Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

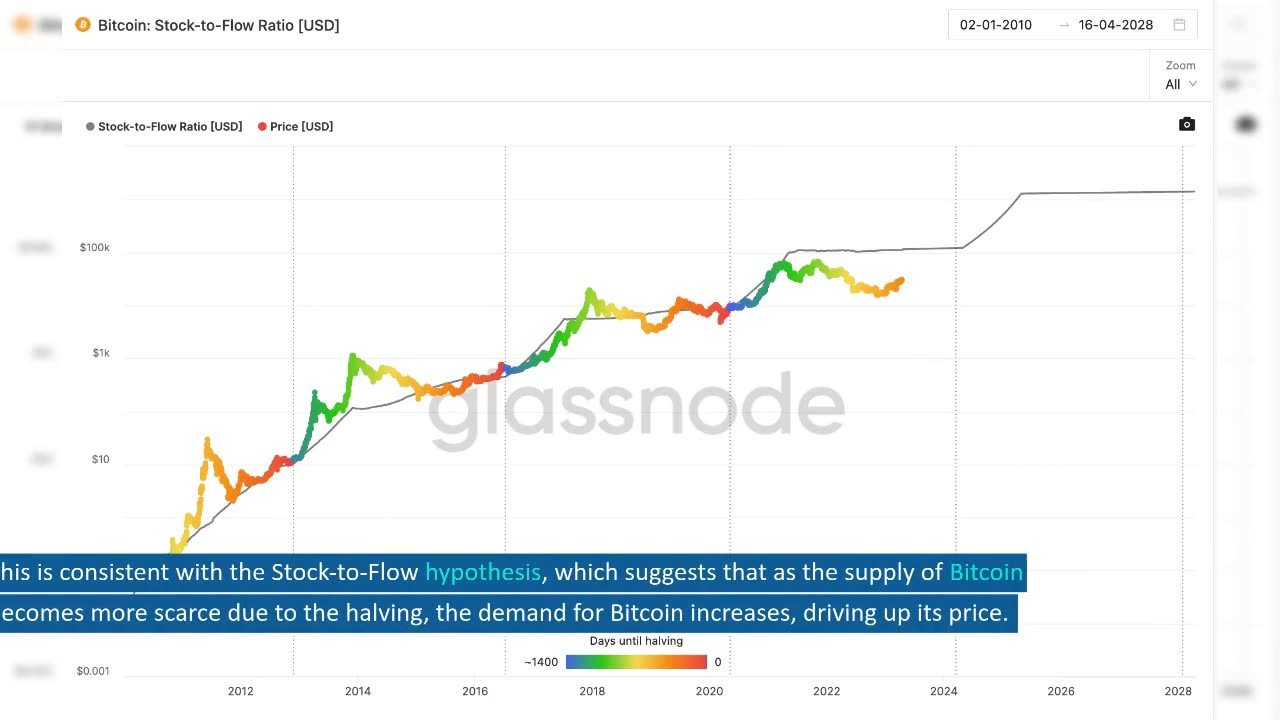

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

DVR

DVR

Steven Crowder

1 hour ago🔴H-1B Fisaco: Who Is in Donald Trump's Ear & What it Means

14.2K9 -

LIVE

LIVE

Badlands Media

9 hours agoBadlands Daily: November 12, 2025

9,834 watching -

LIVE

LIVE

LFA TV

13 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 11/12/25

3,893 watching -

43:54

43:54

VINCE

1 hour agoThomas Speciale: The Man Behind John Brennan's Meltdown | Episode 167 - 11/12/25 VINCE

19K76 -

LIVE

LIVE

Nikko Ortiz

47 minutes agoMILITARY FAILS AND KAREN ACTIVITIES... |Rumble Live

222 watching -

LIVE

LIVE

Wendy Bell Radio

6 hours agoMAGA's Wake Up Call

7,549 watching -

LIVE

LIVE

iCkEdMeL

24 minutes agoBREAKING: Road Rage Shooting Reported on San Antonio’s East Side | LIVE Scene

100 watching -

1:16:23

1:16:23

Graham Allen

2 hours agoThe United States of Islam?! We Are Being INVADED!!! + ANTIFA Must End NOW!!

130K1.45K -

LIVE

LIVE

Viss

1 hour ago🔴LIVE - ARC RAIDERS Befriend or Betray? Chat Decides!

155 watching -

1:10:29

1:10:29

Chad Prather

16 hours agoFailure and the God Who Restores

60.7K19