Premium Only Content

The Greatest Guide To "Building a Solid Foundation for Retirement Investing"

https://rebrand.ly/Goldco6

Sign up Now

The Greatest Guide To "Building a Solid Foundation for Retirement Investing", retirement investing basics

Goldco assists clients secure their retirement savings by rolling over their existing IRA, 401(k), 403(b) or other competent retirement account to a Gold IRA. ... To learn just how safe house precious metals can help you develop and protect your riches, and even secure your retirement phone call today retirement investing basics.

Goldco is one of the premier Precious Metals IRA firms in the United States. Safeguard your wide range and also income with physical precious metals like gold ...retirement investing basics.

Building a Solid Foundation for Retirement Investing

Retirement life is a phase of lifestyle that we all look onward to. It's the time when we can easily ultimately loosen up and enjoy the fruit products of our work. Having said that, in purchase to really take pleasure in retirement life, it is critical to have a sound structure for retirement investing. This indicates making smart monetary selections and developing a strong collection that will definitely generate revenue for years to come.

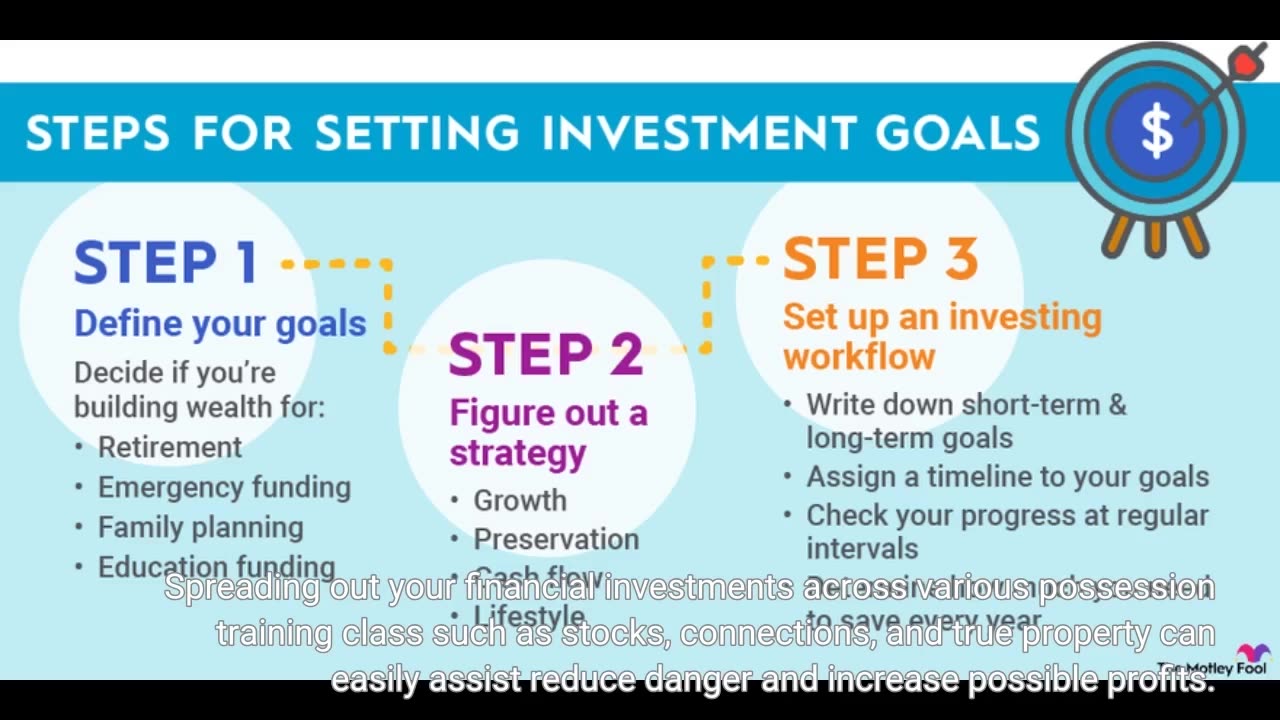

The first measure in constructing a solid groundwork for retirement investing is establishing crystal clear objectives. It's essential to find out how a lot loan you will require in retirement life and what way of living you really want to preserve. By establishing reasonable goals, you can a lot better prepare your investment strategy and make certain that you are on track.

