Premium Only Content

How "The Pros and Cons of Investing in Physical Gold vs. Gold ETFs" can Save You Time, Stress,...

https://rebrand.ly/Goldco2

Sign up Now

How "The Pros and Cons of Investing in Physical Gold vs. Gold ETFs" can Save You Time, Stress, and Money. , investing gold market

Goldco helps customers protect their retired life financial savings by surrendering their existing IRA, 401(k), 403(b) or various other competent retirement account to a Gold IRA. ... To learn just how safe house precious metals can assist you develop and shield your wide range, as well as even protect your retirement phone call today investing gold market.

Goldco is just one of the premier Precious Metals IRA firms in the United States. Shield your wealth as well as resources with physical precious metals like gold ...investing gold market.

Why Gold is Still a Safe Bet for Capitalists

In today's inconsistent financial environment, real estate investors are always on the hunt for safe sanctuaries to protect their resources. While there are actually several options available, gold continues to be one of the most popular and trusted financial investments for those looking to guard their wide range.

One of the main causes why gold is still a risk-free wager for capitalists is its capability to maintain market value over opportunity. Unlike newspaper currencies, which can easily be decreased the value of by inflation or authorities plan, gold has sustained its purchasing energy throughout past history. In truth, it has been made use of as a outlet of value for thousands of years and continues to be sought after by both people and authorities as well.

Yet another factor why gold is taken into consideration a risk-free financial investment is its scarcity. Unlike various other commodities that may be made in unrestricted quantities, such as oil or wheat or grain, the source of gold is finite. As a end result, its market value tends to rise over opportunity as demand outstrips source.

Gold also has the conveniences of being a concrete property that may be stored in physical type. This indicates that it can easilynot just go away overnight like sells or connections can if a provider goes insolvent or nonpayments on its debt. Furthermore, gold does not depend on any sort of particular financial body or institution for its value – it is universally approved and acknowledged around the world.

For these causes, many investors select to include gold in their collections as component of a diversified approach. This indicates buying bodily bullion pubs or pieces directly from dealers or committing in exchange-traded funds (ETFs) that track the rate movements of gold.

Of course, like any type of expenditure possibility, there are threats affiliated with putting in in gold. For example, changes in international financial disorders and geopolitical activities can trigger unexpected rate movements that might affect short-term yields.

Additionally, while gold might supply defense versus rising cost of living over the long term, it may not necessarily generate high returns during the course of time periods of financial development when various other asset courses such as stocks and actual estate tend to execute well.

Despite these threats, however, gold stays a trusted and eye-catching expenditure choice for a lot of real estate investors. Whether you are looking to defend your wealth from rising cost of living, expand your collection or simply store an resource that keeps its market value over opportunity, gold is an superb selection that need to be taken into consideration.

In enhancement to its particular market value, gold has also been used as a hedge against money changes and political weakness. In the course of opportunities of economic unpredictability or political disruption, investors often flock to gold as a secure sanctuary asset that is immune system to the dryness of other monetary tools.

For example, throughout the international monetary crisis of 2008, the rate of gold increased dramatically as clients looked for retreat from the mayhem in various other markets. Likewise, throughout opportunities of geopolitical strain such as wars or terrorist strikes, gold tends to value in worth as capitalists seek protection and stability.

Furthermore, gold has historically carried out effectively during the course of periods of high rising cost of living. As governments imprint additional money to induce their economies or spend off their financial obligations, the market value of newspaper money tends to decrease. In...

-

2:06:32

2:06:32

TimcastIRL

3 hours agoLeftist NO KINGS Protest Begins, Antifa EMBEDS, Riots & Violence FEARED Nationwide | Timcast IRL

148K71 -

2:50:31

2:50:31

TheSaltyCracker

3 hours agoHail to the King ReeEEStream 10-17-25

39.2K98 -

LIVE

LIVE

Man in America

11 hours agoGold’s OMINOUS Warning: A Global Monetary Reset That’ll BLINDSIDE Americans

1,027 watching -

LIVE

LIVE

Flyover Conservatives

21 hours ago3 Winning Mindsets for Building Life-Changing Habits - Clay Clark; Why Employers Are Ditching DEI - Andrew Crapuchettes | FOC Show

342 watching -

LIVE

LIVE

SynthTrax & DJ Cheezus Livestreams

23 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream POST DISCO / FUNK / R & B Edition

148 watching -

51:18

51:18

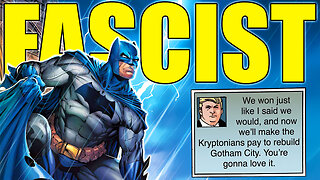

Degenerate Jay

11 hours ago $0.30 earnedJournalist Claims Batman Is A Fascist Like Donald Trump

5.57K4 -

1:18:27

1:18:27

Glenn Greenwald

7 hours agoGlenn Takes Your Questions on Major Saudi Arabia Celeb Controversies, Zohran Mamdani and the NYC Debate, Anti-ICE Protests, and More | SYSTEM UPDATE #533

104K26 -

1:13:26

1:13:26

Tundra Tactical

8 hours ago $3.22 earned🛑{LIVE NOW} Gun Nerd Plays Battlefield 6 Great Tundra Nation Get Together Day 4

16.9K1 -

LIVE

LIVE

GritsGG

8 hours agoRanked Top 70! Most Wins in WORLD! 3734+!

123 watching -

LFA TV

1 day agoLIVE & BREAKING NEWS! | FRIDAY 10/17/25

206K43