Premium Only Content

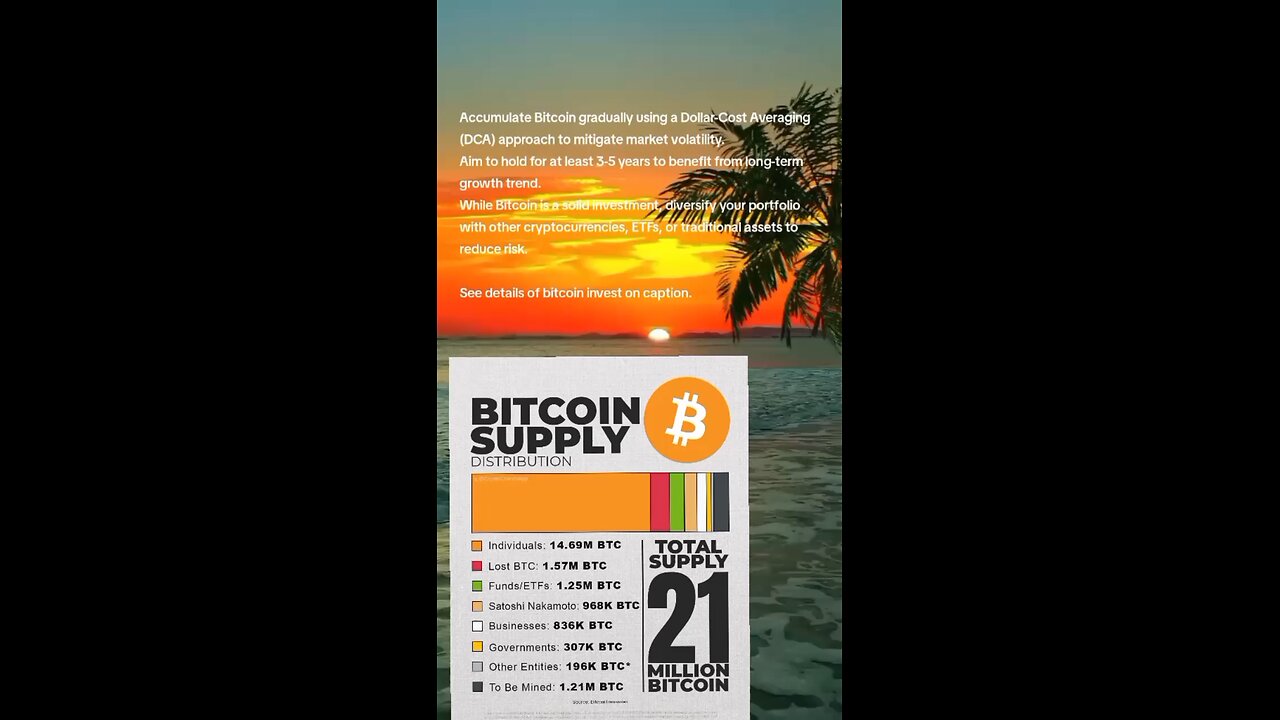

BITCOIN SUPPLY

The data in the Bitcoin Supply Distribution chart provides valuable insight into how Bitcoin is allocated among different entities. Here's an analysis followed by a recommended investment strategy:

---

Analysis:

1. Majority Owned by Individuals (14.69M BTC):

Bitcoin's decentralization is evident, with individuals holding the majority share.

This shows strong retail adoption and could indicate that market movements are influenced heavily by retail behavior.

2. Lost BTC (1.57M BTC):

A significant amount of Bitcoin is permanently lost, reducing the effective supply. This increases scarcity and enhances Bitcoin's potential value as a deflationary asset.

3. Funds/ETFs (1.25M BTC):

Institutional interest is growing as funds and ETFs represent a significant portion. Their long-term holding strategies could stabilize prices and increase demand.

4. Satoshi Nakamoto (968K BTC):

These coins are unlikely to move, essentially reducing the active supply. This further amplifies scarcity.

5. To Be Mined (1.21M BTC):

With a capped total supply, only a small portion remains to be mined. The mining reward halving every four years increases scarcity, potentially driving prices higher over time.

6. Businesses, Governments, and Other Entities (1.34M BTC combined):

Growing institutional and government involvement could indicate Bitcoin's increasing adoption as a store of value and financial asset.

---

Recommended Investment Strategy:

1. Long-Term Investment (HODLing):

Why: Bitcoin's fixed supply and deflationary nature make it a strong hedge against inflation. Historical trends show significant price appreciation over time.

