Premium Only Content

Don’t Buy a Home Until You Watch This | The Financial Mirror

Wondering how much house you can actually afford? Forget what the bank tells you. Lenders base your mortgage approval on outdated debt-to-income ratios that ignore your real life—and that’s exactly how people end up house-poor. In this video, we break down the most accurate and financially sustainable way to calculate home affordability using a smarter method: the 25% rule.

Instead of relying on gross income or bank pre-approvals, we show you how to determine your home buying budget based on take-home pay—the money that actually hits your bank account. Our rule of thumb: Your monthly mortgage payment, PMI, homeowner's insurance, and HOA fees should never exceed 25% of your net income. This ensures you still have room for retirement savings, emergencies, vacations, and everyday living—without sacrificing your future.

We’ll walk you through:

o Why traditional mortgage advice is flawed

o The hidden dangers of lender-approved debt ratios

o The full breakdown of housing costs (and which ones matter most)

o How to budget for maintenance, taxes, and unpredictable repairs

o A real-world case study to show how this plays out in actual numbers

o Whether you should buy at all—or if renting and investing might be the better move

Whether you're a first-time homebuyer, someone relocating, or trying to figure out if it’s finally time to stop renting, this episode gives you real numbers, honest insights, and zero sales fluff.

Ready to stop guessing and start planning? Check out this episode before you make a home-buying decision that locks up your income for decades.

Don’t become house-poor. Buy smart. Live free.

**Support the Stream By Shopping at Our Store**

Buy Your Financial Mirror Gear: https://www.thefinancialmirror.org/shop

YouTube: https://www.youtube.com/@thefinancialmirror

Rumble: https://rumble.com/TheFinancialMirror

Facebook: https://www.facebook.com/thefinancialmirr0r

X: https://twitter.com/financialmirr0r

Instagram: https://www.instagram.com/thefinancialmirror/

Podcast: https://creators.spotify.com/pod/show/thefinancialmirror

If you are in need of a Financial Coach, don’t waste another day of being in debt, not planning for retirement, or simply wondering where your money went each month. Today is the day to take control of your finances and I can help, no issue is too big or too small. Contact me at https://www.thefinancialmirror.org/

#InvestInYourself #PersonalFinance #FinancialEmpowerment #personalfinance #financialfreedom #finance #money #investing #financialliteracy #financialindependence #budgeting #debtfreecommunity #financialplanning #debtfree #financialeducation #debtfreejourney #wealth #financetips #business #budget #investment #entrepreneur #moneymanagement #moneytips #stockmarket #financialgoals #invest #motivation #debt #savings #moneymindset #savingmoney #success

-

21:12

21:12

The Financial Mirror

29 days agoStandard Deduction vs Itemized: Which Saves You More? | The Financial Mirror

544 -

TimcastIRL

3 hours agoFOOD STAMPS OVER, Ending Nov 1, Food RIOTS May Spark Trump INSURRECTION ACT | Timcast IRL

177K76 -

2:18:46

2:18:46

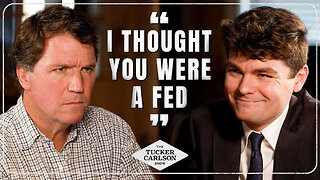

Tucker Carlson

3 hours agoTucker Carlson Interviews Nick Fuentes

39.6K201 -

LIVE

LIVE

Drew Hernandez

12 hours agoCANDACE OWENS CALLS CHARLIE KIRK STAFF INTO QUESTION?

1,247 watching -

47:03

47:03

Barry Cunningham

5 hours agoPRESIDENT TRUMP MEETS WITH THE PRIME MINISTER OF JAPAN!! AND MORE NEWS!

22.4K18 -

DVR

DVR

Flyover Conservatives

21 hours agoThe Dollar Devaluation Playbook: Gold, Bitcoin… and the “Genius Act” - Andy Schectman | FOC Show

11.5K3 -

LIVE

LIVE

SpartakusLIVE

5 hours agoWZ Tonight || Battlefield 6 BATTLE ROYALE Tomorrow!

133 watching -

LIVE

LIVE

megimu32

2 hours agoON THE SUBJECT: Halloween Nostalgia! LET’S GET SPOOKY! 👻

64 watching -

1:24:56

1:24:56

Glenn Greenwald

5 hours agoThe Unhinged Reactions to Zohran's Rise; Dems Struggle to Find a Personality; DHS, on Laura Loomer's Orders, Arrests UK Journalist and Israel Critic | SYSTEM UPDATE #538

105K58 -

LIVE

LIVE

Spartan

4 hours agoBack from worlds. Need a short break from Halo, so single player games for now

52 watching