Premium Only Content

Calculating compound interest.

Calculating compound interest."""Calculating compound interest."""

It's not just simple addition, folks. We're talking about interest *earning* interest. Think of it as your money making little baby money, and then *that* baby money making even *more* money!

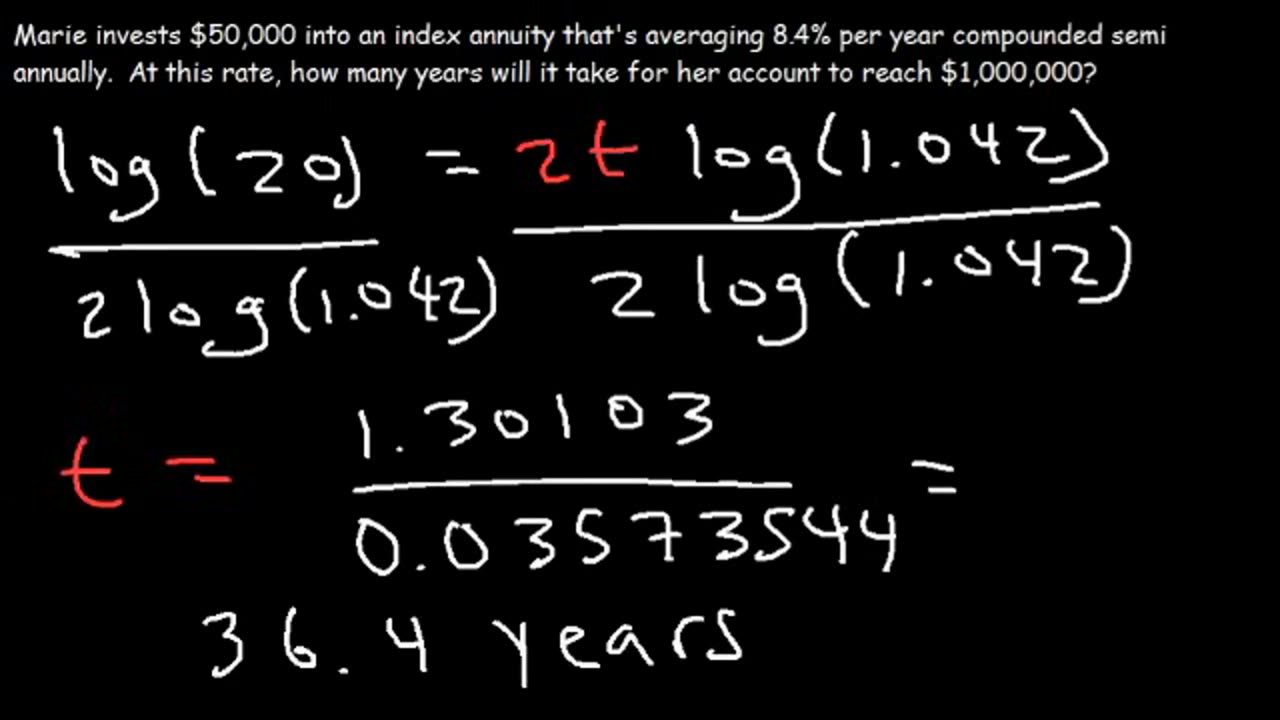

The magic formula is this:

A = P (1 + r/n)^(nt)

Where:

* **A** is the future value of the investment/loan, including interest

* **P** is the principal investment amount (the initial deposit or loan amount)

* **r** is the annual interest rate (as a decimal)

* **n** is the number of times that interest is compounded per year

* **t** is the number of years the money is invested or borrowed for

Let's break it down with an example. Say you invest $1,000 (P = 1000) at an annual interest rate of 5% (r = 0.05) compounded annually (n = 1) for 10 years (t = 10).

Plugging that into our formula:

A = 1000 (1 + 0.05/1)^(1*10)

A = 1000 (1 + 0.05)^10

A = 1000 (1.05)^10

A = 1000 * 1.62889462678

A = $1628.89 (approximately)

So, after 10 years, your initial $1,000 would grow to approximately $1,628.89. That extra $628.89? That's the power of compound interest, baby! Now, if that interest was compounded monthly (n = 12), you'd see an even *better* return. Give it a try with n = 12 in the formula. You'll see the difference. Get compounding!Now, let's talk about why understanding compound interest is like having a financial superpower. Knowing how this works lets you make smarter choices about your savings, investments, and even loans.

Think about it: the more frequently your interest is compounded (that's your 'n' value, remember?), the faster your money grows. Daily compounding (n = 365) is generally better than monthly (n = 12), which is better than annually (n = 1). Of course, the difference might seem small at first, but over long periods, those little gains add up BIG time.

On the flip side, when *borrowing* money, understanding compound interest is crucial for avoiding nasty surprises. Credit card companies LOVE compound interest. If you only pay the minimum each month, a huge chunk of your payment goes towards interest that's compounding daily or monthly. That debt can snowball FAST. Knowing this helps you prioritize paying down high-interest debt quickly.

So, whether you're saving for retirement, investing in the stock market, or taking out a loan, take the time to understand the power of compound interest. It's the difference between letting your money work *for* you or working *for* your money! Get that 'n' value working in your favor!

"""

-

2:27:53

2:27:53

Laura Loomer

4 hours agoBREAKING: MTG Resigns From Congress, Mamdani Meets Trump

32.6K64 -

LIVE

LIVE

PandaSub2000

1 day agoLIVE 10:30pm ET | BUZZ/DISNEY TRIVIA NIGHT with YOU!

251 watching -

15:23

15:23

T-SPLY

9 hours agoBUSTED Assistant Principle And Brother Arrested For Wanting To Kill ICE!

10.5K10 -

22:06

22:06

Jasmin Laine

9 hours agoCBC STUNNED Into SILENCE After JD Vance’s BRUTAL Message to Canadians

7.62K11 -

2:04:27

2:04:27

TimcastIRL

8 hours agoAntifa CONVICTED Of TERRORISM, Fears Of CIVIL WAR Grow | Timcast IRL

227K74 -

2:16:43

2:16:43

TheSaltyCracker

5 hours agoIt's Over Zelensky ReeEEStream 11-21-25

73K125 -

LIVE

LIVE

Drew Hernandez

22 hours agoMIKE HUCKABEE EXPOSED FOR OFF RECORD MEETING WITH CONVICTED ISRAELI SPY?

1,082 watching -

4:07:43

4:07:43

SynthTrax & DJ Cheezus Livestreams

16 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream SYNTHWAVE / ANIME NIGHT

26.6K1 -

14:25

14:25

Tactical Advisor

14 hours agoReal Life John Wick Suit | Grayman & Company

16.8K2 -

LIVE

LIVE

I_Came_With_Fire_Podcast

14 hours agoAlien Enemies Act | Dismantling the Department of Education | Valhalla VFT & America First

303 watching