Premium Only Content

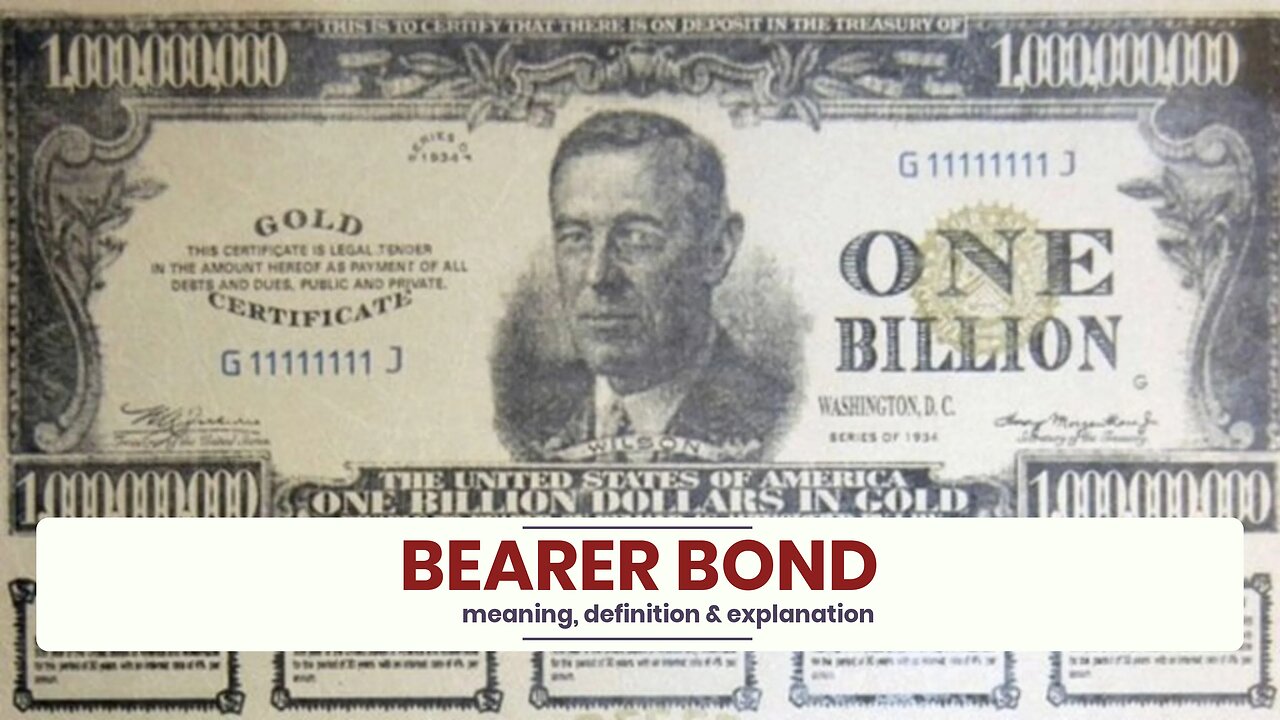

What is BEARER BOND?

✪✪✪✪✪

http://www.theaudiopedia.com

✪✪✪✪✪

What does BEARER BOND mean? BEARER BOND meaning - BEARER BOND definition - BEARER BOND explanation. What is the meaning of BEARER BOND? What is the definition of BEARER BOND? What does BEARER BOND stand for? What is BEARER BOND meaning? What is BEARER BOND definition?

A bearer bond is a bond or debt security issued by a business entity such as a corporation, or a government. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered – no records are kept of the owner, or the transactions involving ownership. Whoever physically holds the paper on which the bond is issued owns the instrument. This is useful for investors who wish to retain anonymity. Recovery of the value of a bearer bond in the event of its loss, theft, or destruction is usually impossible. Some relief is possible in the case of United States public debt.

Bearer bonds have historically been the financial instrument of choice for money laundering, tax evasion, and concealed business transactions in general. In response, new issuances of bearer bonds have been severely curtailed in the United States since 1982.

In the United States all the bearer bonds issued by the U.S. Treasury have matured. They no longer pay interest to the holders. As of May 2009, the approximate amount outstanding is $100 million.

In June 2009, Italian financial police and custom guards seized documents purporting to be U.S. bearer bonds, totaling $134.5 billion. The bonds were in $500 million and $1 billion denominations, although the highest denomination ever issued by the US Treasury was $10,000. It was unclear what the purpose of the fake bonds was; the two men carrying them were not detained after the bonds were seized.

In the United States, the Tax Equity and Fiscal Responsibility Act of 1982 substantially curtailed the issue of debt in bearer form. The Act disallowed a tax-deduction of interest paid on any such bonds issued after 1982 by the issuer in the case of corporate bonds, and removed the tax-exemption of the interest to the holder in the case of municipal bonds. In contrast, registered bonds retained the tax-exempt treatment. A challenge to this tax treatment by the U.S. state of South Carolina was heard by the U.S. Supreme Court in the case of South Carolina v. Baker (1988), which upheld the law and brought to an end the further issue of virtually all U.S. municipal bearer bonds.

-

2:24

2:24

The Audiopedia

1 year agoWhat is AUSTERITY?

90 -

4:41

4:41

Sean Unpaved

2 hours agoNFL Week 8 Eye Openers

9.5K1 -

25:57

25:57

The Kevin Trudeau Show Limitless

4 days agoThe Sound Of Control: This Is How They Program You

83.2K26 -

LIVE

LIVE

GritsGG

5 hours agoQuads Win Streak Record Attempt 28/71 ! Top 70! Most Wins in WORLD! 3744+!

171 watching -

LIVE

LIVE

Astral Doge Plays!

4 hours agoLuigi's Mansion 2 ~LIVE!~ Haunted Towers

68 watching -

37:00

37:00

Tactical Advisor

3 hours agoNew Budget Honeybadger/Glock Discontinues All Models | Vault Room Live Stream 043

84.7K3 -

LIVE

LIVE

TheItalianCEO

4 hours agoLast stream before Dreamhack

83 watching -

LIVE

LIVE

Cripiechuccles

1 hour ago😁18+💚💙SUNDAY FUNDAY WITH CRIPIE💚RUMLUV💙👌SMOKING, GAMING & WATCHING FLICKS!:😁

18 watching -

LIVE

LIVE

DoldrumDan

2 hours agoSACRED SEKIRO DAY 6 FIRST PLAYTHROUGH - DAY 24 NEW LIFE

17 watching -

LIVE

LIVE

Total Horse Channel

7 hours ago2025 IRCHA Derby & Horse Show - October 26th

74 watching