Premium Only Content

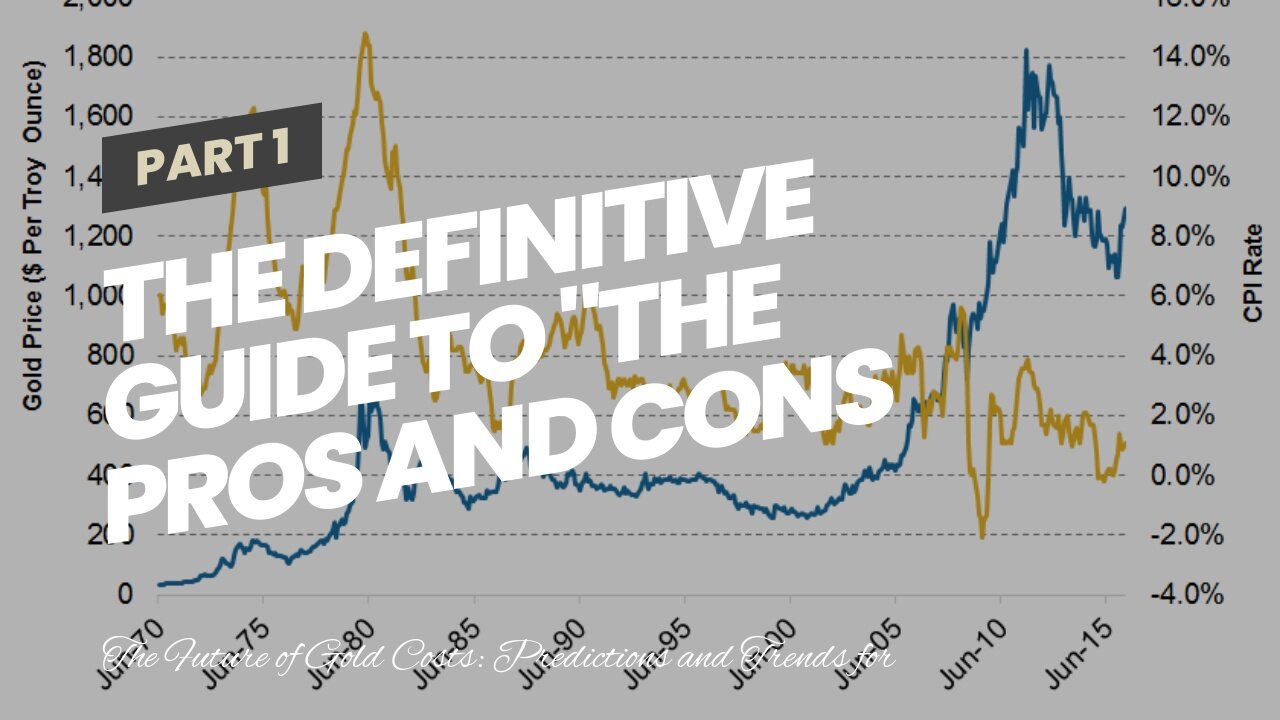

The Definitive Guide to "The Pros and Cons of Investing in Gold Rates: What You Need to Know"

https://rebrand.ly/Goldco

Join Now

The Definitive Guide to "The Pros and Cons of Investing in Gold Rates: What You Need to Know" , gold rate investing

Goldco assists customers secure their retirement cost savings by rolling over their existing IRA, 401(k), 403(b) or other professional retirement account to a Gold IRA. ... To discover how safe haven precious metals can help you develop and shield your wealth, and even safeguard your retired life phone call today gold rate investing.

Goldco is just one of the premier Precious Metals IRA business in the United States. Safeguard your wealth as well as source of income with physical rare-earth elements like gold ...gold rate investing.

The Future of Gold Costs: Predictions and Trends for Capitalists

Gold has regularly been a valuable product, utilized as a form of currency, jewelry, and also as an investment. Its worth has continued to be relatively stable over the years and it is considered a secure shelter investment throughout opportunities of financial unpredictability. Nonetheless, like any sort of other assets, gold prices are subject to variations and forecasting its future can easily be challenging. In this write-up, we will discuss the existing trends in gold costs and prophecies for the future.

