Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

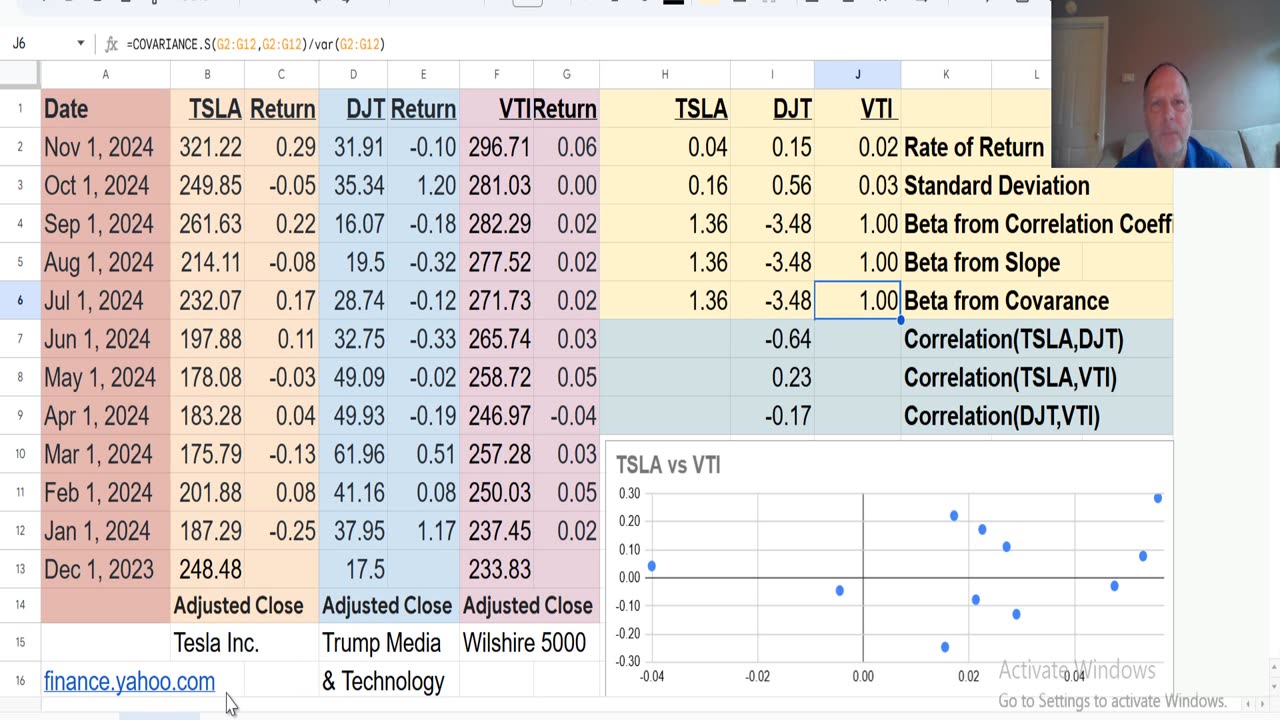

TSLA, DJT, VTI (Standard Deviation, Variance, Correlation, Covariance, and Beta)

10 months ago

27

Finance & Crypto

Brigham

Financial Management

Corporate Finance

Risk and Return

Beta

Covarance

Correlation

Variance

Standard Deviation

VTI

This video uses historic stock data from finance.yahoo.com for Tesla Inc. (TSLA), Trump Media

& Technology Group Corp (DJT), and Vanguard Total Stock Market Index Fund ETF Shares (VTI) to show how to use Excel function to calculate Rate of Return, Variance, Standard Deviation, Correlation, Covariance, and Beta. The Vanguard Total Stock Market Index is a proxy for the Wilshire 5000 which is a broader US stock index than the S&P 500.

The problem is a supplement to the Brigham, Financial Management text chapter on Risk and Return Part 1.

Loading 1 comment...

-

LIVE

LIVE

Red Pill News

2 hours agoNGO’s Caught Funding CCP on Red Pill News Live

3,435 watching -

LIVE

LIVE

GritsGG

3 hours agoDuos into Quads! #1 Most Wins 3880+!

60 watching -

LIVE

LIVE

Spartan

2 hours agoFirst playthrough of First Berserker Khazan

22 watching -

LIVE

LIVE

ReAnimateHer

6 hours ago $0.13 earnedScreaming, Failing, and Probably Dying – A Normal Night in Dead by Daylight

42 watching -

LIVE

LIVE

LFA TV

20 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 10/29/25

1,132 watching -

1:12:02

1:12:02

vivafrei

3 hours agoThe Rise of Mamdami & the Fall of New York! Ice Activits ARRESTED! Ostrich Farm UPDATE! & More!

84.1K54 -

16:31

16:31

Clintonjaws

6 hours ago $8.89 earnedICE Rioters Getting Arrested - This Is Priceless

15.2K9 -

1:05:34

1:05:34

The Quartering

4 hours agoJob Economy Collapsing, Food Wars Start Friday & The War On Tucker Carlson

117K36 -

3:40:16

3:40:16

Barry Cunningham

3 hours agoPRESIDENT TRUMP EVENTS IN SOUTH KOREA | MIKE JOHNSON SHUTDOWN DAY 29 PRESSER | MORE NEWS!

34.8K12 -

59:38

59:38

The HotSeat

2 hours agoAmerican Politics Are Really NOT This HARD!!!!

14.7K5