Premium Only Content

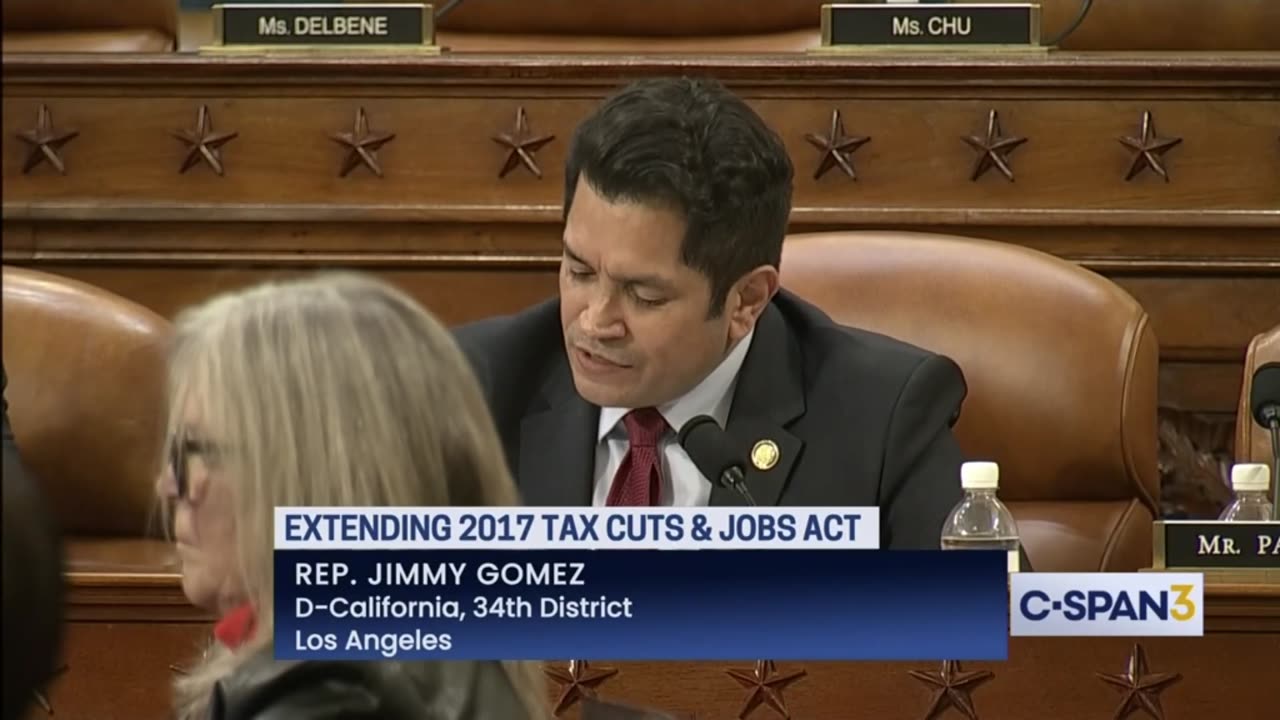

QA ONLY: Extending 2017 Tax Cuts and Jobs Act 02-11-25

0. ...today among America's families, farmers, small businesses?

https://youtu.be/6H3bygwlQQU?t=2297

1. ...thinking about starting a family or growing their family?

https://youtu.be/6H3bygwlQQU?t=2441

2. ...if Congress were to restore the 100% immediate expensing?

https://youtu.be/6H3bygwlQQU?t=2549

3. ...the Republican Party borrowed $3 trillion for the tax cut?

https://youtu.be/6H3bygwlQQU?t=2781

4. ...it, and then complain about the debt they already have?

https://youtu.be/6H3bygwlQQU?t=2840

5. ...credit expansion that the pandemic relief packages offered?

https://youtu.be/6H3bygwlQQU?t=2899

6. ...though it's a timing type issue? Is that your thought on it?

