Premium Only Content

Barometer Readings Webcast - March 5th 2024

Key Points:

Market Overview:

- March marks the beginning of spring and potential volatility due to historical trends in the presidential election cycle. As it is we have not seen evidence of near term risks.

- The market has shown resilience, hitting new all-time highs since January after a correction into the end of October 2023.

Opportunities in Canadian and Global Markets:

- Despite challenges into October, Canadian stocks now show promise.

- Global markets, including Japan, Europe, Mexico, and Brazil, are demonstrating strength after years of underperformance. This is improving equity market breadth.

Fixed Income and Stocks:

- We are currently in a bond bear market, with stocks outperforming.

- Dividend growth stocks are particularly strong, offering better returns than bonds and attracting new buyers interested in outpacing inflation.

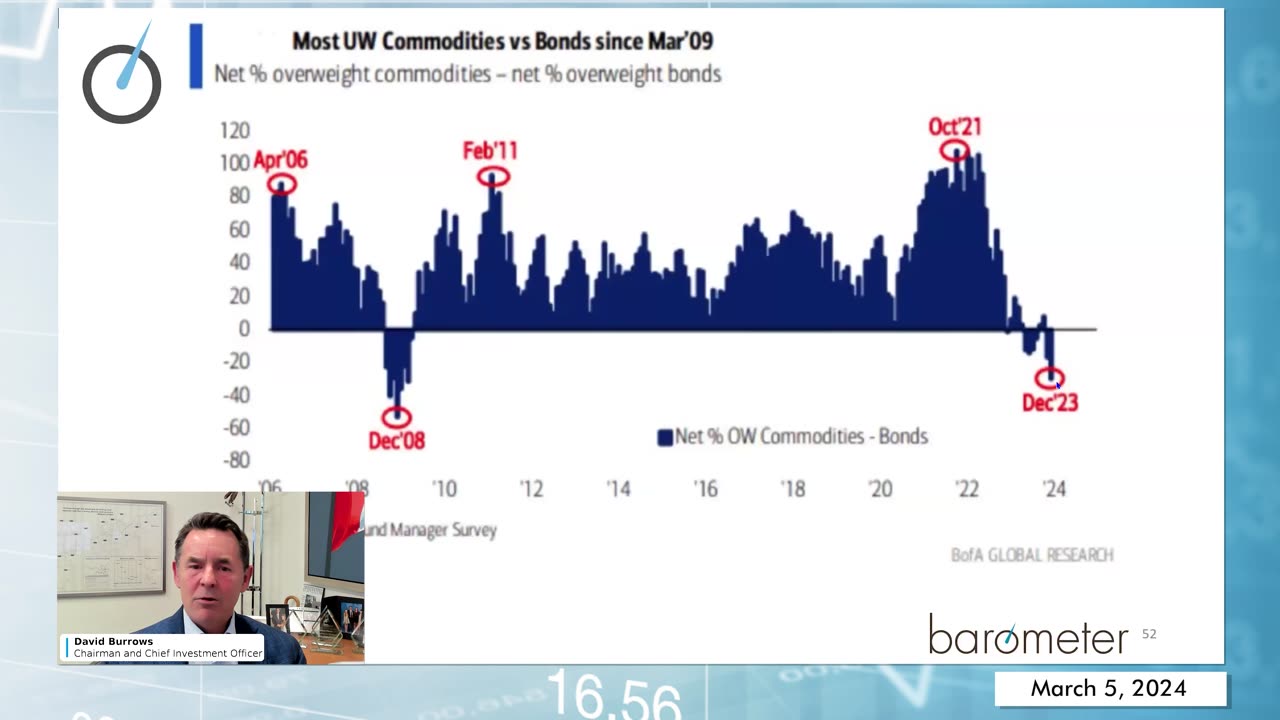

Commodities and Cryptocurrency:

- Potential upside seen in gold and energy, undervalued and under-owned for some time but seeing new catalysts.

- Bitcoin and Ethereum show promise, also benefiting from a weaker US dollar.

Portfolio Alignment:

- Portfolios currently aligned with market themes, ready to adapt to changing conditions.

- Financials, especially Canadian banks, performing well, with recent position adjustments.

Insights on Canadian Banks:

- Stabilization in fundamentals observed after Q4 '23 earnings.

- Domestically focused banks outperforming, while those with more US exposure struggling.

Sector Performance:

- Industrial sector showing strength, with various segments performing well.

- Healthcare and consumer discretionary stocks showing modest gains, while consumer staples lag.

Portfolio Strategy:

- Overweight positions in financials, industrials, and energy; underweight in tech, healthcare, and consumer discretionary.

- Launch of a Global Equity strategy to capitalize on positive structural changes.

Risk Monitoring:

- Monitoring credit risk, volatility, and seasonality.

- Cautiously optimistic approach to gold miners and attention to Bitcoin's recent volatility.

Market Outlook:

- Constructive outlook with always present potential for short-term pullbacks.

- Opportunities present in various sectors; encourage questions and discussions for navigating the market landscape.

-

LIVE

LIVE

Major League Fishing

2 days agoLIVE Tackle Warehouse Pro Circuit, Stop 1, Day 2

2,343 watching -

LIVE

LIVE

GritsGG

1 hour ago#1 Warzone Victory Leaderboard 1280+ Ws!!🔥

76 watching -

46:59

46:59

The Why Files

1 day agoProject Anchor: NASA's Secret Gravity Shutdown Program

42.2K66 -

3:48

3:48

RidiculousRides

1 day ago $0.79 earnedThe World’s Most Expensive Motorhome: Inside The $3M Marchi Element SV

4.86K3 -

14:48

14:48

WhatCulture - Film

4 days ago $0.46 earned10 Movies That Just Got Cancelled

4.77K2 -

10:52

10:52

WhatCulture Gaming

2 days ago $0.07 earnedThe Perfect Game DOES Exist

3.11K1 -

LIVE

LIVE

FrizzleMcDizzle

2 hours ago $0.97 earnedSoloing in nightreign - New emotes

109 watching -

1:50:43

1:50:43

iCkEdMeL

3 hours ago $5.10 earnedTrump Bombshell: 'Very Strong Clues' & Possible Suspect ID'd in Nancy Guthrie Kidnapping!

16.9K14 -

11:02

11:02

WhatCulture Horror

1 day ago $0.16 earned10 MORE Horror Movies Where The Victim Is More Dangerous Than The Villain

4.36K1 -

6:25

6:25

Who What Wear

3 days agoCharli XCX's Stylist Breaks Down Her BRAT Fashion Era | Behind The Looks | Who What Wear

2.67K