Premium Only Content

Treasury decisions under internal revenue laws of the United States.

The video discusses the importance of government admissions regarding tax law and the challenges in legal arguments about citizenship status.

Government Admissions

• The speaker emphasizes the significance of government documents acknowledging certain truths about tax law.

• They highlight the necessity for the government to provide authoritative citations from the Secretary of Treasury.

Legal Arguments

• The government must either present a treasury decision contradicting the speaker's claims or falsely categorize U.S. citizens as non-resident aliens.

• The speaker asserts that the latter argument has been debunked by courts since the 1980s.

Implications

• The speaker believes that the government's inability to fulfill these requirements indicates a strong position for their argument.

• They express confidence that the government will not succeed in presenting a valid counterargument.

RESEARCH and EDUCATION

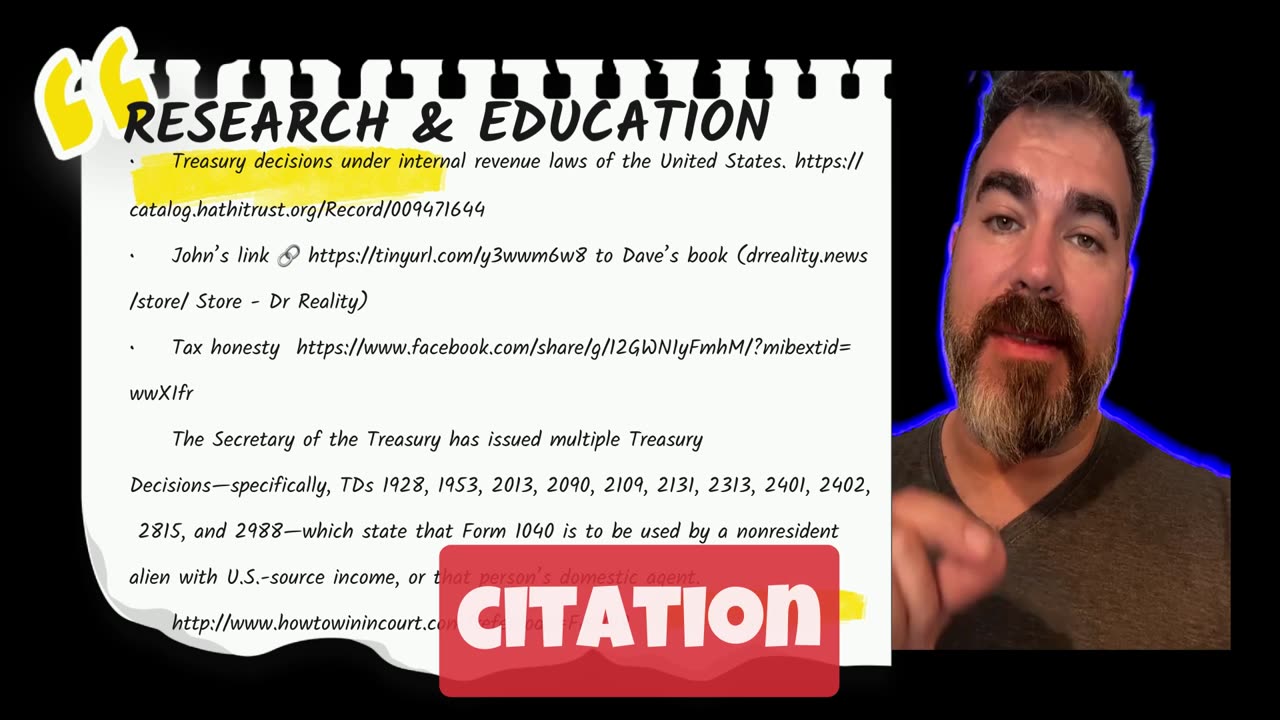

• Treasury decisions under internal revenue laws of the United States.

https://catalog.hathitrust.org/Record/009471644

• John’s link 🔗 https://tinyurl.com/y3wwm6w8 to Dave’s book (drreality.news/store/ Store - Dr Reality)

• Tax honesty https://www.facebook.com/share/g/12GWN1yFmhM/?mibextid=wwXIfr

• How to win in court: http://www.howtowinincourt.com?refercode=FA0019

To Whom It May Concern:

I am writing in response to IRS Notice CP59 dated June 23, 2025, which alleges that I am required to file a 2023 Form 1040 income tax return.

The Secretary of the Treasury has issued multiple Treasury Decisions—specifically, TDs 1928, 1953, 2013, 2090, 2109, 2131, 2313, 2401, 2402, 2815, and 2988—which state that Form 1040 is to be used by a nonresident alien with U.S.-source income, or that person’s domestic agent.

I am neither a nonresident alien with U.S.-source income, nor am I acting as a “U.S. person” on behalf of a foreign person’s U.S.-source income. Therefore, based on the Secretary of the Treasury’s own directives, I have determined I am not required to file Form 1040.

If you believe there is another relevant tax form that I am required to file, please disclose that information to me and I shall confirm that in accordance with the Secretary of the Treasury’s directives.

Please correct and update your records.

-

15:38

15:38

Cash Jordan

6 hours agoPortland Zombies EMPTY 52 Stores… Mayor FREAKS as “Sanctuary” SELF DESTRUCTS

44K50 -

LIVE

LIVE

Precision Rifle Network

1 day agoS5E4 Guns & Grub - Dustin Coleman of ColeTac

92 watching -

1:09:25

1:09:25

Donald Trump Jr.

7 hours agoCorrupt UN Carbon Tax Exposed, Interview with John Konrad | TRIGGERED Ep.285

149K72 -

42:58

42:58

TheCrucible

5 hours agoThe Extravaganza! EP: 59 with Guest Co-Host: Rob Noerr (10/23/25)

79K7 -

1:40:59

1:40:59

Kim Iversen

6 hours agoTrump Threatens To End ALL Support For Israel

70.1K157 -

13:09:10

13:09:10

LFA TV

23 hours agoLIVE & BREAKING NEWS! | THURSDAY 10/23/25

168K23 -

LIVE

LIVE

Side Scrollers Podcast

9 hours ago🔴FIRST EVER RUMBLE SUB-A-THON🔴DAY 4🔴BLABS VS STREET FIGHTER!

915 watching -

LIVE

LIVE

LIVE WITH CHRIS'WORLD

5 hours agoLIVE WITH CHRIS’WORLS - J6 Pipe Bomber | Candace is NUTS | NBA Gambling Scandal | AND MUCH MORE!

40 watching -

1:56:46

1:56:46

Redacted News

6 hours agoHIGH ALERT! Trump pushes "land war" in Venezuela, and Russia goes nuclear | Redacted News Live

144K94 -

16:47

16:47

Robbi On The Record

5 hours ago $1.79 earnedThe Day Seeing Stopped Meaning Believing | Sora, AI and the Uncanny Valley

25.3K18