Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

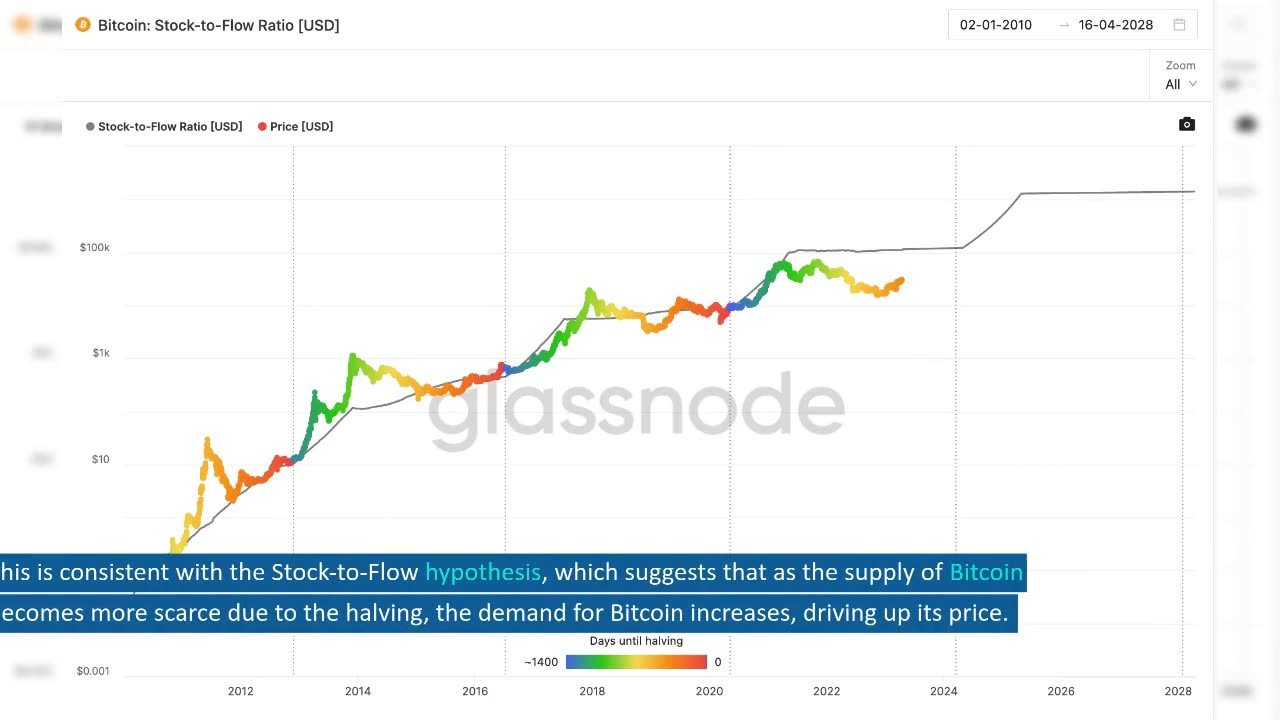

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

17:23

17:23

Russell Brand

1 day agoThey couldn't handle this...

64.7K161 -

18:18

18:18

DeVory Darkins

16 hours ago $16.58 earnedPortland gets NIGHTMARE NEWS as Trump orders Troops to crush violent rioters

18K140 -

LIVE

LIVE

TonYGaMinG

2 hours ago⚔ Trying out this NEW game called " SWORN " ⚔

476 watching -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

180 watching -

29:27

29:27

James Klüg

1 day agoAmericans Remembering Charlie Kirk

13.9K3 -

GoA_Malgus

9 hours ago $0.13 earnedGoA Malgus - The Legend Has Returned!!! - Live domination on Black Ops 6

6.67K -

48:15

48:15

SouthernbelleReacts

1 day ago $8.60 earnedWeapons (2025) REACTION | Josh Brolin, Julia Garner, Alden Ehrenreich | Horror-Mystery Thriller

36K21 -

39:36

39:36

mizery

4 days ago $0.79 earnedI Mastered Fortnite in 30 Days

17.5K6 -

25:50

25:50

ChopstickTravel

18 days ago $3.69 earned24 Hours With Sri Lanka’s Vedda People!! (Barehand Honey Harvest)

32.1K5 -

8:13

8:13

Danny Rayes

1 day ago $2.61 earnedMost Hated Teacher on Tiktok

20K17