Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

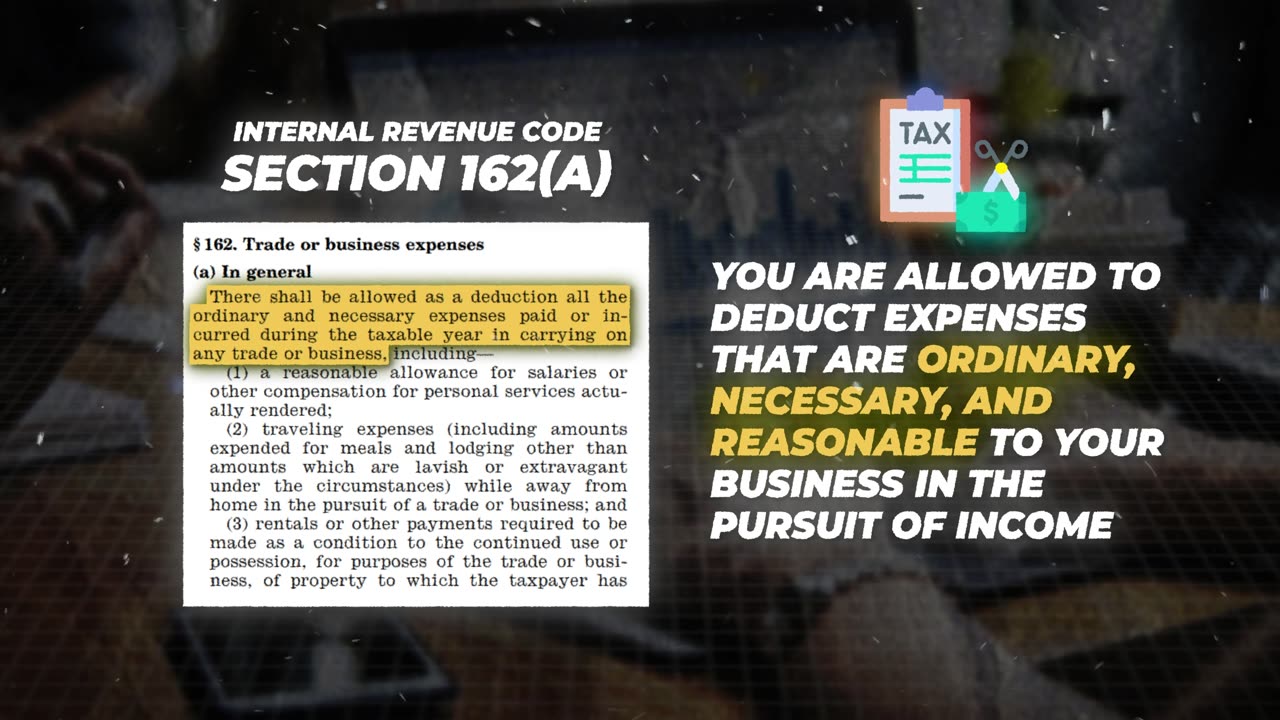

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

6:30

6:30

Karlton Dennis

25 days agoIRS Releases New Inflation-Adjusted Tax Brackets for 2026 | What This Means for You!

21 -

LIVE

LIVE

Steven Crowder

3 hours agoWho is the Real Myron Gaines | Ash Wednesday

43,728 watching -

LIVE

LIVE

The Rubin Report

1 hour agoCharlie Kirk’s Warning for MAGA if Mamdani Won

2,803 watching -

1:00:32

1:00:32

VINCE

3 hours agoNYC Has Been Seized By The Communists | Episode 162 - 11/05/25

138K149 -

1:33:32

1:33:32

Graham Allen

3 hours agoTold You The War Was FAR From Over… The Blue Wave Just Proved It! Evil Is Fighting Back!

88.6K89 -

LIVE

LIVE

Badlands Media

9 hours agoBadlands Daily: November 5, 2025

2,386 watching -

LIVE

LIVE

Wendy Bell Radio

7 hours agoLike Sheep To Slaughter

7,050 watching -

1:13:30

1:13:30

DML

3 hours agoDML LIVE: NYC Goes Socialist: Mamdani’s Victory

47.1K14 -

1:04:43

1:04:43

Chad Prather

15 hours agoTruth on Trial: When Fear Meets Faith

74.1K41 -

LIVE

LIVE

LFA TV

14 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 11/5/25

4,151 watching