Premium Only Content

The Stock to Flow Ratio - Is this a MASSIVE Bitcoin Loophole?

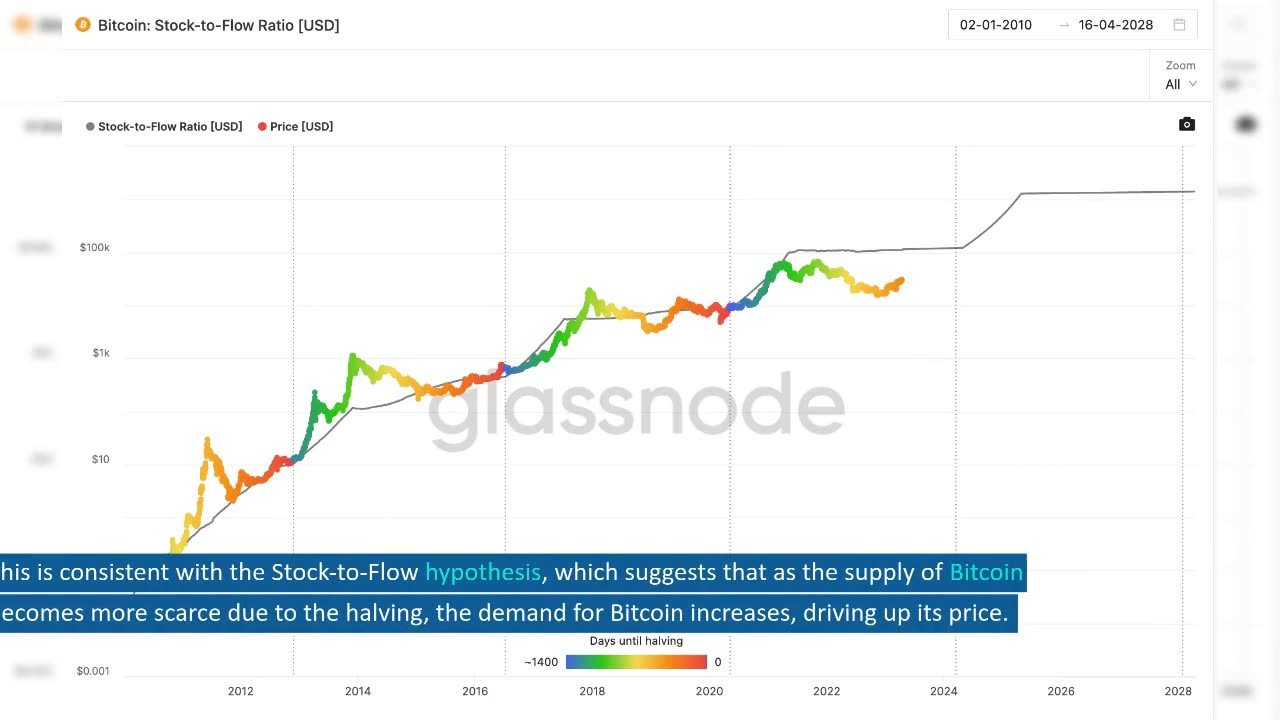

The Stock-to-Flow hypothesis is a theory that suggests scarcity is a significant driver of value. Specifically, the hypothesis argues that when the scarcity of an asset increases, its value should also increase. This hypothesis has been applied to Bitcoin, where it is argued that the Bitcoin halving cycle doubles the scarcity of the asset, leading to a corresponding increase in value.

Data shows that the value of Bitcoin has indeed increased during each halving cycle when the Stock-to-Flow ratio (S2F) has doubled. This is consistent with the Stock-to-Flow hypothesis, which suggests that as the supply of Bitcoin becomes more scarce due to the halving, the demand for Bitcoin increases, driving up its price.

However, if the value of Bitcoin were to decrease post halving, the Stock-to-Flow hypothesis would be rejected. This would suggest that scarcity is not the primary driver of value for Bitcoin, and that other factors such as market sentiment or speculation are more significant.

Interestingly, there is a profitable trading rule based on the Stock-to-Flow hypothesis. The rule suggests that investors should buy Bitcoin six months before each halving and sell 18 months after the halving. This trading rule has been shown to outperform a buy and hold strategy in terms of both risk and return.

Of course, this assumes that the correlation between the Stock-to-Flow ratio and Bitcoin value is not spurious, and that the Stock-to-Flow hypothesis holds true in the future. As with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

In conclusion, the Stock-to-Flow hypothesis suggests that scarcity is a significant driver of value for Bitcoin. Data shows that the value of Bitcoin has increased during each halving cycle when the Stock-to-Flow ratio has doubled. Additionally, there is a profitable trading rule based on the Stock-to-Flow hypothesis. However, as with any investment strategy, there are risks involved, and investors should conduct their own research before making any investment decisions.

-

LIVE

LIVE

LFA TV

11 hours agoLIVE & BREAKING NEWS! | THURSDAY 10/16/25

13,888 watching -

LIVE

LIVE

Game On!

17 hours ago $0.49 earnedTwo 40 Year Old QBs BATTLE It Out On Thursday Night Football!

136 watching -

1:22:45

1:22:45

Tucker Carlson

11 hours agoTucker & Steve Bannon on Jay Jones’ Desire to Genocide Republican Kids and the Future of the Right

94.8K158 -

12:21

12:21

Ken LaCorte: Elephants in Rooms

17 hours ago $1.31 earnedWill Trump Take Greenland?

7.47K11 -

36:57

36:57

RiftTV

10 hours agoPREMIERE: DC Dive with Jordan Conradson | Guest: Ben Bergquam | Pilot Episode #1

15.6K4 -

8:35

8:35

Faith Frontline

12 hours agoAndrew Huberman Just SHOCKED The World With His Belief in God

7.33K2 -

LIVE

LIVE

BEK TV

23 hours agoTrent Loos in the Morning - 10/16/2025

259 watching -

1:58:09

1:58:09

Dialogue works

2 days ago $4.12 earnedLarry C Johnson & Paul Craig Roberts: Can peace be imposed on Israel? - Russia and China Step In

35.8K16 -

8:10

8:10

Nate The Lawyer

2 days ago $3.83 earnedNY AG Letitia James Pattern | All 3 Mortgages Have False Statements

27.6K24 -

17:35

17:35

Actual Justice Warrior

1 day agoDMV Workers CAUGHT Selling CDL Tests To Migrants

24.6K44