Premium Only Content

June Stock Market Outlook - Unveiling Hidden Opportunities and Navigating with Caution

🟢 BOOKMAP DISCOUNT: https://bit.ly/3F8qdGb

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

______________________________________________________________________________________________

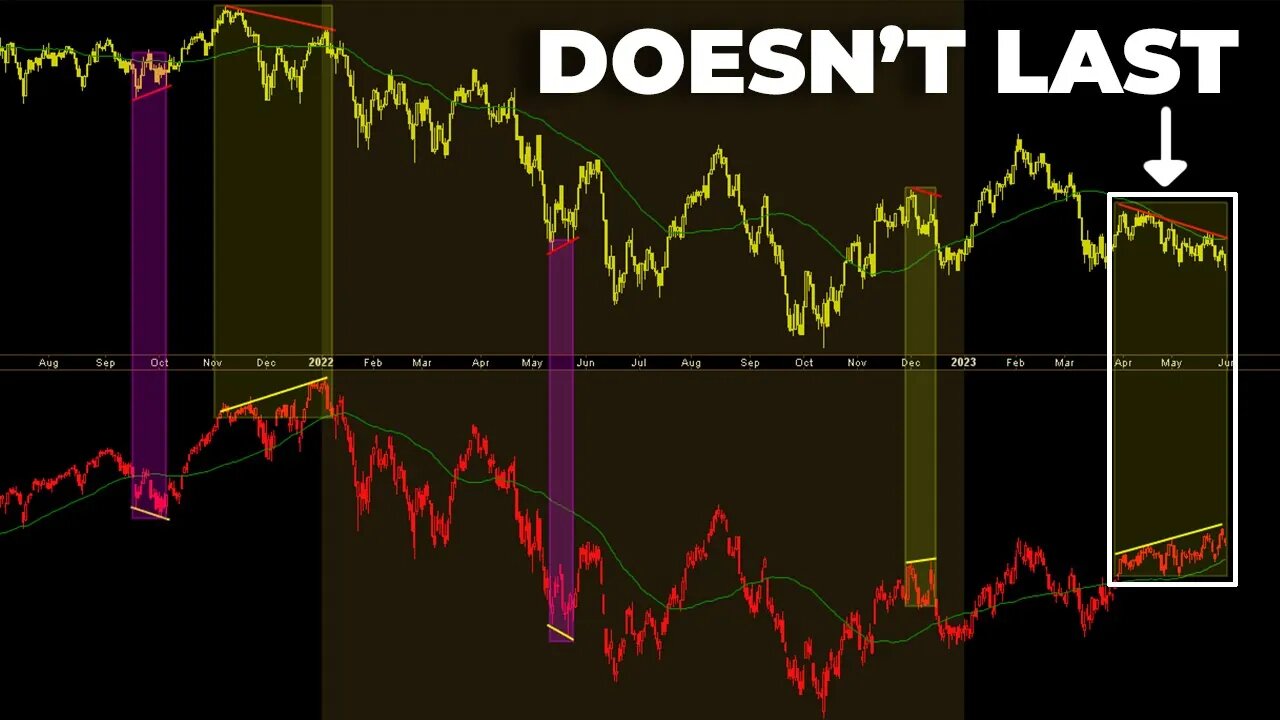

In this video, we discuss the market outlook for June. While May showed positive growth, we need to approach June tactically. The S&P 500 is facing resistance at 4,200 and may slide down if it falls below this level. The market breadth and stocks above moving averages are decreasing, indicating potential weakness.

Many stocks have experienced breakdowns in May, creating potential opportunities at lower levels. Sectors like crude oil, energy, retail, and Bitcoin have seen declines, while technology has led the market.

The tech-heavy Nasdaq has shown a strong upward move but may consolidate or pull back. Major stocks like Apple, Amazon, Microsoft, and Google may undergo corrective movements or sideways consolidation before resuming their uptrend.

Technology, discretionary, and communication services tend to perform well near market bottoms. Industrials may present opportunities as well. The Dow Jones Industrials holding above its 200-day moving average suggests a potential upward move.

Examining Dow theory, transports appear weak while industrials have shown a lower low. This suggests a possible opportunity for an upward move in industrials despite caution regarding transports.

In conclusion, approach the market cautiously in June. Look for opportunities in sectors that have declined, consider potential consolidations in overextended stocks, and remain mindful of intermarket relationships and market cycles for informed decisions.

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at [email protected]

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#stockmarket #sp500 #technicalanalysis

-

7:24

7:24

Figuring Out Money

2 years agoMomentum Slowing, Divergences Growing: What Does This Mean For The Markets?

52 -

LIVE

LIVE

DLDAfterDark

3 hours agoIs The "SnapPocalypse" A Real Concern? Are You Prepared For SHTF? What Are Some Considerations?

105 watching -

19:58

19:58

TampaAerialMedia

14 hours ago $0.32 earnedKEY LARGO - Florida Keys Part 1 - Snorkeling, Restaurants,

3.32K7 -

1:23

1:23

Memology 101

2 days ago $1.73 earnedFar-left ghoul wants conservatives DEAD, warns Dems to get on board or THEY ARE NEXT

6.62K41 -

3:27:27

3:27:27

SavageJayGatsby

4 hours ago🔥🌶️ Spicy Saturday – BITE Edition! 🌶️🔥

41.3K -

26:09

26:09

Exploring With Nug

14 hours ago $9.96 earned13 Cold Cases in New Orleans What We Discovered Beneath the Surface!

41.2K14 -

27:39

27:39

MYLUNCHBREAK CHANNEL PAGE

9 hours agoDestroying Time.

124K29 -

3:27:19

3:27:19

Mally_Mouse

4 hours ago🌶️ 🥵Spicy BITE Saturday!! 🥵🌶️- Let's Play: Minecraft Christmas Adventure!!

126K4 -

2:14:31

2:14:31

Side Scrollers Podcast

9 hours agoSide Scrollers INVITE ONLY - Live From Dreamhack

154K12 -

1:18:23

1:18:23

Simply Bitcoin

2 days ago $14.13 earnedThe Bitcoin Crucible w/ Alex Stanczyk and Lawrence Lepard

35.9K5