Premium Only Content

Treasury decisions under internal revenue laws of the United States.

The video discusses the importance of government admissions regarding tax law and the challenges in legal arguments about citizenship status.

Government Admissions

• The speaker emphasizes the significance of government documents acknowledging certain truths about tax law.

• They highlight the necessity for the government to provide authoritative citations from the Secretary of Treasury.

Legal Arguments

• The government must either present a treasury decision contradicting the speaker's claims or falsely categorize U.S. citizens as non-resident aliens.

• The speaker asserts that the latter argument has been debunked by courts since the 1980s.

Implications

• The speaker believes that the government's inability to fulfill these requirements indicates a strong position for their argument.

• They express confidence that the government will not succeed in presenting a valid counterargument.

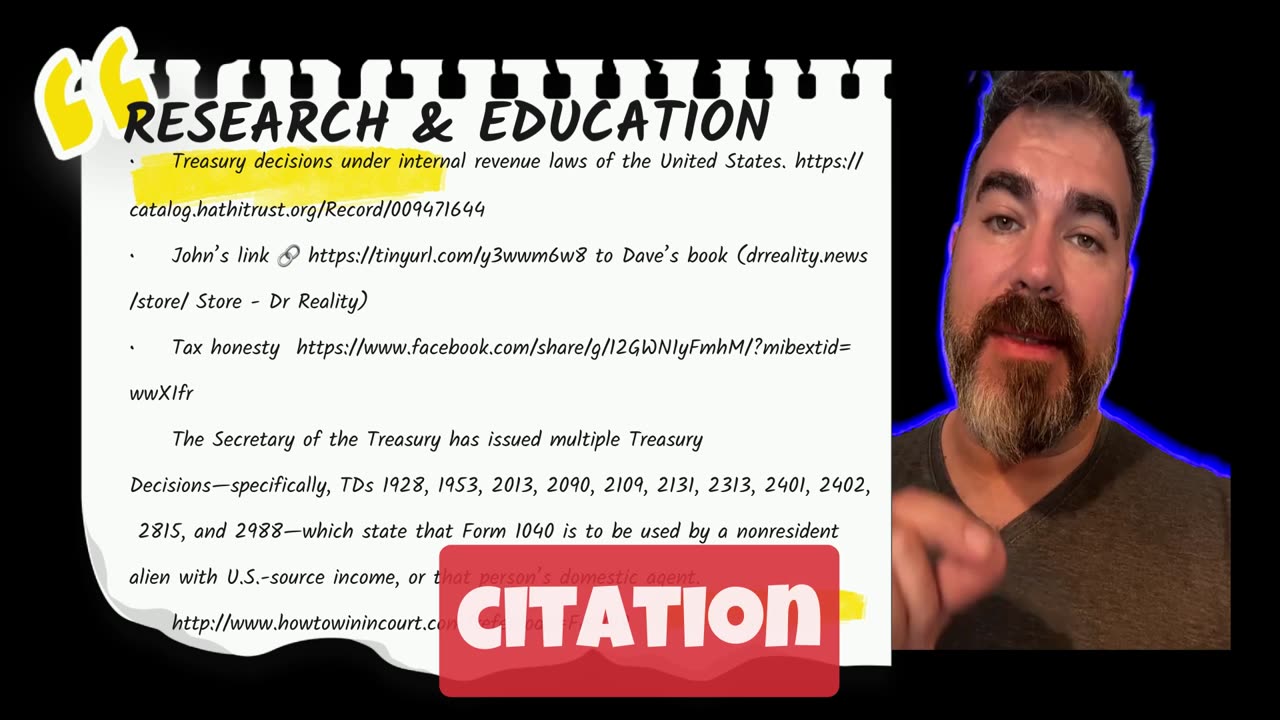

RESEARCH and EDUCATION

• Treasury decisions under internal revenue laws of the United States.

https://catalog.hathitrust.org/Record/009471644

• John’s link 🔗 https://tinyurl.com/y3wwm6w8 to Dave’s book (drreality.news/store/ Store - Dr Reality)

• Tax honesty https://www.facebook.com/share/g/12GWN1yFmhM/?mibextid=wwXIfr

• How to win in court: http://www.howtowinincourt.com?refercode=FA0019

To Whom It May Concern:

I am writing in response to IRS Notice CP59 dated June 23, 2025, which alleges that I am required to file a 2023 Form 1040 income tax return.

The Secretary of the Treasury has issued multiple Treasury Decisions—specifically, TDs 1928, 1953, 2013, 2090, 2109, 2131, 2313, 2401, 2402, 2815, and 2988—which state that Form 1040 is to be used by a nonresident alien with U.S.-source income, or that person’s domestic agent.

I am neither a nonresident alien with U.S.-source income, nor am I acting as a “U.S. person” on behalf of a foreign person’s U.S.-source income. Therefore, based on the Secretary of the Treasury’s own directives, I have determined I am not required to file Form 1040.

If you believe there is another relevant tax form that I am required to file, please disclose that information to me and I shall confirm that in accordance with the Secretary of the Treasury’s directives.

Please correct and update your records.

-

2:03:13

2:03:13

Steven Crowder

5 hours agoDave Smith: Discussing Trump, Israel, & America First

316K382 -

49:56

49:56

The Rubin Report

4 hours agoA Chilling Warning for America & Why Trump’s Tariffs Have Backfired | Yaron Brook

29.8K28 -

17:36

17:36

Bearing

6 hours agoHARD-ASS Police Boss GOES TO WAR With VIOLENT LEFTISTS 🚨🚔

3.38K28 -

DVR

DVR

TheAlecLaceShow

2 hours agoSNAP Benefits to Expire | Mamdani the Real 9/11 Victim | Guest: Leland Vittert | The Alec Lace Show

2.45K -

LIVE

LIVE

LFA TV

17 hours agoLIVE & BREAKING NEWS! | TUESDAY 10/28/25

2,216 watching -

1:34:42

1:34:42

The Mel K Show

3 hours agoMORNINGS WITH MEL K -Restoring National Sovereignty After Decades of Global Deception - 10-28-25

20.2K2 -

1:40:48

1:40:48

The Shannon Joy Show

3 hours agoSJ Show 10/28 - Idiocracy 2025! Are Candace Owens & Nick Fuentes Government Agent Provocateurs? Because The Political Soap Opera Is Getting Kinda Stupid

21.3K10 -

30:50

30:50

Grant Stinchfield

2 hours ago $0.01 earnedBillions for Nothing: New Study Reveals Widespread Fraud and Ghost Enrollments in Obamacare

14.2K7 -

1:00:58

1:00:58

VINCE

5 hours agoBiden Is Back: "Democracy Is At Stake" (w/ Michael Knowles)| Episode 156 - 10/28/25

194K159 -

LIVE

LIVE

Dr Disrespect

5 hours ago🔴LIVE - DR DISRESPECT - BATTLEFIELD 6 - REDSEC LAUNCH - BATTLE ROYALE

1,730 watching