Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Demystifying Taxation On Personal Injury Settlements: What You Need To Know

2 years ago

1

Under the Internal Revenue Code, most personal injury settlements are not considered taxable income. This includes compensation for physical injuries or physical illness.

However, there are some exceptions to this rule. Additionally, interest on any settlement is typically considered taxable.

The tax implications of a personal injury settlement can be complex and depend on the specifics of your case, so you should consult with a tax professional or an attorney for advice related to your specific situation.

Reach out to us for a FREE case evaluation: justiceislovely.com

#justiceislovely #thelovelylawfirm #charleston

Loading comments...

-

9:21

9:21

Dr Disrespect

18 hours agoMOST INSANE 110 ASSIST Game in Battlefield 6

71.2K7 -

2:56:34

2:56:34

Side Scrollers Podcast

19 hours agoTwitch PROMOTES DIAPER FURRY + Asmongold/Trans CONTROVERSY + RIP Itagaki + More | Side Scrollers

41.9K7 -

23:30

23:30

GritsGG

14 hours agoThis Burst AR Still SLAMS! BR Casual Solos!

12K1 -

1:27:43

1:27:43

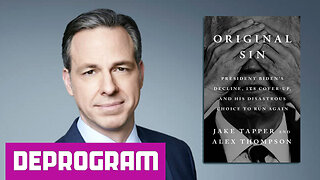

DeProgramShow

3 months agoEXCLUSIVE on DeProgram: “A Live Interview with Jake Tapper”

6.95K2 -

1:25:15

1:25:15

The HotSeat

14 hours agoHere's to an Eventful Weekend.....Frog Costumes and Retards.

14K8 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

149 watching -

1:34:23

1:34:23

FreshandFit

13 hours agoThe Simp Economy is Here To Stay

147K13 -

19:35

19:35

Real Estate

14 days ago $2.07 earnedMargin Debt HITS DANGEROUS NEW LEVEL: Your House WILL BE TAKEN

11.4K3 -

4:03:48

4:03:48

Alex Zedra

9 hours agoLIVE! Battlefield 6

48.4K2 -

2:03:15

2:03:15

Inverted World Live

10 hours agoProbe News: 3I Atlas is Spewing Water | Ep. 125

122K26