Once you have prepared your targets, it's time to begin conserving and investing. One of the most successful means to spare for retirement is through employer-sponsored retirement life strategy such as 401(k) or 403(b) accounts. These plans offer tax advantages and often feature employer suit payments, which can substantially increase your financial savings over opportunity.

In addition to employer-sponsored plans, it's additionally essential to look at specific retirement profiles (IRAs). Conventional IRAs use tax-deferred growth, indicating that you won't pay out tax obligations on your assets increases until you take out the funds in retirement. Roth IRAs, on the other hand, provide tax-free development since additions are made along with after-tax dollars.

Diversity is another crucial factor in constructing a strong foundation for retired life investing. Spreading out your financial investments across various possession training class such as stocks, connections, and true property can easily assist reduce danger and increase possible profits. Through branching out your profile, you are much less conditional on the performance of any type of one expenditure.

On a regular basis examining and rebalancing your profile is additionally important for long-term excellence in retirement life investing. As market problems transform, particular expenditures might outmatch others or come to be riskier than anticipated. Through every now and then reflecting on your collection and producing essential adjustments, you may ensure that your expenditures straighten along with your objectives and threat resistance.

Yet another significant part of retired life investing is managing expenses and expenditures. High expenses may consume right into your assets gains over time, so it's important to properly consider the costs connected along with your financial investments. Look for low-cost mark funds or exchange-traded funds (ETFs) that provide vast market direct exposure at a portion of the expense of proactively dealt with funds.

While committing in the stock market may give sizable yields over the lengthy phrase, it's crucial to keep in mind that it additionally comes along with threats. The trick to productive retired life investing is to possess a long-term viewpoint and not give in to short-term market variations. Keep focused on your targets and avoid helping make rash decisions based on market dryness.

Eventually, looking for qualified insight can be useful when constructing a sound structure for retirement life investing. A monetary expert can aid you generate a customized expenditure strategy based on your goals and danger resistance. They can likewise provide support on tax-efficient approaches, real estate planning, and various other aspects of retirement planning.

In final thought, creating a strong groundwork for retirement investing requires cautious program and dis...

-

1:04:30

1:04:30

Sean Unpaved

1 hour agoSeahawks Looking For REVENGE Against Rams! | UNPAVED

3.25K -

46:32

46:32

The Amber May Show

4 hours agoLaw & Disorder: FBI Shakeups, Arrest Waves, and a Culture That’s Gone Off the Rails

2.22K1 -

1:25:01

1:25:01

Misfits Mania

1 day ago $8.67 earnedMISFITS MANIA: Press Conference

20.2K11 -

1:31:26

1:31:26

Graham Allen

3 hours agoLive From AMFEST 2025: Day 1

34K9 -

1:56:43

1:56:43

Steven Crowder

5 hours agoLWC Christmas Special 2025 | Giving Back with Santa Crowder

241K121 -

14:33

14:33

Robbi On The Record

4 hours ago $2.84 earnedNPC Girls & The Digital Dehumanization of Women

29.6K8 -

53:25

53:25

Simply Bitcoin

1 day ago $1.39 earnedThe Bitcoin Crucible w/ Alex Stanczyk & Tomer Strolight - Episode 13

28.4K1 -

59:21

59:21

The Rubin Report

3 hours agoIs This the Real Reason Bongino Is Leaving the FBI?

47K68 -

LIVE

LIVE

LFA TV

16 hours agoLIVE & BREAKING NEWS! | THURSDAY 12/18/25

2,309 watching -

1:47:45

1:47:45

The Mel K Show

3 hours agoMORNINGS WITH MEL K- America is Mad As Hell And We’re Not Going to Take it Anymore! - 12-18-25

22.7K5