Premium Only Content

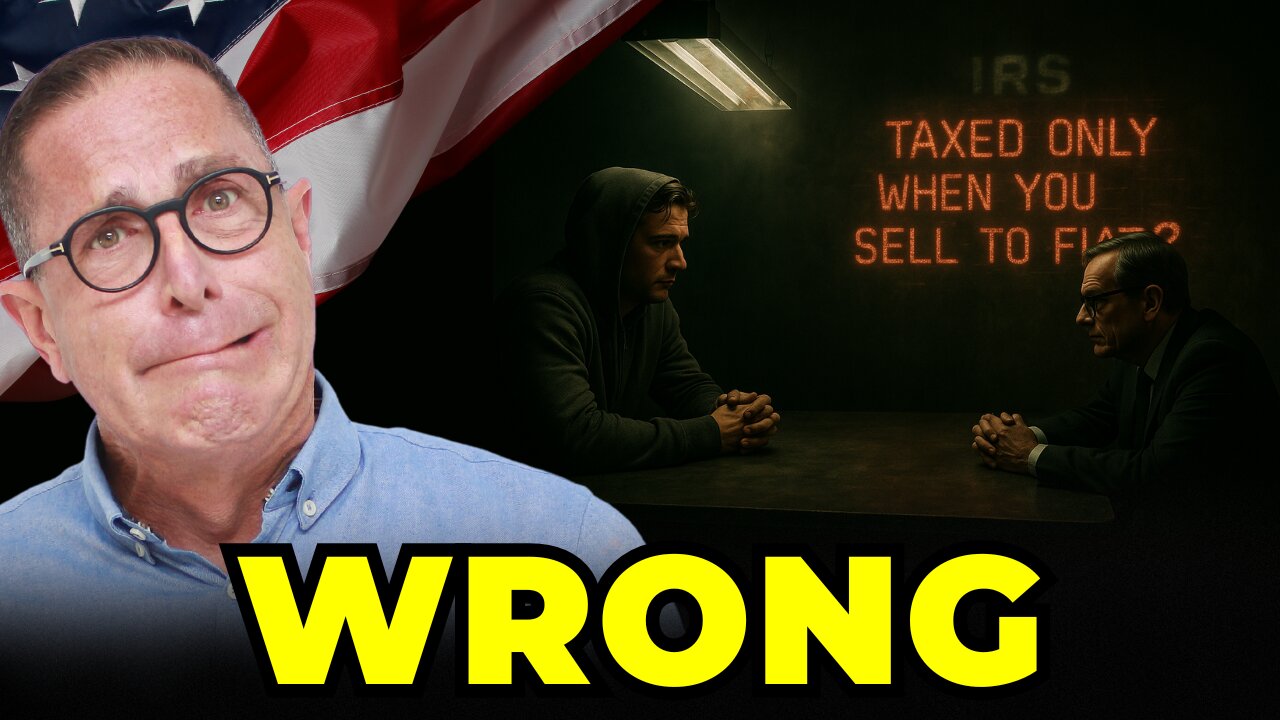

The Greatest Misconception US Crypto Traders Have About Taxes 🇺🇸

What is the greatest misconception US crypto traders have?

That you’re only taxed when you cash out to fiat. That’s just wrong.

In this video, we break down one of the most misunderstood crypto tax rules in the U.S.:

➡️ Every crypto swap, exchange, or stablecoin trade can be a taxable event

➡️ The IRS doesn’t care if you cashed out — they care if you gave up ownership

➡️ Staking and airdrops are considered income on the day you receive them

➡️ Selling junk coins before year-end can save you thousands

Whether you’re trading memecoins, farming airdrops, or just DCA'ing on Coinbase, this info could protect you from a surprise IRS tax bill in 2025.

💥 Don’t let a misconception wreck your tax season.

