Premium Only Content

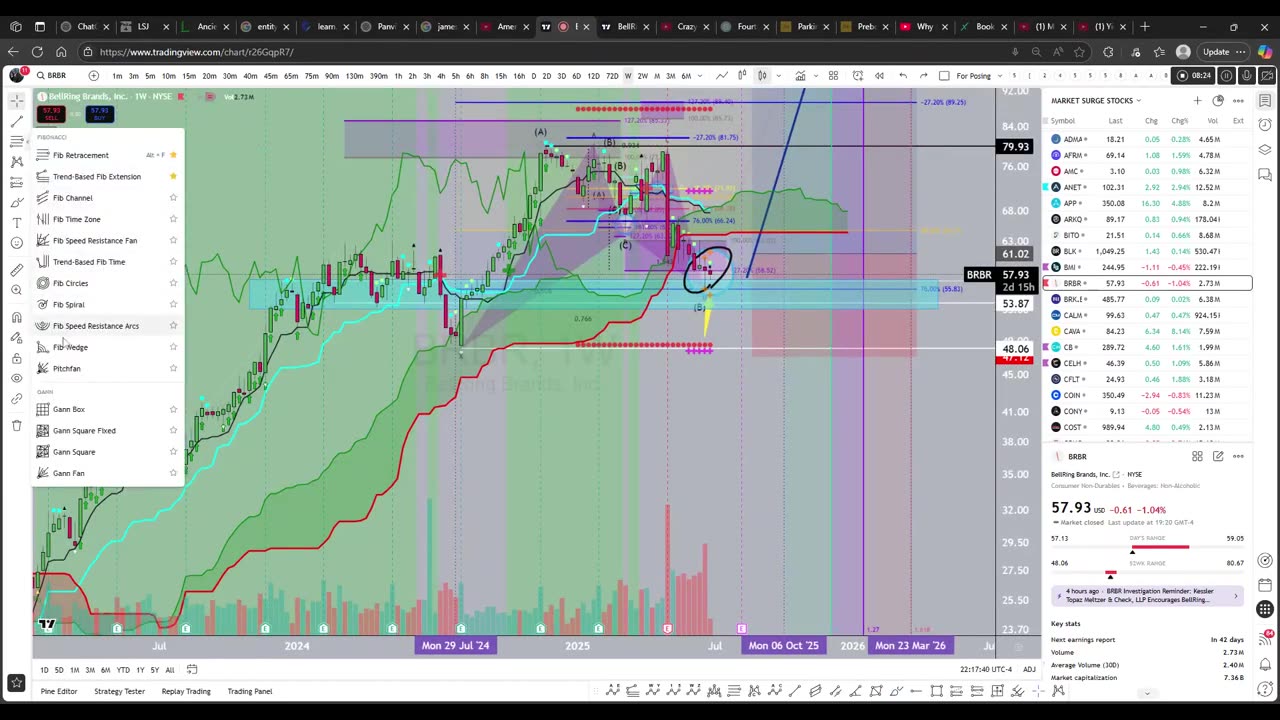

BellRing Brands (BRBR) - Gartley Pattern + Kijun Confluence

BellRing Brands (BRBR) Stock Analysis (video version):

In March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters.

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com/news/bellring-brands-reports-results-second-quarter-2025-affirms.

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

-

2:39:04

2:39:04

TimcastIRL

9 hours agoMarijuana LEGALIZATION IS COMING, Trump Orders Weed To Schedule 3 In HUGE Move | Timcast IRL

118K100 -

2:02:44

2:02:44

megimu32

9 hours agoON THE SUBJECT: CHRISTMAS CORE MEMORIES

51.2K6 -

2:16:09

2:16:09

DLDAfterDark

7 hours ago $4.77 earnedThe Very Merry HotDog Waffle Christmas Stream! Gun Talk - God, Guns, and Gear

44.2K8 -

1:19:51

1:19:51

Tundra Tactical

19 hours ago $16.82 earnedThursday Night Gun Fun!!! The Worlds Okayest Gun Show

68.3K -

55:11

55:11

Sarah Westall

1 day agoHumanity Unchained: The Awakening of the Divine Feminine & Masculine w/ Dr. Brianna Ladapo

50.3K5 -

1:42:41

1:42:41

Glenn Greenwald

13 hours agoReaction to Trump's Primetime Speech; Coldplay "Adultery" Couple Reappears for More Shame; Australia and the UK Obey Israel's Censorship Demands | SYSTEM UPDATE #560

167K105 -

2:46:41

2:46:41

Barry Cunningham

11 hours agoBREAKING NEWS: President Trump Signs The National Defense Authorization Act | More News!

72.1K34 -

43:10

43:10

Donald Trump Jr.

13 hours agoThe Days of Destructive DEI are Over, Plus Full News Coverage! | TRIGGERED Ep.301

127K103 -

52:07

52:07

BonginoReport

12 hours agoThe Internet Picks Bongino’s FBI Replacement - Nightly Scroll w/ Hayley Caronia (Ep.200)

119K98 -

55:30

55:30

Russell Brand

14 hours agoStay Free LIVE from AmFest — Turning Point USA - SF665

144K14