Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

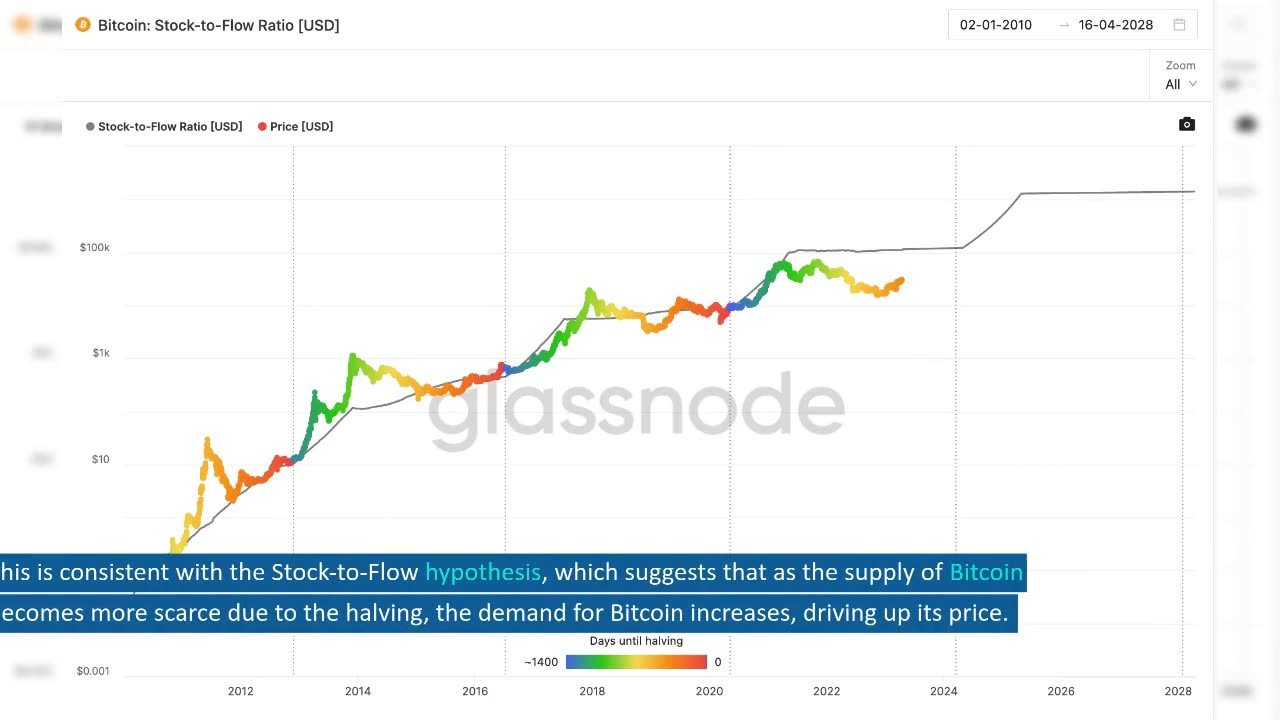

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

LIVE

LIVE

Timcast

36 minutes agoBerkeley Goes BALLISTIC Over TPUSA Event, Massive BRAWL ERUPTS

18,482 watching -

LIVE

LIVE

Steven Crowder

2 hours ago🔴Is This Really MAGA: What the Hell Is Donald Trump Doing?

38,427 watching -

LIVE

LIVE

The Rubin Report

53 minutes agoCNN Panel Looks Angry as Republican Points Out How Dems Shutdown Backfired

1,665 watching -

LIVE

LIVE

Right Side Broadcasting Network

3 hours agoLIVE: President Trump’s Veterans Day Wreath Laying Ceremony and Address - 11/11/25

3,364 watching -

18:09

18:09

Professor Nez

42 minutes ago🚨🔥HOLY MACKEREL! Chuck Schumer FLEES the Senate Floor when CONFRONTED on Obamacare FRAUD!

-

LIVE

LIVE

The White House

2 hours agoPresident Trump and Vice President JD Vance Deliver Remarks

670 watching -

UPCOMING

UPCOMING

The Shannon Joy Show

1 hour agoTrump & The Terrorist * MAHA Dead In DC? * Winter Weather Warfare: Live Exclusive W/ Dane Wigington

12 -

LIVE

LIVE

Grant Stinchfield

29 minutes agoHow Faith, Forgiveness, and Grit Keep the Oldest Among Us Alive and Thriving

17 watching -

1:01:55

1:01:55

VINCE

3 hours agoYoung Men Are Taking The Red Pill (Guest Host Hayley Caronia) | Episode 166 - 11/11/25 VINCE

144K66 -

LIVE

LIVE

LFA TV

14 hours agoLIVE & BREAKING NEWS! | TUESDAY 11/11/25

4,235 watching