Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

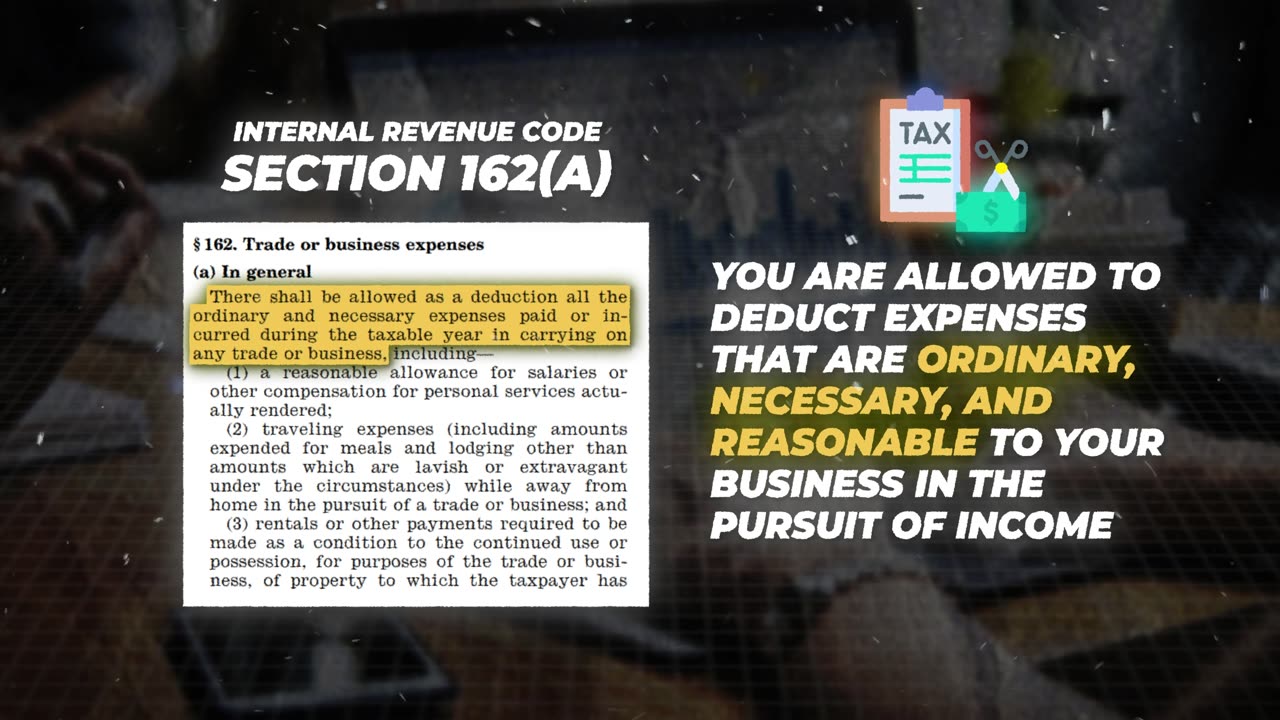

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

11:39

11:39

Karlton Dennis

1 month ago $0.01 earnedMy Wife Saves Us Millions By Doing This!

43 -

LIVE

LIVE

vivafrei

8 hours agoEp. 285: Visa Revocation No-Go! Sortor Arrested! Ostrich Crisis! 2A Win! Comey Defense & MORE!

12,507 watching -

LIVE

LIVE

Nerdrotic

1 hour agoDeDunking the Debunkers with Dan Richards | Forbidden Frontier #119

511 watching -

5:41:09

5:41:09

Right Side Broadcasting Network

2 days agoLIVE REPLAY: President Trump to Deliver Remarks at America's Navy 250 in Norfolk, VA - 10/5/25

93.4K63 -

LIVE

LIVE

SynsFPS

2 hours ago🔴B07 Beta🔴|🔴 LEVEL CAP INCREASED 🔴|🔴Path to Verify 🔴

112 watching -

LIVE

LIVE

tminnzy

2 hours ago*BETA DROPS* BO7 LEVEL CAP INCREASE! OPEN BETA

97 watching -

1:06:42

1:06:42

The White House

3 hours agoPresident Trump Delivers Remarks at Navy 250 Celebration

18.9K38 -

LIVE

LIVE

TinyPandaface

3 hours agoYour FACE is a Gaming Channel! | Homebody

84 watching -

3:22:43

3:22:43

Barry Cunningham

5 hours agoBREAKING NEWS: PRESIDENT TRUMP GIVES SPEECH TO THE NAVY!

58.4K35 -

LIVE

LIVE

EyeSeeU8

2 hours ago🔴Warzone + BO7 Beta w/ EyeSeeU

75 watching