Premium Only Content

Gold Review Week 17th Feb

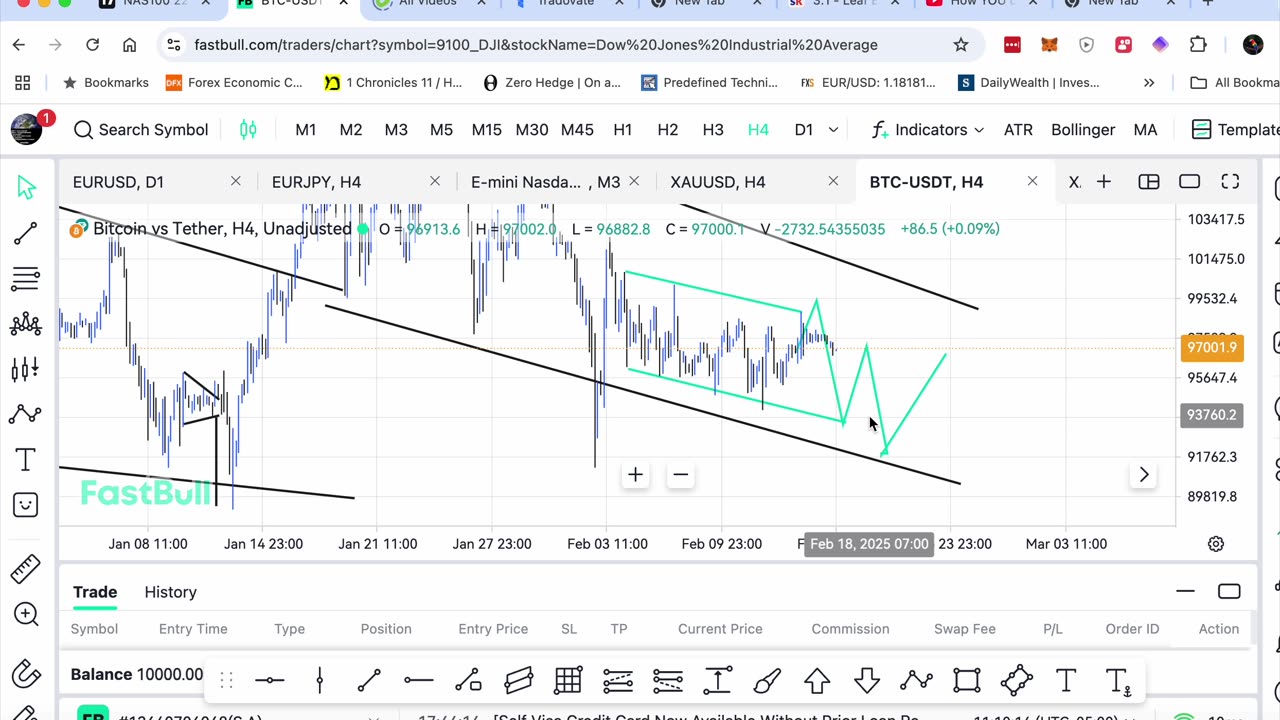

Gold (XAU/USD) Weekly Review: Bullish Momentum Continues

Gold prices surged this week as investors sought safe-haven assets amid growing economic uncertainty and Federal Reserve policy speculation. XAU/USD traded above the key psychological level of $2,000, supported by a weaker U.S. dollar and declining Treasury yields.

Key Factors Driving Gold Prices:

Weaker USD: The DXY index fell, making gold more attractive to foreign buyers.

Inflation Concerns: Rising inflation expectations fueled demand for gold as a hedge.

Geopolitical Uncertainty: Ongoing geopolitical tensions increased demand for safe-haven assets.

Nasdaq 100 (NDX) Weekly Review: Tech Stocks Drive Gains

The Nasdaq 100 continued its rally, reaching new highs as AI stocks and major tech earnings fueled investor optimism. The NDX climbed past 22,000. Look for a major rally breaking new highs.

EUR/USD Weekly Review: Euro Gains Amid USD Weakness

The EUR/USD pair climbed above 1.0500 as the dollar weakened following mixed economic data and expectations of a dovish Federal Reserve. The Euro also gained strength from positive Eurozone economic indicators.

"Euro to USD Forecast | EUR/USD Exchange Rate Trends & Analysis 2025"

"Get the latest EUR/USD exchange rate updates, ECB policy insights, and Eurozone economic trends. Analyze forex trading strategies for the Euro in 2025."

Euro exchange rate, EUR/USD forecast, Eurozone economy, ECB monetary policy, Forex trading Euro, EUR technical analysis, Euro volatility, USD strength

-

LIVE

LIVE

Kim Iversen

2 hours agoSTILL SHADY: Candace Meets With Erika — She Was Right

6,647 watching -

LIVE

LIVE

The Jimmy Dore Show

14 minutes agoTrump to Announce Venezuela War TONIGHT! Netanyahu Threatens Western Nations Over Antisemitism!

1,559 watching -

LIVE

LIVE

Candace Owens

2 hours agoBREAKING NEWS! We Received Photos Of Charlie's Car After The Assassination. | Candace Ep 281

12,198 watching -

1:42:25

1:42:25

Redacted News

2 hours agoPutin just did the UNTHINKABLE as US Senators push for war against Russia

98.6K71 -

LIVE

LIVE

SpartakusLIVE

1 day agoWZ All Night! || Arc has been UNINSTALLED

39 watching -

8:32

8:32

Dr. Nick Zyrowski

4 days agoHow Your Butt Shape Determine Metabolic Health - (Surprising Research!)

6.32K8 -

19:02

19:02

HotZone

5 days ago $4.43 earnedThe Hidden War Inside Israel: Following the Money to Terrorists

8.98K2 -

33:57

33:57

Stephen Gardner

2 hours agoHOLY CRAP! Trump Just Ordered the UNTHINKABLE on Venezuela – Rubio Demands It!

9.22K28 -

LIVE

LIVE

Dr Disrespect

6 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - SKILL TREE EXPERT

1,761 watching -

5:49

5:49

Buddy Brown

5 hours ago $2.36 earnedI Tried to WARN YOU Congress Would SNEAK It In! | Buddy Brown

11.7K13