Premium Only Content

Navigating Uncertainty: How to Avoid the Bull Trap and Stay Bullish

🟢 BOOKMAP DISCOUNT: https://bit.ly/3F8qdGb

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

______________________________________________________________________________________________

In today's video we discuss the following key points and more...

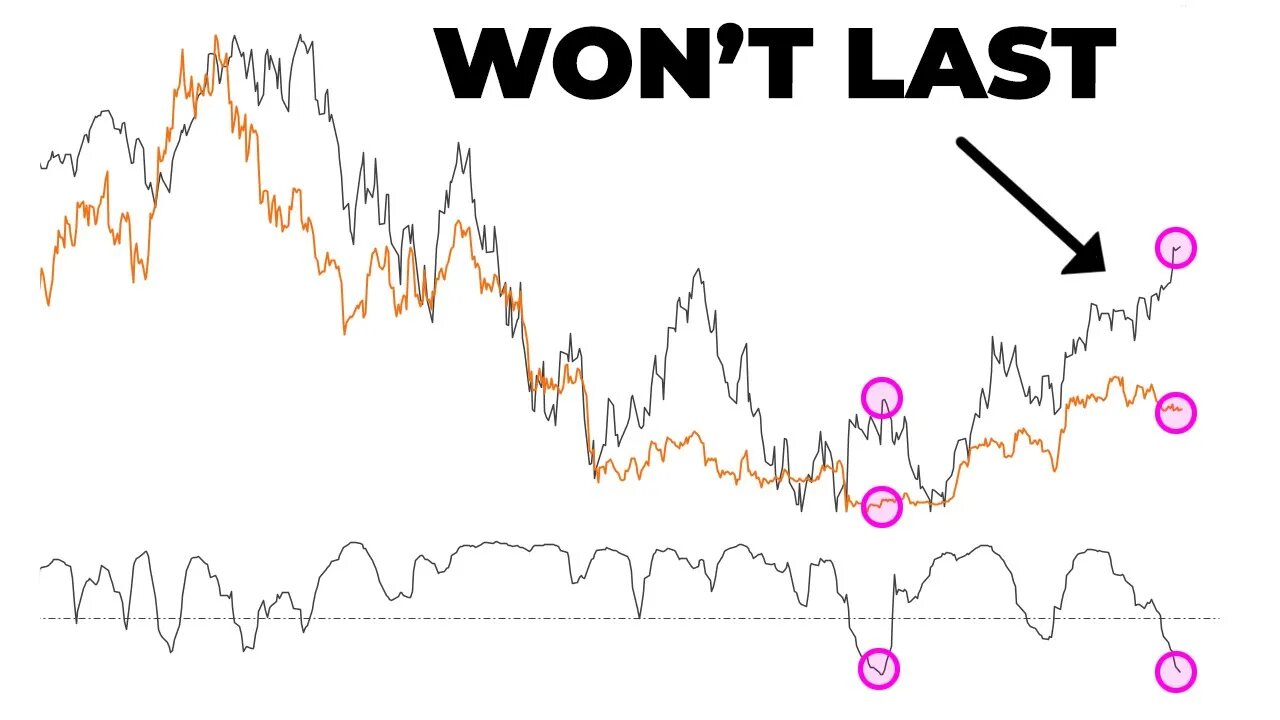

- The evidence suggests that this could be a bull trap in the stock market.

While the chart looks good on the surface, there are red flags when you look closer.

- The market is experiencing a lot of chop due to concerns about the debt ceiling and uncertainty around Powell's actions.

Some areas of the market are decisive, such as technology, communication services, and discretionary sectors.

- The S&P 500 is showing consolidation patterns and may experience a gamma squeeze if it breaks above certain levels.

- Month-to-date performance shows mixed sentiment, with some assets like Bitcoin down while others like the S&P 500 and technology sectors are up.

- The 10-year yield has been on a significant rise, while commodities like oil and copper are down.

- Market bottoms are typically associated with sectors like discretionary, communication services, and technology performing well.

- Caution is advised as previous bear markets have seen stocks like Apple, Amazon, and Nvidia experience significant moves before further downside.

- The yield curve is signaling a potential recession, with rising yields and negative rate of change in oil prices.

- The dollar and S&P 500 correlation is typically negative, but it has recently shown some positive correlation.

- The dollar's recent rise and the S&P 500's upward movement could indicate a bull trap.

- These bullet points can be used to summarize the main points for your YouTube description.

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at [email protected]

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#stockmarket #sp500 #technicalanalysis

-

20:11

20:11

Figuring Out Money

2 years ago $0.01 earnedLet's Get Ready To Rumble!

37 -

17:39

17:39

Clownfish TV

5 hours agoWhy is YouTube PURGING Millions of Channels This Year? Is it AI or WORSE? | Clownfish TV

23K32 -

4:52:13

4:52:13

Midnight In The Mountains™

6 hours agoMorning Coffee w/ Midnight & The Early Birds of Rumble | The Hate.... The Violence MUST End Already

34.2K1 -

7:12:59

7:12:59

LethalPnda

8 hours agoKim Kardashian is now in Fortnite. Use code "lethalpnda" in the Item Shop!

33.6K2 -

9:28

9:28

ThatStarWarsGirl

2 days agoSupergirl Trailer REACTION!

63K9 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

273 watching -

3:06:46

3:06:46

Boxin

6 hours agoBoxin + Moogsical RV There Yet!? Take 2! (special guest?)

31.2K -

28:03

28:03

The Hannah Faulkner Show

2 days ago $1.43 earnedCWA Study Finds Shocking Content in Netflix Shows | LIVE WITH HANNAH FAULKNER

19.8K5 -

31:45

31:45

The Heidi St. John Podcast

2 days agoFan Mail Friday: Faith, Discernment, and Keeping Christ at the Center

10.6K -

39:10

39:10

The Bryce Eddy Show

2 days ago $0.18 earnedFresh Mouth Club: Exposing the Dental Industry’s Biggest Lie

8.05K3