Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

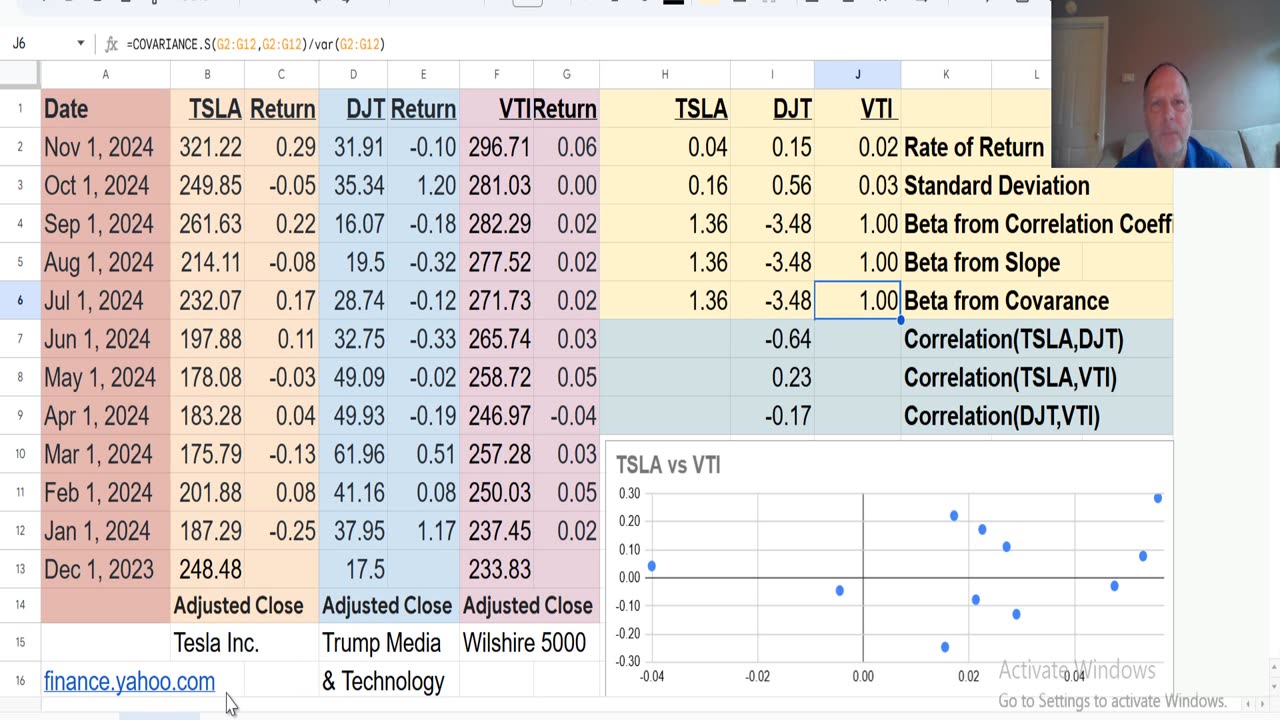

TSLA, DJT, VTI (Standard Deviation, Variance, Correlation, Covariance, and Beta)

10 months ago

28

Finance & Crypto

Brigham

Financial Management

Corporate Finance

Risk and Return

Beta

Covarance

Correlation

Variance

Standard Deviation

VTI

This video uses historic stock data from finance.yahoo.com for Tesla Inc. (TSLA), Trump Media

& Technology Group Corp (DJT), and Vanguard Total Stock Market Index Fund ETF Shares (VTI) to show how to use Excel function to calculate Rate of Return, Variance, Standard Deviation, Correlation, Covariance, and Beta. The Vanguard Total Stock Market Index is a proxy for the Wilshire 5000 which is a broader US stock index than the S&P 500.

The problem is a supplement to the Brigham, Financial Management text chapter on Risk and Return Part 1.

Loading 1 comment...

-

24:14

24:14

Verified Investing

2 days agoBiggest Trade As AI Bubble Begins To Burst, Bitcoin Flushes Through 100K And Gold Set To Fall

8.16K -

1:12:28

1:12:28

Sean Unpaved

3 hours agoAB's Dubai Drama: Extradited & Exposed + NFL Week 10 Locks & CFB Week 11 Upsets

19.7K -

2:06:08

2:06:08

The Culture War with Tim Pool

5 hours agoDemocrats Elect Man Who Wants To Kill Conservatives, Time For An Exorcism | The Culture War Podcast

121K95 -

1:36:52

1:36:52

Steven Crowder

6 hours agoMamdani's Anti-White Victory Must Be America's Wake Up Call

314K348 -

2:18:38

2:18:38

Side Scrollers Podcast

4 hours agoGTA 6 GETS WRECKED AFTER ANOTHER DELAY + India THREATENS YouTuber Over Video + More | Side Scrollers

25.6K6 -

1:00:20

1:00:20

Simply Bitcoin

7 hours ago $0.08 earnedThe Bitcoin Crucible w/ Alex Stanczyk ft Tomer Strolight - Episode 7

39.4K1 -

17:33

17:33

a12cat34dog

7 hours agoRUMBLE TAKEOVER @ DREAMHACK | VLOG | {HALLOWEEN 2025}

32.1K22 -

LIVE

LIVE

Spartan

4 hours agoStellar Blade Hard Mode with death counter (First Playthrough)

37 watching -

1:02:11

1:02:11

VINCE

7 hours agoPelosi Is Passing The Torch - Who's Next? | Episode 164 - 11/07/25 VINCE

210K192 -

4:58:29

4:58:29

GloryJean

5 hours agoWINNING All Day Long Baby 😎

23.8K1