Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

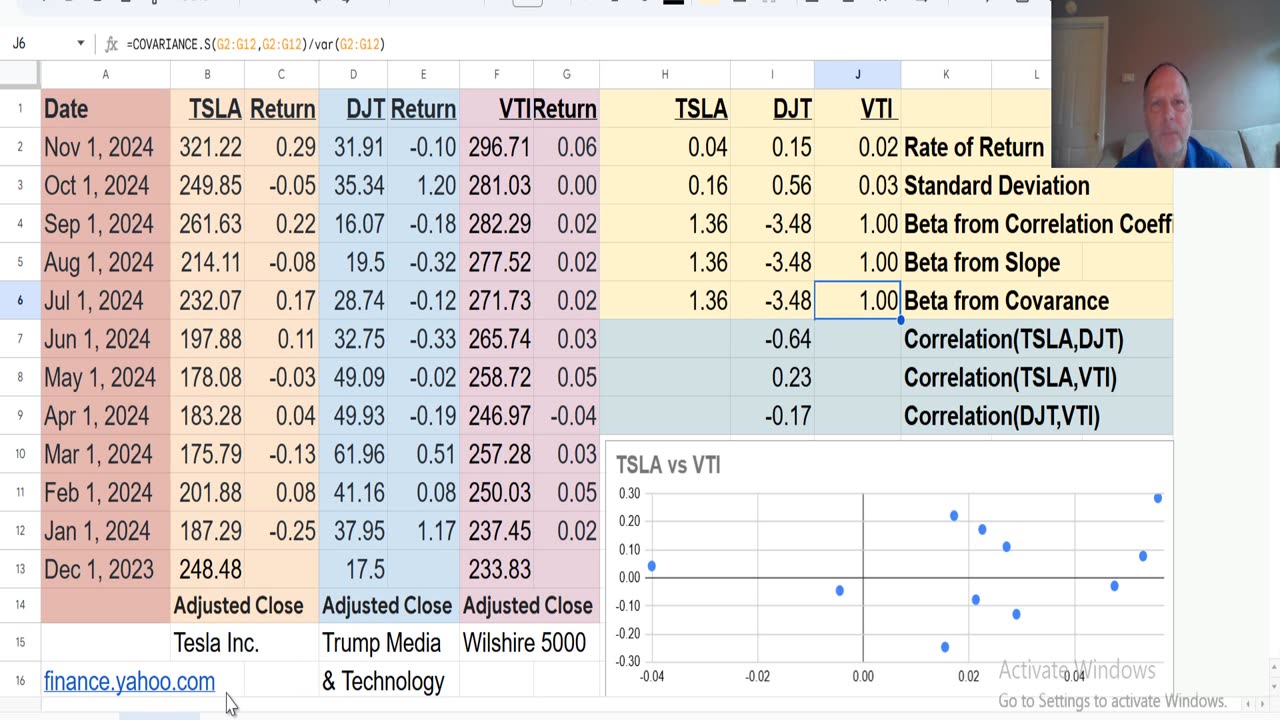

TSLA, DJT, VTI (Standard Deviation, Variance, Correlation, Covariance, and Beta)

10 months ago

25

Finance & Crypto

Brigham

Financial Management

Corporate Finance

Risk and Return

Beta

Covarance

Correlation

Variance

Standard Deviation

VTI

This video uses historic stock data from finance.yahoo.com for Tesla Inc. (TSLA), Trump Media

& Technology Group Corp (DJT), and Vanguard Total Stock Market Index Fund ETF Shares (VTI) to show how to use Excel function to calculate Rate of Return, Variance, Standard Deviation, Correlation, Covariance, and Beta. The Vanguard Total Stock Market Index is a proxy for the Wilshire 5000 which is a broader US stock index than the S&P 500.

The problem is a supplement to the Brigham, Financial Management text chapter on Risk and Return Part 1.

Loading 1 comment...

-

LIVE

LIVE

ZWOGs

5 hours ago🔴LIVE IN 1440p! - Playing Puppet Combo Games For The First Time! - Come Hang Out!

57 watching -

1:12:57

1:12:57

Kim Iversen

3 hours agoGaza War Over—Or Just on Pause? | California’s Next Governor—Screams at Staff, Hits Husband

15.4K70 -

LIVE

LIVE

Badlands Media

15 hours agoQuite Frankly Ep. 25

346 watching -

LIVE

LIVE

The Rabble Wrangler

16 hours agoThe Best in the West Plays Hunt: Showdown

22 watching -

LIVE

LIVE

AirCondaTv Gaming

7 hours ago $0.08 earnedHell Divers II & Blue Protocol: Star Resonance - Diving Straight into UwU Hell w/JFG (Collab)

29 watching -

LIVE

LIVE

clijin gaming

2 hours agoborderlands 4

5 watching -

33:02

33:02

Stephen Gardner

2 hours agoBOMBSHELL: Forensic Expert REVEALS Evidence FBI Missed in Charlie Kirk Case!

12.9K35 -

37:57

37:57

Simply Bitcoin

11 hours ago $0.46 earnedBitcoin Crucible w/ Alex Stanczyk | EP 3

7.91K3 -

11:09

11:09

Tundra Tactical

2 hours agoWhat Your Rifle Caliber Says About You In 2025 Tundra Tactical Is Back!

4.54K1 -

15:43

15:43

ArynneWexler

2 hours agoNONNEGOTIABLE #4: What is going on with Megyn Kelly?

4.62K9