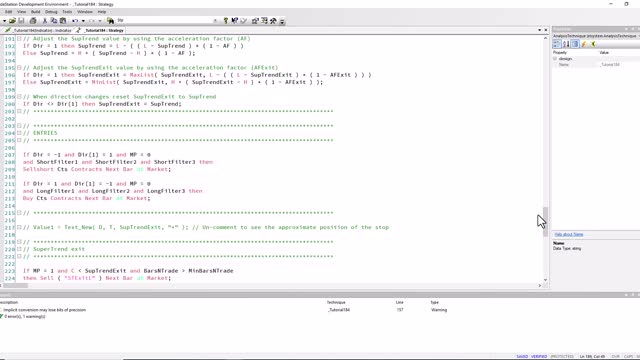

This implementation calculates the Average True Range (ATR) of the average price using the exponential moving average. A user input multiple of the ATR is added to or subtracted from the average price to give Upper and Lwr respectively, depending on the direction. Direction is determined by the Close of a bar relative to the value of the SuperTrend, Upper and Lwr.

There are many different interpretations of the so-called SuperTrend indicator. In this Markplex version the SuperTrend value is also tightened (i.e. moved closer to price) by using an acceleration factor which increases incrementally each bar by user input: AFStep up to a a maximum value of user input: MaxAF.

In addition a 'Supertrend' stop is calulated (SupTrendExit). The value of this is set to the value of SupTrend when direction changes and is then calculated using:

SupTrendExit = MaxList( SupTrendExit, L - ( ( L - SupTrendExit ) * ( 1 - AFExit ) ) )

when Dir = 1, otherwise by:

SupTrendExit = MinList( SupTrendExit, H + ( SupTrendExit - H ) * ( 1 - AFExit ) )

A buy market order is generated when Dir changes from -1 to 1, provided that LongFilter1, LongFilter2 and LongFilter3 each evaluate to true and the program is not currently in a trade. A sell short market order is generated when Dir changes from 1 to -1, provide that ShortFilter1, ShortFilter2 and ShortFilter3 each evaluate to true and the program is not currently in a trade.

When in a long position and the close crosses under SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. Similarly, when in a short position and the close goes above SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. The user could experiment with replacing this functionality will other types of stop, for example a trailing stop.

The tutorial gives an example of LongFilter1 and ShortFilter1 using an implementation of the Moving Average Gap Ratio. If this is used, the user will need to change the strategies' "Maximum Number of Bars Study will reference" to be equal to the value of SlowLength. The user can experiment with replacing this filter with their own as the strategy tends to get 'whipsawed' in non-trending markets.

For more details go to: https://markplex.com/free-tutorials/tutorial-184-supertrend-strategy-framework-and-indicator/

-

12:52

12:52

The Kevin Trudeau Show Limitless

2 days agoBeyond Good And Bad: The Hidden Reality Code

34.6K18 -

1:03:11

1:03:11

BonginoReport

6 hours agoBrown U Security Failures EXPOSED - Nightly Scroll w/ Hayley Caronia (Ep.201)

116K37 -

51:09

51:09

Patriots With Grit

2 hours agoWill A.I. Replace Doctors? | Dr. Stella Immanuel MD

1.75K3 -

4:10:32

4:10:32

Nerdrotic

7 hours ago $10.85 earnedHollywood's DOOMSDAY! WB FIRESALE! - Friday Night Tights 385 w Zachary Levi

62.7K13 -

12:25:53

12:25:53

LFA TV

19 hours agoLIVE & BREAKING NEWS! | FRIDAY 12/19/25

189K27 -

1:08:59

1:08:59

Edge of Wonder

4 hours agoNASA’s Intergalactic Spacecraft, Real Dwarves Spotted & Research Roundup

15.5K4 -

1:21:27

1:21:27

Kim Iversen

7 hours agoPutin Says Russia is Ready for WAR With Europe

37.1K83 -

1:24:41

1:24:41

The Daily Signal

5 hours ago $4.01 earned🚨BOMBSHELL: 315,000+ Illegal Ballots in Georgia, Terrorists Released, Rubio Slashes Foreign Aid

28.7K9 -

1:53:45

1:53:45

The Mike Schwartz Show

7 hours agoTHE MIKE SCHWARTZ SHOW Evening Edition 12-19-2025

20.3K4 -

![[Ep 814] LIVE From AmFest 2025 with Kaitlin Bennett](https://1a-1791.com/video/fwe2/7e/s8/1/6/O/v/J/6OvJz.0kob-small-Ep-814-LIVE-From-AmFest-202.jpg) 37:38

37:38

The Nunn Report - w/ Dan Nunn

6 hours ago[Ep 814] LIVE From AmFest 2025 with Kaitlin Bennett

44.8K12