Premium Only Content

PLTY from YieldMax

PLTY refers to the YieldMax PLTR Option Income Strategy ETF. This ETF aims to generate monthly income by selling call options on Palantir Technologies Inc. (PLTR) stock. In essence, it uses a synthetic covered call strategy to provide income while also offering indirect exposure to the price movements of PLTR, although potential gains are capped.

Here's a breakdown of what PLTY is and how it works:

What is PLTY?

YieldMax PLTR Option Income Strategy ETF: It's an actively managed exchange-traded fund (ETF) focused on generating income.

Underlying Asset: The ETF's performance is tied to the stock of Palantir Technologies Inc. (PLTR).

Synthetic Covered Call Strategy: PLTY employs this strategy, which involves selling call options on PLTR to generate income.

Capped Gains: While the ETF offers exposure to PLTR's price, the potential gains are limited due to the nature of the options strategy.

Income Focus: The primary objective of PLTY is to provide current income to investors.

How does PLTY work?

Option Selling: The fund generates income by selling call options on PLTR stock.

Indirect PLTR Exposure: PLTY's value is influenced by PLTR's stock price, but not directly.

Income Generation: The premiums received from selling call options are distributed to PLTY shareholders as income.

Capped Upside: If PLTR's stock price increases significantly, the call options that PLTY sold may be exercised, limiting the ETF's potential gains.

In summary, PLTY offers a way to generate income and gain indirect exposure to PLTR's stock price, but it comes with a trade-off of capped potential gains.

PLTY

YieldMax™ PLTR

Option Income

Strategy ETF

The Fund does not invest directly in PLTR.

Investing in the fund involves a high degree of risk.

Single Issuer Risk. Issuer-specific attributes may cause an investment in the Fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on an individual security PLTR, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

The Fund’s strategy will cap its potential gains if PLTR shares increase in value. The Fund’s strategy is subject to all potential losses if PLTR shares decrease in value, which may not be offset by income received by the Fund.

-

2:06:36

2:06:36

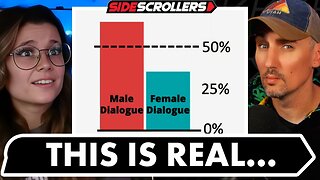

Side Scrollers Podcast

19 hours agoThis is the Dumbest Story We’ve Ever Covered… | Side Scrollers

72.5K21 -

15:37

15:37

The Pascal Show

18 hours ago $6.77 earnedCANDACE OWENS DISAPPEARS?! Candace Owens Goes Into Hiding After Revealing A**assination Claims

17.4K11 -

18:05

18:05

GritsGG

1 day agoThis Duo Lobby Got a Little Spicy! We Have Over 20,000 Wins Combined!

30K -

1:12:29

1:12:29

PandaSub2000

3 days agoSonic Galactic | GAME ON...ly! (Edited Replay)

28K5 -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

244 watching -

21:23

21:23

Neil McCoy-Ward

19 hours ago🚨 While You Were Distracted TODAY... (This Quietly Happened!!!)

23.9K11 -

6:09:42

6:09:42

SpartakusLIVE

10 hours agoLIVE from OCEAN FRONT || ENERGIZED Wins and TOXIC Comms

267K18 -

1:35:45

1:35:45

Tucker Carlson

11 hours agoTucker Puts Piers Morgan’s Views on Free Speech to the Ultimate Test

67.7K347 -

2:06:16

2:06:16

TheSaltyCracker

11 hours agoMedia Justifies Attack on National Guard ReeEEStream 11-26-25

124K304 -

3:54:35

3:54:35

Mally_Mouse

14 hours ago🎮 Let's Play!!: Stardew Valley pt. 34

56.8K2