Premium Only Content

#272 Initial Public Offering (IPO)

IPO stands for Initial Public Offering. It is the process by which a private company goes public by selling its shares to the general public for the first time. This allows the company to raise capital from a wide range of investors and list its shares on a stock exchange.

Here is a brief overview of the IPO process:

Preparation: The company interested in going public works with investment banks and legal experts to prepare financial statements, prospectuses, and other documents required for the IPO.

Regulatory Approval: The company must file a registration statement with the relevant regulatory authorities (such as the Securities and Exchange Commission in the United States). This document provides information about the company's financials, business model, risks, and more. Once approved, the company can proceed with the IPO.

Underwriting: The company typically partners with one or more investment banks to underwrite the offering. These banks help determine the offering price, the number of shares to be issued, and assist in marketing the IPO to potential investors.

Roadshow: The company's executives and underwriters go on a roadshow to pitch the IPO to institutional investors and potential buyers. This helps generate interest in the stock.

Pricing: The final IPO price is determined based on investor demand and other market factors. The offering price can be higher or lower than the company's initial expectations.

Trading: Once the IPO is complete and the shares are issued to investors, the company's stock begins trading on a stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Post-IPO: After the IPO, the company becomes publicly traded, and its shares can be bought and sold by investors on the stock exchange. The company must also comply with various reporting and regulatory requirements.

IPOs are a way for companies to raise capital and access the public markets, but they involve a considerable amount of work and regulatory compliance. Investors often closely scrutinize IPOs to determine if they want to invest in the newly public company. The success of an IPO is often judged by how well the stock performs after it starts trading on the stock exchange.

www.antharas.co.uk/ companies website or top book distributors!

#BusinessStrategy

#Entrepreneurship

#Leadership

#Management

#Marketing

#Finance

#Startups

#Innovation

#Sales

#SmallBusiness

#CorporateCulture

#Productivity

#SelfDevelopment

#SuccessStories

#PersonalBranding

#Networking

#Negotiation

#BusinessEthics

#TimeManagement

#GrowthStrategies

#MarketAnalysis

#BusinessPlanning

#FinancialManagement

#HumanResources

#CustomerExperience

#DigitalTransformation

#Ecommerce

#SocialMediaMarketing

-

14:15

14:15

AV

1 year ago#1151 Press release - AUKUS real-time AI trials

312 -

LIVE

LIVE

SpartakusLIVE

3 hours agoBattlefield 6 - REDSEC || ARC Raiders Later? || Anybody Want Warzone???

345 watching -

LIVE

LIVE

Alex Zedra

24 minutes agoLIVE! Spooky Games tn

96 watching -

1:39:58

1:39:58

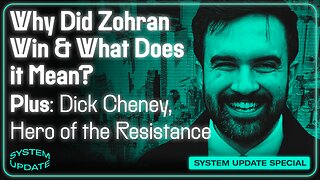

Glenn Greenwald

3 hours agoWhy Did Zohran Win & What Does it Mean? Plus: Dick Cheney, "Hero of the Resistance" | SYSTEM UPDATE #543

83.5K43 -

LIVE

LIVE

SilverFox

4 hours ago🔴LIVE - Arc Raiders is Game of the Year

144 watching -

1:44:39

1:44:39

vivafrei

2 hours agoArctic Frost is Bigger Scandal than you Think!! Live with Former Green Beret Ivan Raiklin!

21.1K22 -

LIVE

LIVE

Turning Point USA

2 hours agoTPUSA Presents This Is the Turning Point Tour LIVE with Eric and Lara Trump at Auburn University!

1,649 watching -

LIVE

LIVE

XDDX_HiTower

1 hour agoBATTLEFIELD 6 REDSEC! [RGMT CONTENT Mgr.

25 watching -

LIVE

LIVE

Joker Effect

31 minutes agoSTREAMER NEWS: What actually occurred at Dreamhack ATL. Frontier Airlines. Kick Staff Trolled me?!

467 watching -

LIVE

LIVE

VapinGamers

42 minutes agoBF6 RedSpec - Nothing but Wins and New Rum Bot Testing - !rumbot !music

14 watching