Premium Only Content

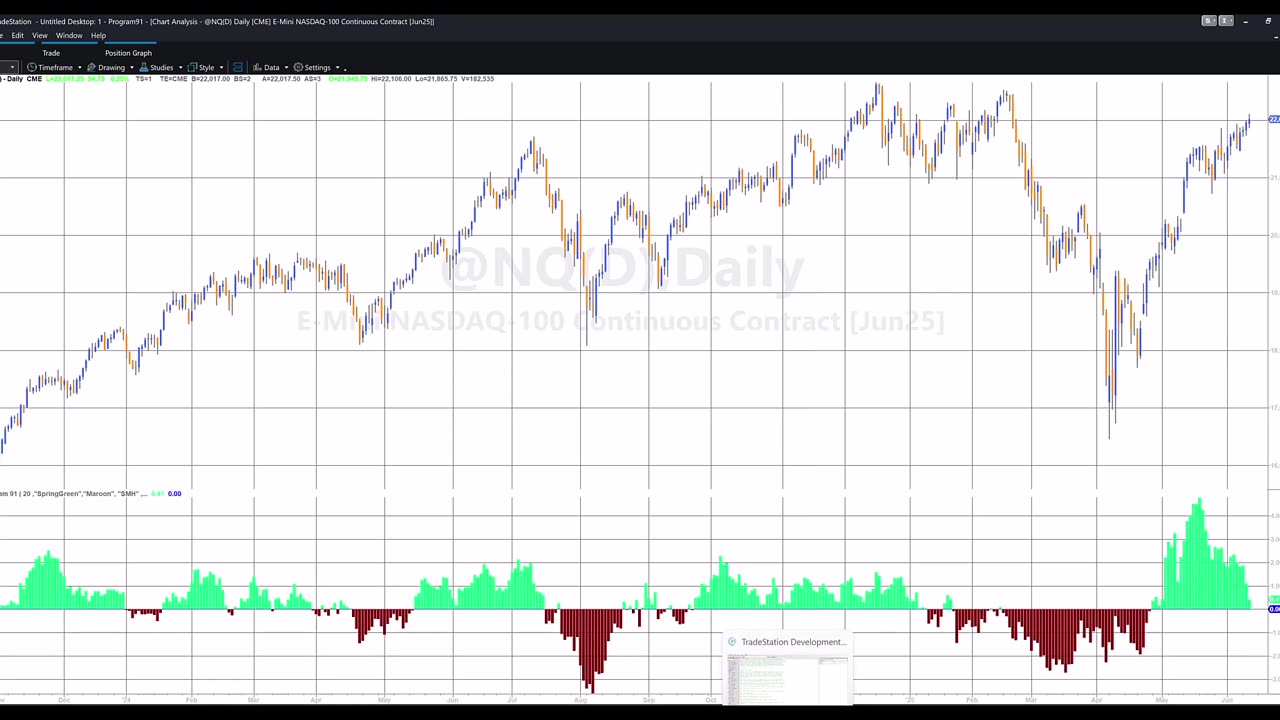

Program 91 | Markplex Sector Tilt indicator

Program 91 is a TradeStation EasyLanguage indicator that gauges market risk sentiment by comparing what might be considered “growth-oriented” sectors (like tech, consumer discretionary, semiconductors) against what might be considered “defensive” sectors (like utilities, consumer staples, health care). By analyzing six Exchange Traded Funds (ETFs) (chosen as inputs to the program) we can get an idea of whether the market is currently higher or lower risk. when “growth-oriented” ETFs outperform, it indicates potentially higher risk appetite in the markets. When “defensive” ETFs outperform, it indicates lower risk appetite.

This video does not imply that any specific ETF is safer, more stable, or more likely to grow in value than another.

See https://markplex.com/easylanguage-programs/program-91-markplex-sector-tilt-indicator/

-

11:59

11:59

stateofdaniel

1 day agoBreaking Bad's Gus Fring Actor Calls for Revolution: "They Can't Take Us All Down" – Epic Fail!

28.1K70 -

12:19

12:19

Clintonjaws

19 hours ago $16.06 earnedLA Mayor Has A Melt Down Live On-Air As She Crumbles Over Don Lemon

73.7K132 -

9:59

9:59

Tactical Advisor

1 day agoBest Gun of 2026 | Rideout Arsenal Dragon

36.9K20 -

15:26

15:26

World2Briggs

16 hours ago $6.29 earned10 States Where Natural Disasters Are Becoming the New Normal

44.7K18 -

12:41

12:41

GBGunsRumble

18 hours agoGBGuns Range Report 31JAN26

32.1K8 -

15:33

15:33

DeVory Darkins

20 hours agoMinnesota dealt LEGAL BLOW after District Court hands Trump MAJOR WIN

188K159 -

2:02:52

2:02:52

Badlands Media

1 day agoDevolution Power Hour Ep. 428: Process, Pressure, and the Illusion of Immediate Outcomes

206K52 -

6:37:12

6:37:12

Akademiks

14 hours agoJay Z and Pusha T in the Epstein Files? NLE Choppa vs Baby moms. YE is bak? LIL BABY tryna BACK OUT?

79.3K10 -

1:11:29

1:11:29

Man in America

19 hours agoFriday’s Silver BLOODBATH: The Paper Ponzi Is Breaking as Bullion Banks Lose Control

105K52 -

3:32:44

3:32:44

MattMorseTV

17 hours ago $46.65 earned🔴Bannon x Epstein INTERVIEW.🔴

104K263