Premium Only Content

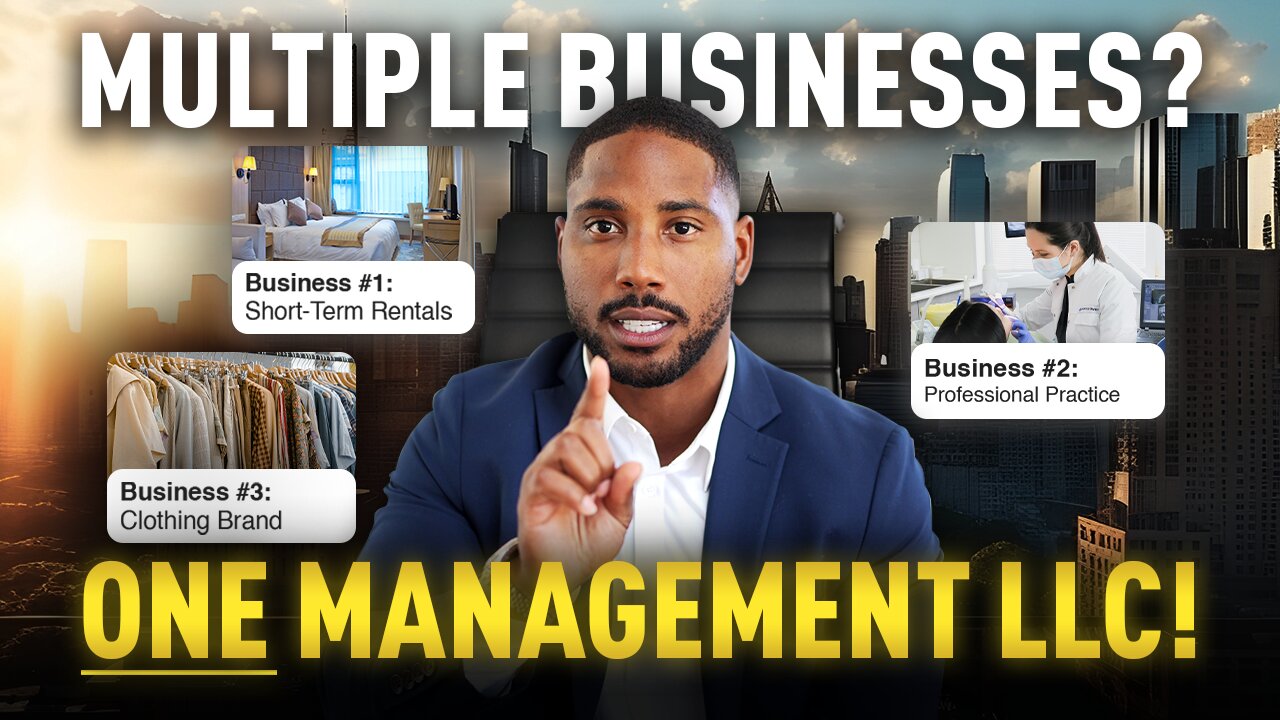

When Should You Set Up an LLC Management Company?

JOIN THE TAX-FREE WEALTH CHALLENGE NOW! OCTOBER 14-18, 2024!

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube

TAKING THE NEXT STEP:

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

Many entrepreneurs and business owners have several, or even a large number of business entities that they either own or operate. If you are an entrepreneur, then the way that you structure your entities can have huge implications both for your taxes and the liabilities that your businesses are exposed to.

In this video, tax expert Karlton Dennis breaks explains the concept of LLC management companies. He discusses what they are, when entrepreneurs should consider forming them, and what their most important benefits are. He also explains how business owners can shift income from their operational companies to their management companies, and how management companies can be used by real estate investors.

A lot of people who own businesses also want to add either their spouses or their children to payroll. Karlton explains how LLC management companies can be extremely useful for this purpose as well. Due to the complexities of entity structuring, it is important to consult a tax professional to answer any questions you might have about setting up management companies.

CHAPTERS:

0:00 Intro

0:31 What is a Management Company?

2:30 How to Use Management Companies for Income Shifting

6:45 Tax Advantages of Placing Your Children on Payroll

7:20 Using the Home Office Deduction

7:43 Vehicle Write-Offs for Real Estate Investors

8:58 The Different Types of Management Companies

9:41 Study the Court Cases with a Tax Professional

9:59 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#realestateinvesting #managementcompany #entrepreneur

-

8:44

8:44

Karlton Dennis

2 days agoShould You Trust AI for Financial Advice?

111 -

5:32:20

5:32:20

Turning Point Action

21 hours agoLIVE NOW: AMFEST DAY 4 - DONALD TRUMP JR., ERIKA KIRK, TOM HOMAN, VICE PRESIDENT JD VANCE & MORE…

1.05M273 -

5:41:23

5:41:23

Misfits Mania

5 days ago $916.50 earnedMISFITS MANIA: Fight Night

3.27M -

12:25

12:25

Actual Justice Warrior

1 day agoSan Francisco Democrats PASS Black Privilege Law

2.64K30 -

LIVE

LIVE

DynastyXL

1 hour ago🎅 3 Sleeps Till Christmas 🎄🎁 Fortnite with viewers! !join

65 watching -

52:08

52:08

Man in America

12 hours agoThe Sinister Plan to Crush Small Business — and Put You Under Corporate Rule

68.2K25 -

1:11:28

1:11:28

Sarah Westall

14 hours agoNewsmax Fired Me on Air! What Gets You Fired These Days w/ Dennis Michael Lynch

49.3K23 -

54:31

54:31

OFFICIAL Jovan Hutton Pulitzer Rumble

12 hours agoReview Of The Con In Progress!

66.9K17 -

2:32:35

2:32:35

IsaiahLCarter

1 day ago $9.34 earnedRageaholics Anonymous || APOSTATE RADIO 038 (w/RAZ0RFIST)

47.9K7 -

1:13:11

1:13:11

vivafrei

17 hours agoEARLY HOLIDAY STREAM! Kirk / TPUSA Internet Pile-On CONTINUES! Minnesota Fraud! Georgia Faud & MORE!

126K155