📘 Learn how to file crypto taxes the right way (even without a 1099):

https://www.youtube.com/playlist?list=PLlRL1XYAzH0lQlqJ4XIhHassQZHKGFVQK

🔔 Subscribe for more crypto tax facts, IRS warnings, and gain-saving strategies.

#CryptoTax #CryptoTrader #IRS #1099DA #CryptoGains #StakingTax #CryptoAirdrop #CryptoLosses #DeFiTax #CryptoTaxAudit

▬▬▬▬▬ SPONSOR ▬▬▬▬▬

🐋 Sponsor: CryptoTaxAudit

CryptoTaxAudit is the ultimate solution for ensuring your crypto taxes are precise and fully compliant with the latest regulations. With expert guidance and support, you can avoid costly penalties and enjoy complete peace of mind. Don't take any chances with your hard-earned assets. Become an IRS Guard Dog member today and take control of your financial future! Visit CryptoTaxAudit.com today.

Visit 👉 https://www.cryptotaxaudit.com/?afmc=yt

▬▬▬▬▬ NOTICE ▬▬▬▬▬

⚠️ 𝗕𝗘𝗪𝗔𝗥𝗘 𝗢𝗙 𝗦𝗖𝗔𝗠𝗠𝗘𝗥𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗖𝗢𝗠𝗠𝗘𝗡𝗧𝗦 𝗔𝗡𝗗 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦

We will never ask you for your personal information on social media. Beware of people masquerading as our host, guests, or sponsor company.

📜 Disclaimer

The content in this video is for educational and entertainment purposes only. While we aim to provide accurate and up-to-date information about cryptocurrency taxation, this is not intended as legal, tax, or financial advice. Always consult with a qualified tax professional to ensure compliance with IRS regulations and accurate reporting of your cryptocurrency transactions.

Related Search Terms: do you pay taxes when swapping crypto, is crypto taxed if I don't cash out, crypto to crypto taxable event, common crypto tax mistakes, IRS rules for crypto 2025, how crypto is taxed in the US, capital gains crypto 2025, how to avoid crypto tax penalties, crypto tax myths debunked, do staking rewards count as income, airdrop tax rules IRS, when does crypto become taxable, how to report crypto trades on taxes

-

5:32

5:32

The Clinton Donnelly Show

28 days agoThe New Broker Dealer Rule: What It Means for Crypto Taxes in 2025

481 -

21:08

21:08

Professor Nez

2 hours agoTrump Just BROKE the ENTIRE Democrat Party with one Line!

17.2K21 -

1:00:22

1:00:22

Timcast

4 hours agoPentagon To Test NUKES, Russia Warns Of WW3

125K67 -

2:07:00

2:07:00

Steven Crowder

6 hours agoTrump vs. Xi: Who Won The US - China Trade Meeting & Who is Lying

383K381 -

49:47

49:47

Sean Unpaved

3 hours agoYesavage's 12-K Masterclass Clinches Jays Game 5, Ravens-Dolphins TNF Clash, CFB Hot Seat Inferno

21K -

2:12:48

2:12:48

Side Scrollers Podcast

5 hours agoSydney Sweeney’s VIRAL “Assets” + DHS Lord of the Rings Meme MELTDOWN + More | Side Scrollers

36.1K8 -

LIVE

LIVE

StoneMountain64

3 hours agoArc Raiders is FINALLY Out for Everyone #ad !ark !arktips

79 watching -

53:09

53:09

Daniel Davis Deep Dive

6 hours agoJohn Mearsheimer: New Nuclear Arms Race, Pentagon to Resume Testing

17.8K4 -

32:33

32:33

TheAlecLaceShow

4 hours agoTrump Meets With Xi Jinping | Guest: Jared Hudson | The Alec Lace Show

12.4K3 -

1:57:46

1:57:46

The Charlie Kirk Show

3 hours agoOle Miss Aftermath = Arctic Frost + Charlie's Speech Mission | Halperin, Rogers | 10.30.2025

62.6K18