Premium Only Content

Ep. 19 | The National Debt Series | Confiscating Wealth from the Top 1%

Confiscate the wealth of the richest Americans—would that fix the national debt? Let's run the numbers in this latest episode.

Transcript:

Hello, everyone. Dr, Mark. L. Teague, here again, A Working Man's Guide. So last episode, we were discussing the idea that to solve the national debt, we should just tax the rich. Well, from an income standpoint, that already happens, the rich pay by far the majority federal taxes.

You can see that distribution from the last episode. The next idea is, well, what about net worth? What about wealth? What about assets? The richest families have so much more than anyone else. Why shouldn't we tax that? Well, let's take a look.

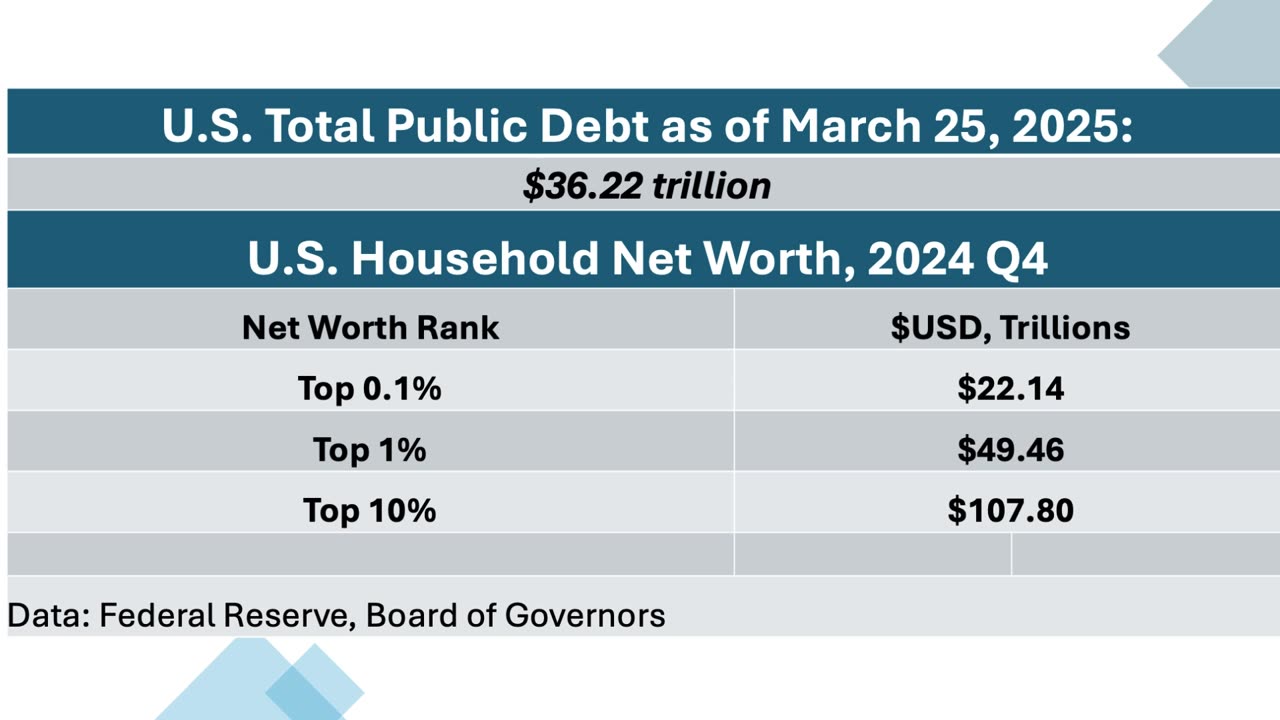

Let's look at Federal Reserve data, the Board of Governors, first of all, the national debt. Total public debt as of today is $36.22 trillion well, if we look at the wealthiest households as ranked by the Federal Reserve, you can see where we stand with that regard. If you take the top point 1% that's 1/10 of 1%

Well, you don't have enough. 22.1 4 trillion. You could confiscate and take everything they have and not get what you need. Let's take the top 1% 1% of American households. That gives you 49 basically 49 and a half trillion dollars. You have enough, but think about what that means you have to take almost everything they have. Well, what is that wealth? It's stock, companies, shares, land, assets, homes, etc. You're talking about losing 10s of 1000s of jobs, reshaping the American economy in a devastating way you take us to Venezuela. That's where we go.

So you need to stop and think that through what it means we're going to explore this just a little bit more in our next episode. Thank you.

-

LIVE

LIVE

Phyxicx

10 hours agoBack to FF8 - Let's actually play the story now! - 11/23/2025

110 watching -

19:19

19:19

GritsGG

15 hours agoINSANE Trio Match! Most Winning Warzone Player IGLs to Victory!

14.6K1 -

32:24

32:24

Forrest Galante

1 day agoHunting and Eating The World's WORST Fish (Everglades At Night)

132K9 -

11:37

11:37

The Pascal Show

1 day ago $15.78 earnedTHEY WANT TO END HER?! Candace Owens Claims French President & First Lady Put A H*t Out On Her?!

55.7K52 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

300 watching -

35:40

35:40

The Why Files

5 days agoPsyops: From Dead Babies to UFOs - The Same Pattern Every Time

120K107 -

1:48:26

1:48:26

Tucker Carlson

2 days agoKristen Breitweiser: 9-11 Cover-Ups, Building 7, and the Billion-Dollar Scam to Steal From Victims

190K423 -

5:48

5:48

Russell Brand

2 days agoThey BURNED me in effigy!

73.7K45 -

1:21:40

1:21:40

Man in America

10 hours agoThe Secret AI Plan to Enslave Humanity — And Why It Will FAIL w/ Todd Callender

57.8K26 -

2:18:17

2:18:17

TheSaltyCracker

11 hours agoTreason Season ReeEEStream 11-23-25

169K272