Premium Only Content

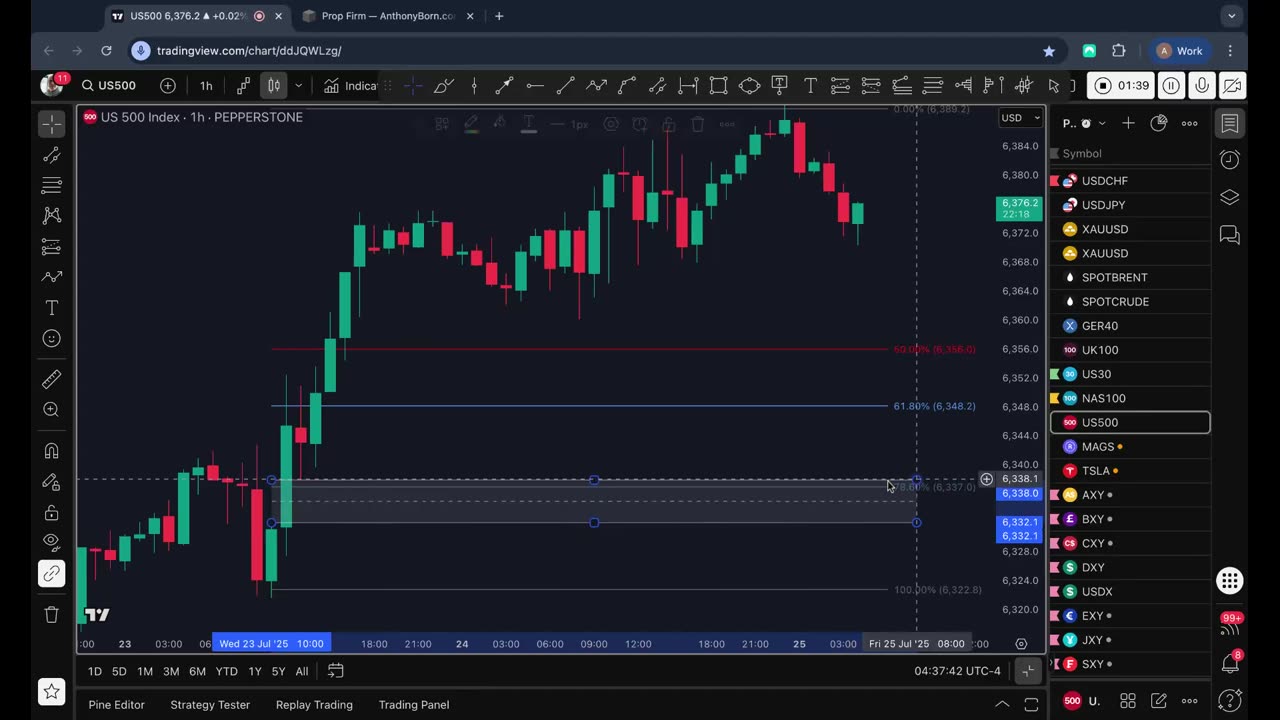

S&P 500 Counter-Trend Setup After Bullish Week US500

Currently watching the S&P 500 (US500) closely 👀. The index has been in a strong bullish trend 📈, but I’m now evaluating a potential counter-trend opportunity.

Given the strength we’ve seen this week — possibly a “foolish rally” — there’s a chance we’ve either printed or are close to printing the high of the week 🧱. That opens the door for a retracement setup, particularly as we head into Monday’s open 🗓️.

🧠 Trade idea: If we get a bearish market structure break, I’ll be looking to enter short — targeting a 1R take profit initially, and holding a portion for a 2R–3R extension 🎯.

Friday sessions, especially after strong trends, often present clean intraday pullbacks — and when Monday’s low is set early, it can trap late buyers and fuel the move 📉.

⚠️ This is not financial advice — just sharing my thought process and trade plan.

3 days ago

Trade closed: target reached

Nice outcome

-

UPCOMING

UPCOMING

Badlands Media

5 hours agoBadlands Daily: November 3, 2025

3.84K1 -

LIVE

LIVE

Wendy Bell Radio

5 hours agoThings Will Get Worse Before They Get Better

7,802 watching -

1:08:17

1:08:17

Chad Prather

8 hours agoHow to Get Along With People You Don’t Even Like (Most of the Time)

49.3K13 -

1:45:29

1:45:29

MTNTOUGH Podcast w/ Dustin Diefenderfer

7 hours agoTaya + Colton Kyle: Can American Marriages Survive 2025? | MTNPOD #140

95 -

1:12:23

1:12:23

The Bold Lib

15 hours agoSay Something Beyond W/MikeMac: JOKER - Ep.12

50 -

LIVE

LIVE

LFA TV

15 hours agoLIVE & BREAKING NEWS! | MONDAY 11/3/25

3,382 watching -

1:30:13

1:30:13

Game On!

13 hours ago $6.64 earnedChiefs Dynasty OVER, New Longest FG RECORD, and Patriots Are Winning The Super Bowl!

18.1K2 -

LIVE

LIVE

The Bubba Army

3 days agoIS AMERICA OVER TRUMP? - Bubba the Love Sponge® Show | 11/03/25

1,541 watching -

48:57

48:57

Man in America

18 hours agoThe Sinister Reason They Put Fluoride in Everything w/ Larry Oberheu

362K99 -

1:06:56

1:06:56

Sarah Westall

15 hours agoAstrological Predictions, Epstein & Charlie Kirk w/ Kim Iversen

99.8K71