Premium Only Content

#238 Cut the Bleeding

"Cut the bleeding" in financial terms:

Assess the Financial Situation: The first step is to thoroughly assess the financial situation. Identify the sources of financial losses or drains on resources. This could include reviewing income, expenses, debt, and investment performance.

Create a Budget: Develop a detailed budget that outlines income and all expenses. Identify areas where expenses can be reduced or eliminated to improve cash flow.

Prioritize Expenses: Categorize expenses into essential and non-essential categories. Focus on reducing or cutting non-essential expenses first. Essential expenses include things like rent/mortgage, utilities, groceries, and debt payments.

Negotiate with Creditors: If you have outstanding debts, consider negotiating with creditors to lower interest rates, extend repayment terms, or explore debt consolidation options.

Increase Income: Explore opportunities to increase your income, such as taking on part-time work, freelancing, selling assets, or seeking a higher-paying job.

Emergency Fund: Building or tapping into an emergency fund can help cover unexpected expenses and prevent further financial bleeding during tough times.

Review Investments: Assess your investment portfolio and consider rebalancing or reallocating assets to align with your financial goals and risk tolerance.

Seek Professional Help: If your financial situation is particularly complex or dire, consider consulting a financial advisor, accountant, or bankruptcy attorney for guidance.

Cut Unnecessary Business Costs: In a business context, "cutting the bleeding" often involves scrutinizing operational expenses, renegotiating contracts, optimizing inventory, and evaluating the efficiency of various business processes.

Monitor Progress: Continuously monitor your financial situation and make adjustments as necessary. Regularly reviewing your financial health can help prevent future financial crises.

The specific actions you take will depend on your unique financial circumstances. The goal is to stop the financial losses and create a sustainable financial plan that puts you on a path toward financial stability and growth. It's important to act promptly when facing financial challenges to prevent further damage to your financial health.

www.antharas.co.uk/ companies website or top book distributors!

#BusinessStrategy

#Entrepreneurship

#Leadership

#Management

#Marketing

#Finance

#Startups

#Innovation

#Sales

#SmallBusiness

#CorporateCulture

#Productivity

#SelfDevelopment

#SuccessStories

#PersonalBranding

#Networking

#Negotiation

#BusinessEthics

#TimeManagement

#GrowthStrategies

#MarketAnalysis

#BusinessPlanning

#FinancialManagement

#HumanResources

#CustomerExperience

#DigitalTransformation

#Ecommerce

#SocialMediaMarketing

#BusinessCommunication

-

8:04

8:04

AV

1 year ago#1149 Press release - Pension funds can fire up the UK economy

361 -

LIVE

LIVE

BonginoReport

10 hours agoTrump Is Trying To SAVE America (Again) | Episode 220 - (02/06/26) VINCE

18,755 watching -

LIVE

LIVE

Chad Prather

16 hours agoKingdom People in a Compromised World

1,855 watching -

LIVE

LIVE

LFA TV

10 hours agoLIVE & BREAKING NEWS! | FRIDAY 2/6/26

2,881 watching -

LIVE

LIVE

Major League Fishing

1 day agoLIVE Tackle Warehouse Pro Circuit, Stop 1, Day 1

92 watching -

12:46

12:46

DeVory Darkins

20 hours agoMS NOW host drops BRUTAL NEWS for Chuck Schumer

4.85K13 -

LIVE

LIVE

Game On!

13 hours agoThe New England Patriots Are GUARANTEED To Make Super Bowl HISTORY!

171 watching -

LIVE

LIVE

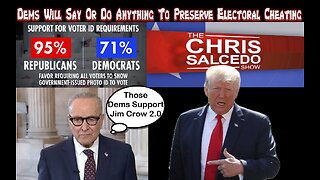

The Chris Salcedo Show

15 hours agoDems Say That 83% Who Support Voter ID, Support Jim Crow 2.0

574 watching -

1:03:09

1:03:09

Crypto Power Hour

13 hours ago $1.04 earnedMaster Your Crypto, Your Ultimate Wallet Guide

25.3K8 -

58:42

58:42

Chris Ripa

12 hours agoTHE WAKE UP CALL - 02/06/2026 - Episode. 58

11.6K4