Premium Only Content

Barometer Readings Webcast - March 5th 2024

Key Points:

Market Overview:

- March marks the beginning of spring and potential volatility due to historical trends in the presidential election cycle. As it is we have not seen evidence of near term risks.

- The market has shown resilience, hitting new all-time highs since January after a correction into the end of October 2023.

Opportunities in Canadian and Global Markets:

- Despite challenges into October, Canadian stocks now show promise.

- Global markets, including Japan, Europe, Mexico, and Brazil, are demonstrating strength after years of underperformance. This is improving equity market breadth.

Fixed Income and Stocks:

- We are currently in a bond bear market, with stocks outperforming.

- Dividend growth stocks are particularly strong, offering better returns than bonds and attracting new buyers interested in outpacing inflation.

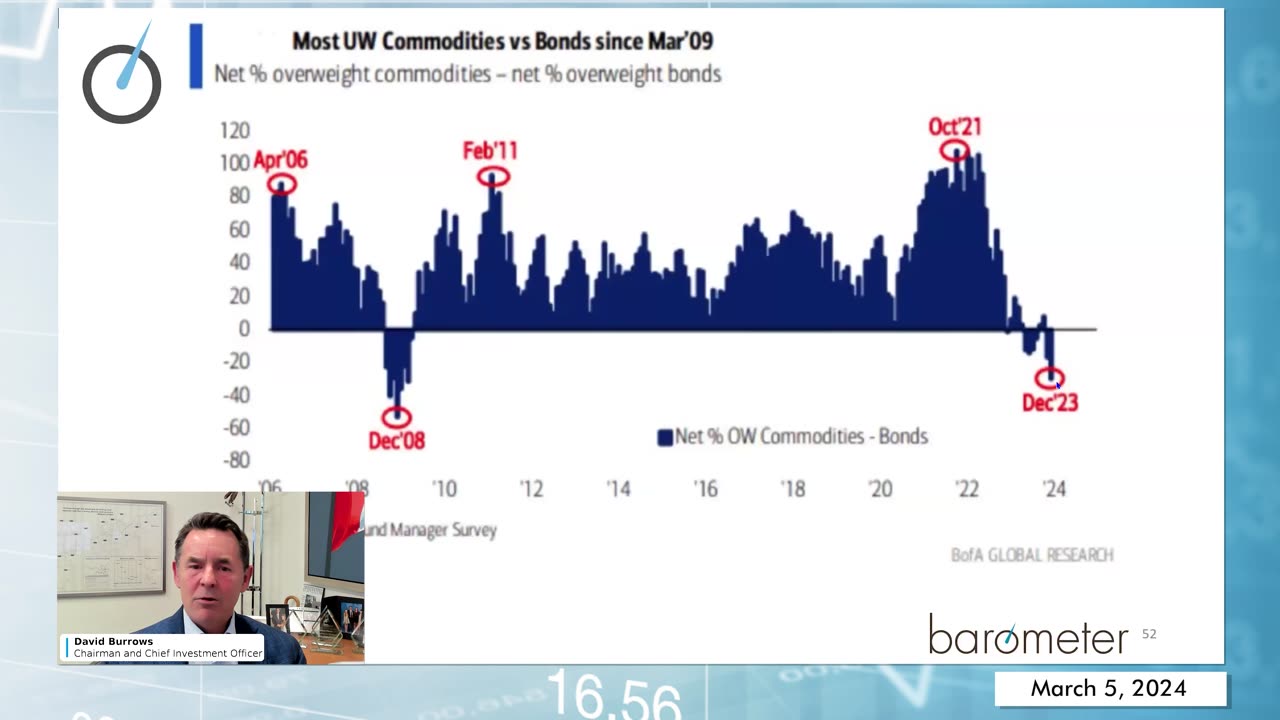

Commodities and Cryptocurrency:

- Potential upside seen in gold and energy, undervalued and under-owned for some time but seeing new catalysts.

- Bitcoin and Ethereum show promise, also benefiting from a weaker US dollar.

Portfolio Alignment:

- Portfolios currently aligned with market themes, ready to adapt to changing conditions.

- Financials, especially Canadian banks, performing well, with recent position adjustments.

Insights on Canadian Banks:

- Stabilization in fundamentals observed after Q4 '23 earnings.

- Domestically focused banks outperforming, while those with more US exposure struggling.

Sector Performance:

- Industrial sector showing strength, with various segments performing well.

- Healthcare and consumer discretionary stocks showing modest gains, while consumer staples lag.

Portfolio Strategy:

- Overweight positions in financials, industrials, and energy; underweight in tech, healthcare, and consumer discretionary.

- Launch of a Global Equity strategy to capitalize on positive structural changes.

Risk Monitoring:

- Monitoring credit risk, volatility, and seasonality.

- Cautiously optimistic approach to gold miners and attention to Bitcoin's recent volatility.

Market Outlook:

- Constructive outlook with always present potential for short-term pullbacks.

- Opportunities present in various sectors; encourage questions and discussions for navigating the market landscape.

-

1:45:14

1:45:14

Redacted News

2 hours agoBREAKING: Jeffrey Epstein's Israeli Mossad Connections EXPOSED in New Documents - Cover-Up Deepens

97.3K49 -

1:14:16

1:14:16

vivafrei

4 hours agoKash Patel's Girlfriend Sues Elijah Schaeffer for $5 MIL Man Charged Over Portnoy Incident & MORE!

99.1K38 -

1:53:37

1:53:37

The Quartering

5 hours agoWar Declared On ICE In Chicago, Massive Allegations Against Leftist Streamer Hasan, 600,000 Chinese

120K40 -

2:04:04

2:04:04

DeVory Darkins

6 hours agoSchumer gets NIGHTMARE NEWS from Democrats

138K53 -

8:41

8:41

ARFCOM News

5 hours ago $1.32 earnedWill It Dremel? New V-Series Glock Pics Leaked! + ATF Alters The Deal

4.28K3 -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | TUESDAY 11/11/25

1,121 watching -

LIVE

LIVE

freecastle

6 hours agoTAKE UP YOUR CROSS- For the Lord is a GOD of justice; BLESSED are all those who wait for him!

130 watching -

2:10:12

2:10:12

Side Scrollers Podcast

7 hours agoMAJOR Hasan Allegations + Arc Raiders Review CONTROVERSY + Craig TRENDS on X + More | Side Scrollers

44.5K7 -

5:43

5:43

Buddy Brown

7 hours ago $6.03 earnedThere's a List of WEF's "Post Trump" Predictions GOING VIRAL! | Buddy Brown

32.5K17 -

1:43:59

1:43:59

The HotSeat With Todd Spears

4 hours agoEP 207: Have YOU earned THEIR Sacrifice??

14.8K4