Premium Only Content

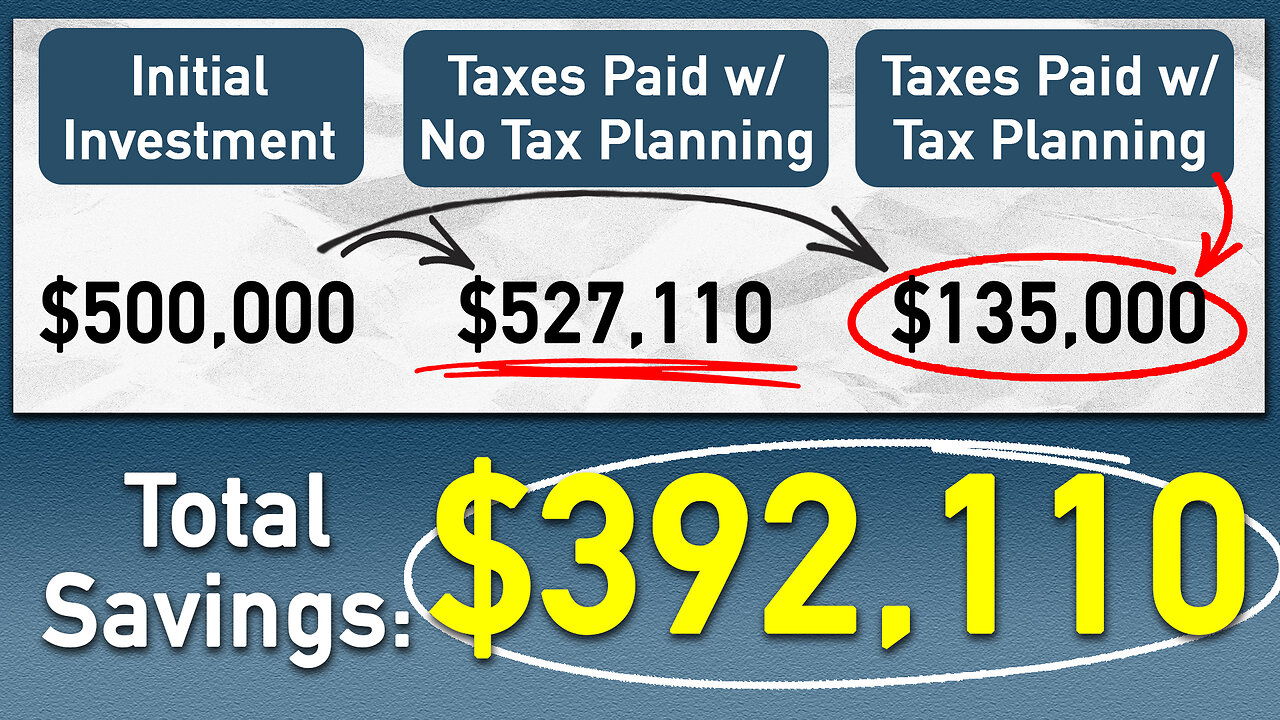

How to Save Over $300k in Taxes Over Your Lifetime!

In this video, we discuss a tax planning strategy that can help you save over $300,000 in taxes over your lifetime. We walk through a case study of a couple who are 64 years old and have $500,000 in tax-deferred dollars. We explore their current plan, which involves paying taxes on required minimum distributions (RMDs), the impact of social security taxes, and taxes paid by beneficiaries. We then introduce a simple strategy of converting their $500,000 to a Roth IRA over the next three years, which involves paying $120,000 in taxes upfront, but offers tax-free growth and eliminates taxes on RMDs, social security, and taxes paid by beneficiaries. By implementing this strategy correctly, you can save a significant amount in taxes over your lifetime. If you're interested in running your personal numbers in this tax calculator, please reach out to us for a consultation!

Please note, this video discusses factors that could apply to a hypothetical couple. Your specific circumstances may vary materially.

Are you interested in receiving expert help in planning for your financial future?

If so, give us a call at (614)500-4121 or visit us at https://peakretirementplanning.com/schedule-a-meeting/

🟥 I Love Roth IRAs and Roth Conversions! 🟥

https://www.kiplinger.com/retirement/retirement-plans/roth-iras/604539/i-love-roth-iras-and-roth-conversions

🎥 Subscribe to our channel:

https://bit.ly/430T9Lv

🤝 Join our Insider's List:

https://peakretirementplanning.com/resources/

📞 Talk with us:

https://peakretirementplanning.com/schedule-a-meeting/

#retirement #retirementplanning #taxes

Disclaimer: Since we do not know your specific situation, none of this information can serve as tax, legal, financial, insurance, or financial advice, and may be outdated or inaccurate. The information comes from sources believed to be reliable but cannot be guaranteed. This content is prepared for educational purposes only. If you need advice, please contact a qualified CPA, attorney, insurance agent, financial advisor, or the appropriate professional for the subject you would like help with. Peak Retirement Planning, Inc. is an Ohio based registered investment adviser and able to offer advisory services in Ohio and in other states where registered or exempt from registration.

-

1:16:04

1:16:04

Rebel News

2 hours agoHealth-care collapsing, Bloc says Quebec sends Alberta $, US Ambassador's advice | Rebel Roundup

8.67K15 -

1:44:03

1:44:03

The Shannon Joy Show

3 hours agoThe BEST Of Shannon Joy 2025! Special Thanksgiving Holiday Compilation

12.4K -

1:07:25

1:07:25

Sarah Westall

18 hours agoSarah Westall is Not a Porn Star – Conversation w/ Stuart Brotman

10K11 -

2:59:36

2:59:36

Wendy Bell Radio

10 hours agoPoint Blank Hate

74K103 -

4:56:43

4:56:43

MrR4ger

8 hours agoWARLOCK SOLO SELF FOUND HARDCORE - D4RK AND D4RKER HAPPY TURKEY DAY RUMBLEFAM

16.8K1 -

1:33:31

1:33:31

Barry Cunningham

15 hours agoBREAKING NEWS: KASH PATEL AND DOJ HOLD PRESS CONFERENCE UPDATE ON NATIONAL GUARD ATTACK

123K68 -

1:22:22

1:22:22

iCkEdMeL

5 hours ago $13.72 earned🔴 BOMBSHELL: DC Shooter Worked With CIA-Backed Unit in Afghanistan, Officials Say

28.8K23 -

17:28

17:28

Tactical Advisor

1 day agoComparing the NEW Cloud Defensive EPL

25.1K1 -

LIVE

LIVE

freecastle

14 hours agoTAKE UP YOUR CROSS- THANKSGIVING MUSIC EXTRAVAGANZA!

19 watching -

57:54

57:54

A Cigar Hustlers Podcast Every Day

10 hours ago $1.56 earnedCigar Hustlers Podcast Evere Week Day w/Steve Saka

17.5K1