Premium Only Content

How to Turn Everyday Expenses Into Tax Write Offs

JOIN THE TAX-FREE WEALTH CHALLENGE! MARCH 10th-14th, 2025

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube&utm_medium=description

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube&utm_medium=description&utm_campaign=kd255_write_off_everyday_expenses

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

People who know how to implement tax strategy correctly can successfully turn everyday expenses into tax write-offs. If you can learn how to do this, then you will most likely find that you can turn many more different types of expenses into deductions than you might have previously thought.

In this video, tax expert Karlton Dennis explains how you can turn everyday expenses into write-offs correctly and in full compliance with tax law. Importantly, he also provides a detailed explanation of expenses that you are not allowed to turn into tax write-offs. Knowing the difference is crucial to prevent audits and penalties.

It is also important to understand that not all taxpayers are allowed to write off the same expenses. So, Karlton also explains who is able to write off certain types of everyday expenses, and who is not. Watching this video can help you get a better understanding of the deductions you may qualify for.

CHAPTERS:

0:00 Intro

0:18 Employees vs Business Owners

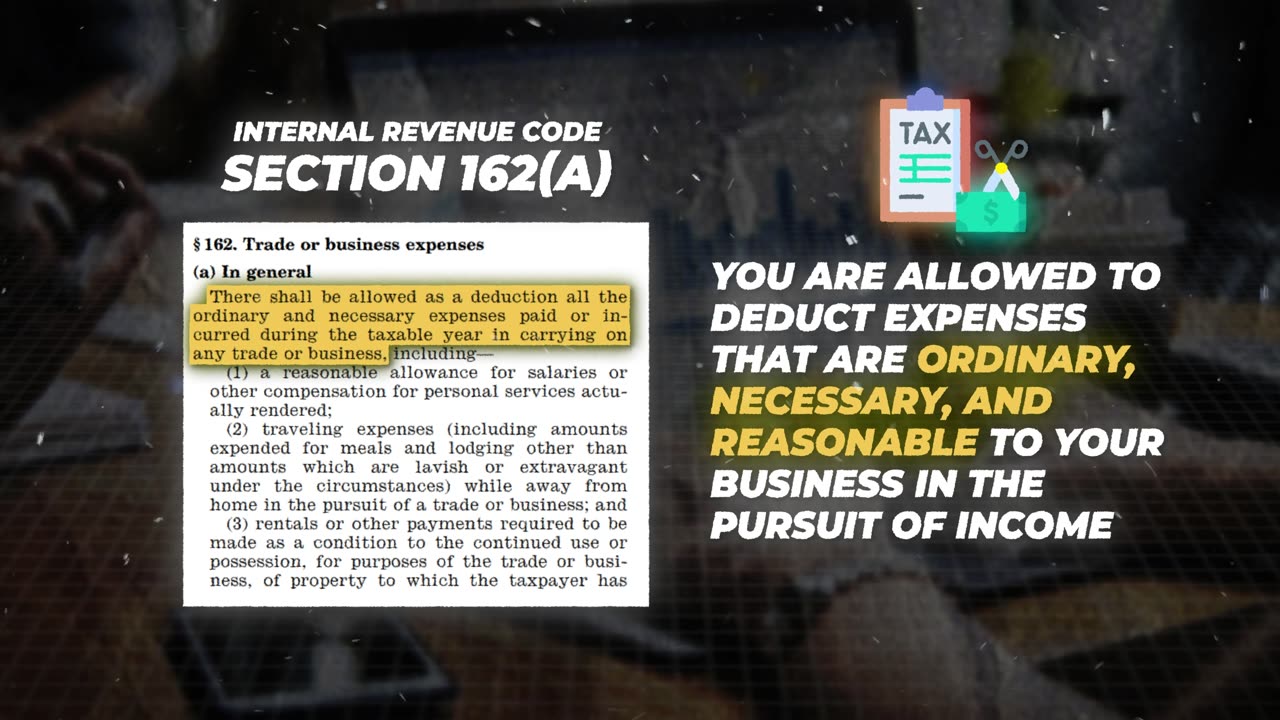

1:03 Code Section 162(a)

1:43 Expense #1: Home-Related Expenses

3:02 Expense #2: Laptop

3:44 Expense #3: Cell Phone

4:17 Expense #4: Vehicles

5:43 Expense #5: Meals

7:11 Expense #6: Travel

8:54 Subscriber Question!

9:43 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxdeductions #writeoffs #taxplanning

-

25:15

25:15

Karlton Dennis

15 hours agoFrom Stage to Site Visits: Tax Strategies in Action

4 -

2:18:38

2:18:38

Side Scrollers Podcast

17 hours agoGTA 6 GETS WRECKED AFTER ANOTHER DELAY + India THREATENS YouTuber Over Video + More | Side Scrollers

66.2K12 -

18:03

18:03

Nikko Ortiz

1 day agoEBT Meltdowns Are Insane...

5.97K17 -

9:03

9:03

MattMorseTV

14 hours ago $6.08 earnedTrump’s America First CALL TO ACTION.

14.5K35 -

17:33

17:33

a12cat34dog

20 hours agoRUMBLE TAKEOVER @ DREAMHACK | VLOG | {HALLOWEEN 2025}

40K25 -

10:48

10:48

GritsGG

13 hours agoWarzone Stadium Easter Egg! Unlock Grau Blueprint EASY!

6.51K2 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

223 watching -

1:43:54

1:43:54

TruthStream with Joe and Scott

3 days agoStuey and Elisa V interview Joe and Scott Q, AI, Glutathione, Tylenol etc 11/5 #510

10K5 -

29:15

29:15

BlabberingCollector

2 days agoHarry Potter X Fortnite, Fans Reee Over Trans Rights, NEW Audiobooks Are OUT, Wizarding Quick Hits

28.8K3 -

1:20:42

1:20:42

The Connect: With Johnny Mitchell

6 days ago $9.74 earnedThe Truth Behind The U.S. Invasion Of Venezuela: Ed Calderon Exposes American Regime Change Secrets

35.5K17