https://youtu.be/6H3bygwlQQU?t=3174

7. ...to that 43% bracket? But what's your thought on the 199?

https://youtu.be/6H3bygwlQQU?t=3254

8. ...like, perhaps, to an individual business or even beyond?

https://youtu.be/6H3bygwlQQU?t=3938

9. ...and what would happen if the Republicans, uh, repeal that?

https://youtu.be/6H3bygwlQQU?t=4229

10. ...credit and the section 45 ex of our manufacturing sector?

https://youtu.be/6H3bygwlQQU?t=4280

11. ...farmers, we take this tariff discussion off the table now.

https://youtu.be/6H3bygwlQQU?t=4311

12. ...how we had to bail out farmers because of those tariffs?

https://youtu.be/6H3bygwlQQU?t=4336

13. ...It sounds to me like you're raising a wonderful family?

https://youtu.be/6H3bygwlQQU?t=4609

14. ...help not only these families, but the economy as well?

https://youtu.be/6H3bygwlQQU?t=5534

15. ...cuts. Can you talk about what that would mean to businesses?

https://youtu.be/6H3bygwlQQU?t=5949

16. ...for a child tax credit that is not fully refundable?

https://youtu.be/6H3bygwlQQU?t=6197

17. ...the Tcga is going to actually widen that racial inequality?

https://youtu.be/6H3bygwlQQU?t=6323

18. ...can she answer that question, Mr. Chairman. Quickly, please?

https://youtu.be/6H3bygwlQQU?t=6680

19. ...more Americans. Can you talk a little bit about that?

https://youtu.be/6H3bygwlQQU?t=6975

20. ...in your business to support your employees and customers?

https://youtu.be/6H3bygwlQQU?t=7274

21. ...first trade proposals? Um, let me turn that one over to you.

https://youtu.be/6H3bygwlQQU?t=7505

22. ...you speak to how cutting IRS funding impacts the deficit?

https://youtu.be/6H3bygwlQQU?t=7608

23. ...way to support the smallest businesses in this country?

https://youtu.be/6H3bygwlQQU?t=8151

24. ...you don't think that 199 A is important at all to anybody?

https://youtu.be/6H3bygwlQQU?t=8297

25. ...For us to be one of the higher tax nations in the world?

https://youtu.be/6H3bygwlQQU?t=8438

26. ...nation in the world when it comes to global competitiveness?

https://youtu.be/6H3bygwlQQU?t=8473

27. ...deductions as compared to somebody that's got one person?

https://youtu.be/6H3bygwlQQU?t=8561

28. Um, do tax cuts pay for themselves?

https://youtu.be/6H3bygwlQQU?t=8747

29. ...all approximately in that $4.5 trillion range? Correct?

https://youtu.be/6H3bygwlQQU?t=8753

30. ...tariffs make goods less expensive for the American people?

https://youtu.be/6H3bygwlQQU?t=8851

31. ...admits the uncertainty from the Biden administration?

https://youtu.be/6H3bygwlQQU?t=9126

32. Mr. Duke, what percent do the top 10% pay in taxes?

https://youtu.be/6H3bygwlQQU?t=9244

33. ...things would you have to face if that were to occur in 2014?

https://youtu.be/6H3bygwlQQU?t=9355

34. ...making cars in the United States? Think about this policy.

https://youtu.be/6H3bygwlQQU?t=9737

35. ...to, to provide for their wages and benefits, if you will.

https://youtu.be/6H3bygwlQQU?t=9888

36. ...have done to your small business owners that you work with?

https://youtu.be/6H3bygwlQQU?t=9990

37. ...of the standard deduction and the benefit that it gave.

https://youtu.be/6H3bygwlQQU?t=10074

38. ...for themselves, ever. Do you wish to qualify that at all?

https://youtu.be/6H3bygwlQQU?t=10157

39. ...your family, and the importance of keeping that protected?

https://youtu.be/6H3bygwlQQU?t=10276

40. ...were to expire, how they, how they harm these very people.

