Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

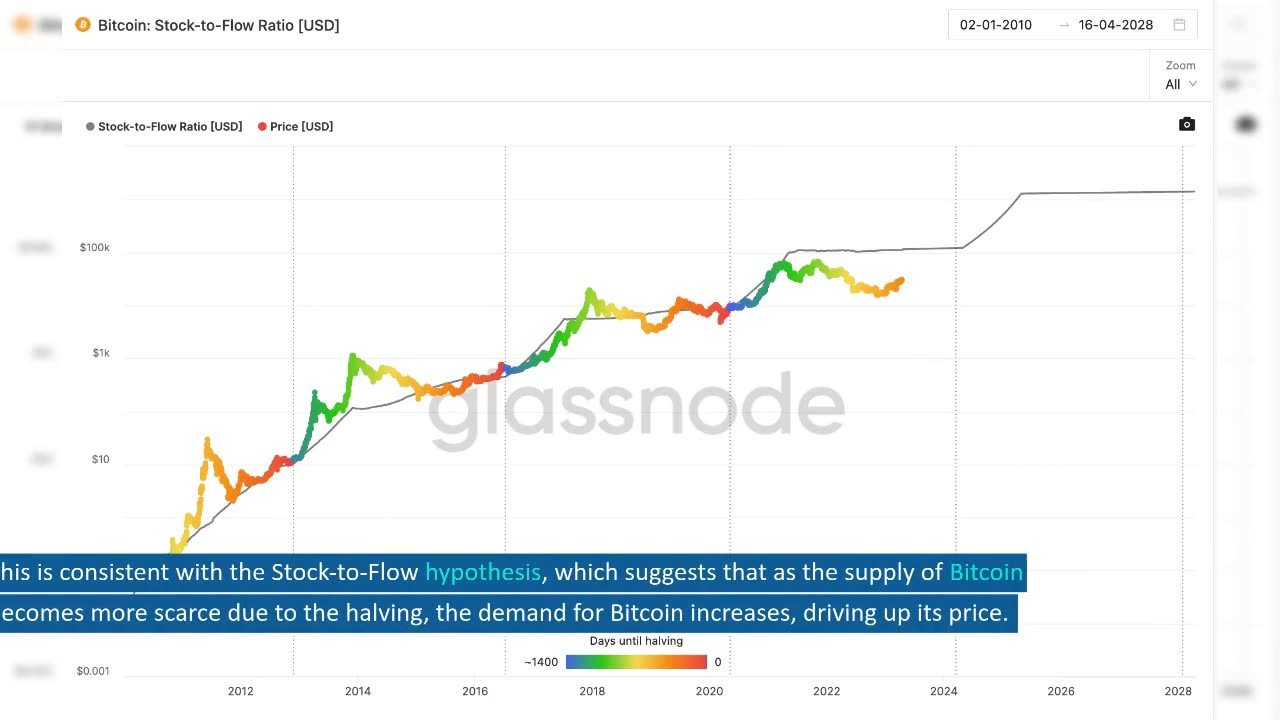

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

LIVE

LIVE

Donald Trump Jr.

18 hours agoMaking America Affordable Again, Interview with Economist Steve Moore | TRIGGERED Ep.294

7,167 watching -

LIVE

LIVE

BonginoReport

1 hour agoThe Insane Proposal That Will Ruin Elections FOREVER - Nightly Scroll w/ Hayley Caronia (Ep.184)

1,761 watching -

LIVE

LIVE

The Jimmy Dore Show

19 minutes agoCandace Owens Faces “Credible” Assassination Threats! Massie CALLS OUT Israel-Epstein Connection!

2,354 watching -

TheCrucible

2 hours agoThe Extravaganza! EP: 64 (11/24/25)

26.8K2 -

LIVE

LIVE

Kim Iversen

1 hour agoIsrael Running The Dept Of Homeland Security Social?!?

1,267 watching -

LIVE

LIVE

Akademiks

47 minutes agoSheck Wes exposes Fake Industry. Future Not supportin his mans? D4VD had help w disposing his ex?

830 watching -

LIVE

LIVE

The Trish Regan Show

1 hour agoJUST IN: ABC HIRES Marjorie Taylor Greene for ‘The View’?! Hosts FREAKING OUT Over Being REPLACED!

633 watching -

22:02

22:02

We Got Receipts

5 hours agoIt just got WORSE for Democrats…

24 -

4:15

4:15

Captain Peach

9 days ago5 Ways Games Trick You Into Buying

7 -

1:00:30

1:00:30

Based Campwith Simone and Malcolm

4 days agoYou Think You Hate The Media ... You Don't Hate Them Enough

1091