Existing Trends in Gold Rates

In 2020, gold costs struck an all-time high due to the COVID-19 pandemic's influence on global economic conditions. The unpredictability caused by the pandemic led investors to look for safe-haven investments such as gold. Furthermore, low-interest rates produced it a lot more appealing for entrepreneurs to hold onto their gold financial investments somewhat than committing in other assets.

However, in 2021, gold costs have found a decrease due to many variables. The rollout of COVID-19 vaccinations has led to enhanced confidence regarding economic recovery and security. As a end result, clients have moved their emphasis in the direction of riskier possessions such as stocks instead than safe-haven financial investments like gold.

Yet another variable that has contributed to the decline in gold prices is the building up US dollar. As gold is valued in US dollars worldwide, a more powerful buck produces it more costly for foreign buyers which lessen requirement for gold.

Predictions for Future Gold Rates

While forecasting future patterns in any market can easily be difficult, there are a number of factors that might likely determine future fads in gold fees:

1) Passion Costs: One of the key vehicle drivers of need for gold is rate of interest rates. When interest costs are low or bad like they are currently a lot of central banks worldwide rely upon monetary stimulation such as quantitative convenience (QE). This leads capitalists towards keeping onto resources like valuable metallics that do not go through from inflationary stress associated with QE plans.

2) Economic Recovery: With economic conditions reopening worldwide after the COVID-19 pandemic, there is a capacity for boosted economic activity which could lead to a decrease in need for gold as clients relocate towards riskier possession lessons.

3) Rising cost of living: As economic conditions bounce back coming from the pandemic, rising cost of living rates may increase due to improved demand for goods and companies. Gold is usually found as a hedge versus inflation and an boost in inflation fees could possibly lead to an rise in need for gold.

4) Geopolitical Dangers: Political stress between countries can additionally influence gold costs. For example, any sort of growth of pressures between Iran and the United States could possibly potentially lead to an rise in gold prices as capitalists seek out safe-haven financial investments.

Final thought

In final thought, it is hard to forecast potential fads in gold prices with certainty. Nevertheless, a number of variables such as interest costs, economic healing, rising cost of living fees, and geopolitical dangers might affect future patterns. As along with any type of financial investment decision, it is crucial for financiers to evaluate the dangers and potential benefits just before creating any selections.

Capitalists must look at branching out their portfolio and not only count on gold as an expenditure. While gold has traditionally been a safe-haven expenditure, it is necessary to remember that past efficiency does not guarantee future end result. Entrepreneurs must find specialist g...

-

LIVE

LIVE

ttvglamourx

1 hour agoGLAMS DULULU FOR FORTNITE !DISCORD

63 watching -

35:24

35:24

The Rubin Report

21 hours agoThe Simple Rules to Fight Crime Blue Cities Choose to Ignore | Jay Collins

38.7K21 -

LIVE

LIVE

BBQPenguin_

6 hours agoRivals Road to ELITE!

41 watching -

LIVE

LIVE

RJTWIN

37 minutes ago🔴LIVE - First Time Playing! | Halo 3 | Clean Content - !blerp !discord !rumbot

18 watching -

LIVE

LIVE

FyrBorne

12 hours ago🔴Warzone M&K Sniping: Modern Warfare Weapons That Still Cook in 2025

1,822 watching -

17:40

17:40

Actual Justice Warrior

1 day agoBlack Mob ATTACKS Conservatives On Campus

96.7K203 -

2:04:41

2:04:41

MG Show

1 day agoJames 'Dirty Cop' Comey Indicted; A Plan to Starve the American People

85.3K23 -

9:11

9:11

MattMorseTV

21 hours ago $27.17 earnedVance just DROPPED the HAMMER.

169K94 -

10:16

10:16

GritsGG

21 hours agoBEST Controller Settings for Warzone! Rank 1 Player's Settings!

63.4K4 -

2:13:30

2:13:30

Side Scrollers Podcast

1 day agoUK Introduces MANDATORY Digital ID + Dallas ICE Shooting BLAMED on Gaming + More | Side Scrollers

183K35