https://youtu.be/6H3bygwlQQU?t=10328

41. ...comport with the notion of tax equity, uh, and tax fairness?

https://youtu.be/6H3bygwlQQU?t=10587

42. ...or no? It wasn't the 199 eight. It helped you get equipment?

https://youtu.be/6H3bygwlQQU?t=10650

43. ...has a real world impact for your employees and customers?

https://youtu.be/6H3bygwlQQU?t=10852

44. ...and our employees of these family businesses impacted?

https://youtu.be/6H3bygwlQQU?t=10993

45. ...your business, and what would be the consequences of that?

https://youtu.be/6H3bygwlQQU?t=11383

46. ...out of poverty? So could you speak to that issue, please?

https://youtu.be/6H3bygwlQQU?t=11584

47. ...was paid out prior to the bill. Can you please describe why?

https://youtu.be/6H3bygwlQQU?t=11646

48. ...for the tax bill extensions. Would this problem get worse?

https://youtu.be/6H3bygwlQQU?t=11723

49. ...So I'm just curious, what do you consider a small business?

https://youtu.be/6H3bygwlQQU?t=11772

50. ...of this? Do you think that the 199 A actually helps them?

https://youtu.be/6H3bygwlQQU?t=11799

51. ...New Deal programs that are benefiting China. Am I correct?

https://youtu.be/6H3bygwlQQU?t=11855

52. ...renew the president's tax cuts? President Trump's tax cuts.

https://youtu.be/6H3bygwlQQU?t=12016

53. ...that, how it affects you and what compliance looks like?

https://youtu.be/6H3bygwlQQU?t=12284

54. ...is to small businesses as an incentive and not a mandate?

https://youtu.be/6H3bygwlQQU?t=12396

55. ...to a family business of having too much of a debt burden?

https://youtu.be/6H3bygwlQQU?t=12497

56. ...of the United States? What the burden is at this point?

https://youtu.be/6H3bygwlQQU?t=12559

57. ...what kind of impact would that be on middle class families?

https://youtu.be/6H3bygwlQQU?t=12884

58. ...may have not benefited from Salt because of the AMT?

https://youtu.be/6H3bygwlQQU?t=12946

59. ...and then cap it so only certain incomes could qualify?

https://youtu.be/6H3bygwlQQU?t=13052

60. ...idea how a tax increase like that would impact your family?

https://youtu.be/6H3bygwlQQU?t=13292

61. ...have to grow to fully offset an extension of the Tcga?

https://youtu.be/6H3bygwlQQU?t=13545

62. ...credits in the IRA do to the ability to expand our economy?

https://youtu.be/6H3bygwlQQU?t=13597

63. ...residents and aluminum from the United Kingdom. Correct?

https://youtu.be/6H3bygwlQQU?t=13640

64. ...you want to pay for the TCA with those price increases?

https://youtu.be/6H3bygwlQQU?t=13692

65. ...families? And and would this have benefited your family?

https://youtu.be/6H3bygwlQQU?t=13872

66. ...and get that right off it? Anything to add to that?

https://youtu.be/6H3bygwlQQU?t=13980

67. Increasing and increasing of the threshold?

https://youtu.be/6H3bygwlQQU?t=14013

68. ...of work as a requirement for receiving the child tax credit?

https://youtu.be/6H3bygwlQQU?t=14224

69. ...go to people who are not here in this country legally?

https://youtu.be/6H3bygwlQQU?t=14300

70. ...who want to want to put solar panels on their roof? Uh?

https://youtu.be/6H3bygwlQQU?t=14336

71. ...than wealthy families, making more than $400,000 per year?

https://youtu.be/6H3bygwlQQU?t=14361

72. ...think we could afford these things that I just mentioned?

https://youtu.be/6H3bygwlQQU?t=14616

73. ...or will you guys capitulate like you did in December?