Strategy:

Accumulate Bitcoin gradually using a Dollar-Cost Averaging (DCA) approach to mitigate market volatility.

Aim to hold for at least 3-5 years to benefit from long-term growth trends.

2. Diversification:

While Bitcoin is a solid investment, diversify your portfolio with other cryptocurrencies, ETFs, or traditional assets to reduce risk.

3. Monitor Institutional Trends:

Pay attention to fund and ETF adoption, as institutional investments often precede long-term price increases.

4. Keep an Eye on Halving Events:

The next Bitcoin halving (scheduled in 2024) will reduce the block reward from 6.25 BTC to 3.125 BTC. Historically, halving events have been followed by significant price surges. Consider increasing your Bitcoin holdings before this event.

5. Risk Management:

Only invest what you can afford to lose. Cryptocurrencies are highly volatile, and prices can fluctuate rapidly. Keep a balance between Bitcoin and other stable investments.

6. Use Secure Storage:

After purchasing Bitcoin, store it in a hardware wallet for maximum security. Avoid leaving significant amounts on exchanges.

7. Stay Informed:

Keep track of global economic trends, regulatory developments, and adoption by governments or businesses, as these factors heavily influence Bitcoin's price.

---

Conclusion:

Invest in Bitcoin with a focus on its long-term potential. Adopt a balanced and disciplined approach like DCA, diversify your holdings, and take advantage of market dynamics (like halving events) to optimize returns. Prioritize security and stay informed to adapt your strategy as the market evolves.

#bitcoin #crypto #trump

-----------

Claim your Moomoo welcome rewards https://j.moomoo.com/01Iik6

Gate.io Crypto exchange, Web3, NFT, Defi

https://www.gate.io/ref/X1NDAVk?ref_type=102

OKX Crypto exchange and Wallet

https://okx.com/join/9458250

Bridget, enjoy the crypto trading joiner together.

https://bit.ly/3Bx99Mn

Enjoy the sharing ideas and earning

https://rumble.com/register/themarkets

Check out https://linktr.ee/thecapmarkets for complete coverage along with all the latest financial news and data!

Follow us on socials:

Instagram: https://www.instagram.com/thecapmarkets

Facebook: https://www.facebook.com/thecapmarkets

TikTok: https://www.tiktok.com/@thecapmarkets

Twitter: https://www.x.com/tradingpalace

Telegram: https://t.me/thecapmarket

Spotify: https://tr.ee/m1Yhu61xS_

Substack :

thecapmarkets.substack.com

Disclaimer: Trading in financial markets involves significant risk, and there is no guarantee of profit. The information provided by any financial product or service is for educational purposes and should not be considered as financial advice. Before making any investment decisions, it's important to conduct thorough research and consult with a qualified financial advisor. Past performance is not indicative of future results. Always invest what you can afford to lose and be aware of the potential for loss in any investment strategy.

-

9:55

9:55

MattMorseTV

18 hours ago $17.17 earnedTheir ENTIRE PLOT just got EXPOSED.

16.6K75 -

1:55

1:55

Dr Disrespect

2 days agoPeak Focus. No Crash. This Is KENETIK

16.3K9 -

2:06:36

2:06:36

Side Scrollers Podcast

19 hours agoThis is the Dumbest Story We’ve Ever Covered… | Side Scrollers

72.5K21 -

15:37

15:37

The Pascal Show

18 hours ago $6.77 earnedCANDACE OWENS DISAPPEARS?! Candace Owens Goes Into Hiding After Revealing A**assination Claims

17.4K11 -

18:05

18:05

GritsGG

1 day agoThis Duo Lobby Got a Little Spicy! We Have Over 20,000 Wins Combined!

30K -

1:12:29

1:12:29

PandaSub2000

3 days agoSonic Galactic | GAME ON...ly! (Edited Replay)

28K5 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

241 watching -

21:23

21:23

Neil McCoy-Ward

19 hours ago🚨 While You Were Distracted TODAY... (This Quietly Happened!!!)

23.9K11 -

6:09:42

6:09:42

SpartakusLIVE

10 hours agoLIVE from OCEAN FRONT || ENERGIZED Wins and TOXIC Comms

267K18 -

1:35:45

1:35:45

Tucker Carlson

10 hours agoTucker Puts Piers Morgan’s Views on Free Speech to the Ultimate Test

67.7K346