Premium Only Content

TRADING Pattern 4 - LEARN and EARN

A price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. A continuation pattern can be considered a pause during a prevailing trend. This is when the bulls catch their breath during an uptrend or when the bears relax for a moment during a downtrend.

2

While a price pattern is forming, there is no way to tell if the trend will continue or reverse. As such, careful attention must be placed on the trendlines used to draw the price pattern and whether the price breaks above or below the continuation zone. Technical analysts typically recommend assuming a trend will continue until it is confirmed that it has reversed.

In general, the longer the price pattern takes to develop, and the larger the price movement within the pattern, the more significant the move once the price breaks above or below the area of continuation.

If the price continues on its trend, the price pattern is known as a continuation pattern. Common continuation patterns include:

Pennants, constructed using two converging trendlines

Flags, drawn with two parallel trendlines

Wedges, constructed with two trendlines that would converge if they were long enough, where both are angled either up or down

Triangles are among the most popular chart patterns used in technical analysis since they occur frequently compared to other patterns. The three most common types of triangles are symmetrical triangles, ascending triangles, and descending triangles. These chart patterns can last anywhere from a couple of weeks to several months.

Reversal Patterns

A price pattern that signals a change in the prevailing trend is known as a reversal pattern. These patterns signify periods where the bulls or the bears have run out of steam. The established trend will pause, then head in a new direction as new energy emerges from the other side (bull or bear).

3

For example, an uptrend supported by enthusiasm from the bulls can pause, signifying even pressure from both the bulls and bears, then eventually give way to the bears. This results in a change in trend to the downside.

Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. Conversely, reversals that occur at market bottoms are known as accumulation patterns, where the trading instrument becomes more actively bought than sold.

-

2:44:24

2:44:24

Laura Loomer

7 hours agoEP144: Trump Cracks Down On Radical Left Terror Cells

37.8K10 -

LIVE

LIVE

Drew Hernandez

10 hours agoLEFTISTS UNITE TO DEFEND KIMMEL & ANTIFA TO BE DESIGNATED TERRORISTS BY TRUMP

1,000 watching -

1:12:32

1:12:32

The Charlie Kirk Show

5 hours agoTPUSA AT CSU CANDLELIGHT VIGIL

81.2K57 -

6:53:45

6:53:45

Akademiks

8 hours agoCardi B is Pregnant! WERE IS WHAM????? Charlie Kirk fallout. Bro did D4VID MURK A 16 YR OLD GIRL?

51.7K6 -

2:26:15

2:26:15

Barry Cunningham

6 hours agoPRESIDENT TRUMP HAS 2 INTERVIEWS | AND MORE PROOF THE GAME HAS CHANGED!

119K82 -

1:20:27

1:20:27

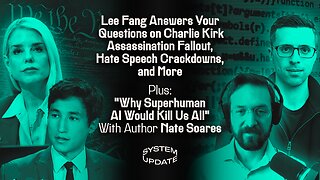

Glenn Greenwald

7 hours agoLee Fang Answers Your Questions on Charlie Kirk Assassination Fallout; Hate Speech Crackdowns, and More; Plus: "Why Superhuman AI Would Kill Us All" With Author Nate Soares | SYSTEM UPDATE #518

108K33 -

1:03:06

1:03:06

BonginoReport

8 hours agoLyin’ Jimmy Kimmel Faces The Music - Nightly Scroll w/ Hayley Caronia (Ep.137)

162K64 -

55:40

55:40

Donald Trump Jr.

12 hours agoThe Warrior Ethos & America's Mission, Interview with Harpoon Ventures Founder Larsen Jensen | Triggered Ep275

98.9K56 -

1:12:08

1:12:08

TheCrucible

8 hours agoThe Extravaganza! EP: 39 (9/18/25)

136K18 -

1:21:41

1:21:41

Kim Iversen

9 hours agoNick Fuentes Denies Israel Killed Charlie Kirk | Right-Wing CANCELS Jimmy Kimmel

88.7K274