https://youtu.be/6H3bygwlQQU?t=14689

74. ...or local economies with high reliance on this deduction?

https://youtu.be/6H3bygwlQQU?t=14893

75. ...if these critical tax benefits are allowed to expire?

https://youtu.be/6H3bygwlQQU?t=15001

76. ...difference for the Marple household. Is that correct?

https://youtu.be/6H3bygwlQQU?t=15190

77. You must run a fortune 500 company. Is that correct?

https://youtu.be/6H3bygwlQQU?t=15202

78. It's $75,000? Is that correct? About right?

https://youtu.be/6H3bygwlQQU?t=15223

79. ...but yet it did. Was it a game changer for you, Miss Marple?

https://youtu.be/6H3bygwlQQU?t=15233

80. ...that, uh, your clients have done so well? Is that correct?

https://youtu.be/6H3bygwlQQU?t=15275

81. ...do a fortune 500 exclusively. Is that right, Miss Couch?

https://youtu.be/6H3bygwlQQU?t=15297

82. ...picture? Is that a scary question? What's going to happen?

https://youtu.be/6H3bygwlQQU?t=15335

83. ...on you? If you're having to pay a 43%, uh, income tax rate?

https://youtu.be/6H3bygwlQQU?t=15364

84. ...that predominantly benefit the wealthy, like 199 1998?

https://youtu.be/6H3bygwlQQU?t=15562

85. ...tax rate help small businesses and working families?

https://youtu.be/6H3bygwlQQU?t=15677

86. ...countries, especially countries like our adversary, China?

https://youtu.be/6H3bygwlQQU?t=15921

87. ...they save from reduced tax rates? Using section 199 eight.

https://youtu.be/6H3bygwlQQU?t=15985

88. ...or expand their production, or to create new jobs?

https://youtu.be/6H3bygwlQQU?t=16032

89. ...Miss Gallagher, you're are you an accountant, I think?

https://youtu.be/6H3bygwlQQU?t=16624

90. ...beneficial to a lot of people in the country at one time?

https://youtu.be/6H3bygwlQQU?t=16644

91. ...Do you think that helped a lot of families in America?

https://youtu.be/6H3bygwlQQU?t=16724

92. Um, where are you from, Miss Silver?

https://youtu.be/6H3bygwlQQU?t=16741

-

1:05:14

1:05:14

Cut to the chase

6 months agoQA ONLY: Dep Sec of Commerce Confirmation 05-01-25

7 -

2:06:49

2:06:49

vivafrei

23 hours agoEp. 289: Arctic Frost, Boasberg Impeachment, SNAP Funding, Trump - China, Tylenol Sued & MORE!

275K202 -

2:56:28

2:56:28

IsaiahLCarter

18 hours ago $11.30 earnedThe Tri-State Commission, Election Weekend Edition || APOSTATE RADIO 033 (Guest: Adam B. Coleman)

45.7K7 -

15:03

15:03

Demons Row

13 hours ago $13.21 earnedThings Real 1%ers Never Do! 💀🏍️

61.7K22 -

35:27

35:27

megimu32

16 hours agoMEGI + PEPPY LIVE FROM DREAMHACK!

181K15 -

1:03:23

1:03:23

Tactical Advisor

20 hours agoNew Gun Unboxing | Vault Room Live Stream 044

266K41 -

19:12

19:12

Robbi On The Record

21 hours ago $25.16 earnedThe Loneliness Epidemic: AN INVESTIGATION

96.1K119 -

14:45

14:45

Mrgunsngear

1 day ago $151.02 earnedFletcher Rifle Works Texas Flood 30 Caliber 3D Printed Titanium Suppressor Test & Review

155K35 -

17:17

17:17

Lady Decade

1 day ago $12.93 earnedMortal Kombat Legacy Kollection is Causing Outrage

101K24 -

35:51

35:51

Athlete & Artist Show

1 day ago $21.13 earnedIs Ryan Smith The Best Owner In The NHL?

106K17