Premium Only Content

WHY WE DON'T LEARN THIS IN SCHOOL ?

The teaching of personal finance and money management in schools has indeed been a topic of discussion and debate for many years. The reasons why financial education might not be widely taught in schools can vary and may include:

Curriculum Priorities: Educational systems have limited time and resources to cover a wide range of subjects. As a result, some topics, including personal finance, might not receive as much attention as others deemed more academically essential.

Lack of Expertise: Many educators might not have sufficient expertise in personal finance to effectively teach the subject. This requires specialized knowledge that some teachers might not possess.

Traditional Curriculum: Educational curricula often reflect traditional subjects like math, science, and literature, with less emphasis on practical life skills such as budgeting, investing, and financial planning.

Lack of Standardized Curriculum: There's no universally agreed-upon curriculum for teaching personal finance, which can make it challenging for schools to incorporate it into their programs.

Cultural and Socioeconomic Factors: The perceived importance of financial education can vary depending on cultural norms and economic circumstances. In some cases, there might be less emphasis on formal education in personal finance due to other immediate priorities.

Educational Reform Challenges: Implementing changes in educational curricula often requires significant effort, including adjustments to teacher training, curriculum development, and resources.

Parents' Responsibility: Some argue that teaching financial literacy is primarily the responsibility of parents or guardians, rather than schools.

However, it's important to note that the situation has been changing in recent years. Many advocates and educators recognize the importance of teaching financial literacy to young people. Some schools and organizations have introduced financial education programs, and there's a growing awareness of the need to equip students with practical skills to manage their finances effectively.

It's always a good idea to advocate for well-rounded education that includes life skills such as financial literacy. You can engage with local school boards, educational policymakers, and community organizations to promote the inclusion of financial education in school curricula.

-

1:27

1:27

420 VGT LIVE 5.0

1 year agoFormer Illinois Republican Rep. Mike Boast lost his temper

1471 -

LIVE

LIVE

Athlete & Artist Show

17 hours agoBombastic Bets & Games w/ Canadian World Champion!

32 watching -

LIVE

LIVE

The Mel K Show

1 hour agoMORNINGS WITH MEL K - Reversal of Fortune for Lawfare Operatives & Their Benefactors - 10-30-25

267 watching -

UPCOMING

UPCOMING

The Shannon Joy Show

1 hour agoConservative CRACK UP Over Nick Fuentes, Tucker Carlson & Candace Owens * TACO Trump’s China Deal * SNAP Riots & America’s Gold Plated Economy LIVE With Bonk DaCarnivore!

103 -

LIVE

LIVE

Grant Stinchfield

22 hours agoColleges Cash In While Taxpayers Get Robbed

61 watching -

1:36:10

1:36:10

Graham Allen

3 hours agoBiden Admin EXPOSED For Spying On Senators!! + Erika Kirk/JD Vance Take Over Ole Miss!

97.3K46 -

LIVE

LIVE

LadyDesireeMusic

2 hours ago $0.08 earnedLive Piano & Convo

223 watching -

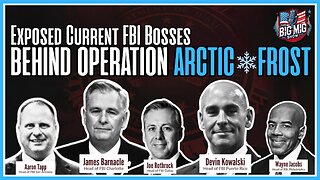

The Big Mig™

3 hours agoExposed, Current FBI Bosses Behind Operation Arctic Frost

1.64K12 -

Badlands Media

5 hours agoBadlands Daily: October 30, 2025

31.7K16 -

LIVE

LIVE

GrimmHollywood

14 hours ago🔴LIVE • GRIMM HOLLYWOOD • GRIMM RAIDERS • RELEASE DAY •

134 watching