Premium Only Content

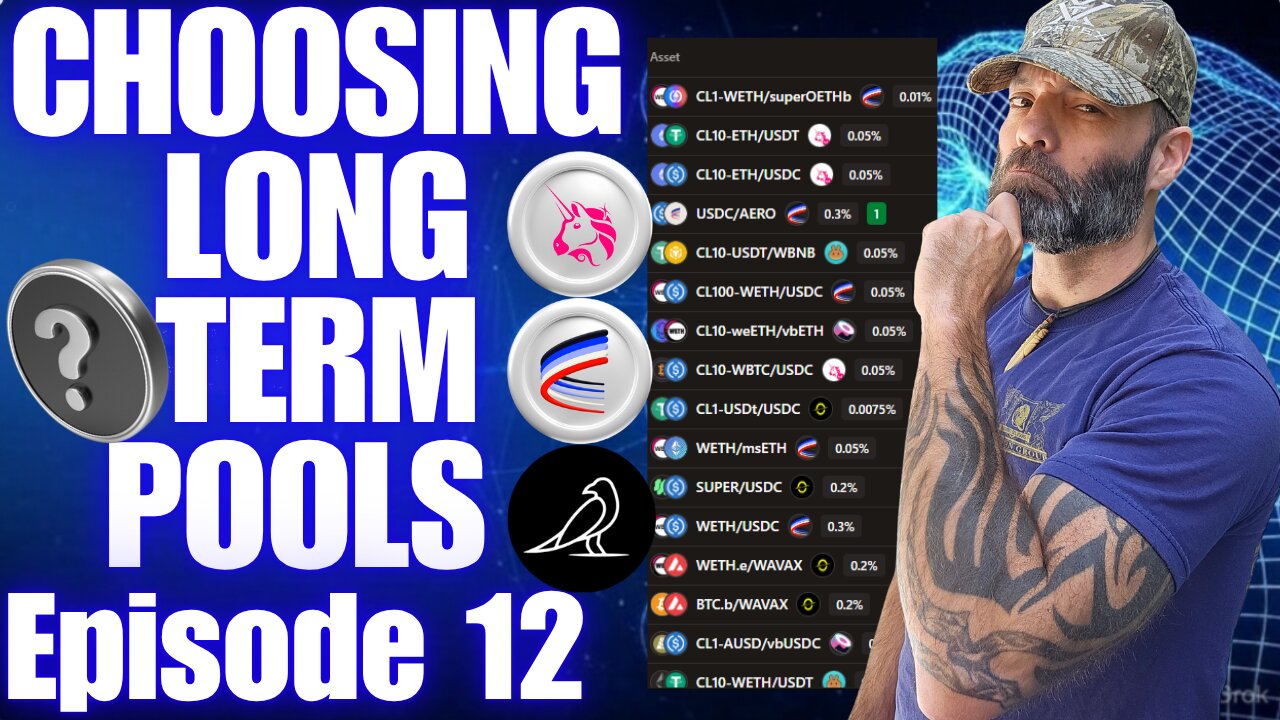

Ultimate Guide to Long-Term DeFi Pools (Maximize Your Crypto Yields!)

Looking to build long-term passive income in crypto? In this video, we break down how to choose the best long-term DeFi liquidity pools for consistent yield, capital preservation, and sustainable growth. Whether you're farming with stablecoins, staking altcoins, or providing liquidity on decentralized exchanges, understanding how to evaluate pools is essential in 2025’s evolving crypto landscape.

We’ll walk through key metrics like APR vs. APY, TVL (Total Value Locked), protocol reliability, token incentives, and impermanent loss risks so you can make smart, data-driven decisions in DeFi. This is your roadmap to identifying high-quality liquidity pools across Ethereum, Arbitrum, Optimism, Solana, and Base.

Learn how to filter through the noise and avoid short-term pumps in favor of long-term crypto yield strategies. We’ll cover liquidity pool design, protocol incentives, real yield mechanics, and how to assess tokenomics of reward tokens like CRV, AERO, VELO, PENDLE, and more.

Whether you’re a seasoned DeFi investor or just diving into decentralized finance, we’ll break down:

How to evaluate the long-term viability of a DeFi liquidity pool

What metrics indicate sustainability and profitability

How to spot DeFi protocols with strong fundamentals

Why some altcoin pools outperform over time

How DeFi platforms structure incentives and fees

Which pools are best for stablecoin farming vs. altcoin exposure

Risks of impermanent loss and how to minimize them

We’ll also touch on real-world examples like Pendle Finance, Aerodrome, Velodrome, and Uniswap V3 to show how smart liquidity providers position themselves for long-term yield. By the end, you'll have a checklist for choosing liquidity pools that align with your crypto investment goals.

This is a must-watch for anyone following crypto news, bitcoin trends, and DeFi investing in 2025. As the market matures and real yield replaces inflationary incentives, it’s never been more important to understand how to choose the right pools that generate returns without exposing you to unnecessary risk.

📈 If you're serious about long-term wealth building through DeFi, smash that like button, subscribe for weekly crypto updates, and drop a comment below with your favorite yield farms or protocols!

-

1:10:39

1:10:39

Defi Crypto & Airdrops

3 months ago🔥DeFi Experts Reveal SIMPLE Strategies (Anyone Can Use!)

471 -

5:26:18

5:26:18

Akademiks

9 hours agoEbro has MELTDOWN after Drake tells him to *** SLOWLY! Radio Over? NLE vs Youngboy part 805?

39.8K -

1:35:27

1:35:27

Inverted World Live

10 hours agoLost Satellites, Wild Horses, and 3i/Atlas

154K6 -

2:53:42

2:53:42

TimcastIRL

9 hours agoCandace Owens IMPLODES, Audience IN REVOLT, Claim SHES A CLONE Or GOT THE CALL | Timcast IRL

295K221 -

2:49:53

2:49:53

Barry Cunningham

9 hours agoLIVE BREAKING NEWS: President Trump Celebrates Hanukkah! And More News

74.6K14 -

1:29:40

1:29:40

Anthony Rogers

16 hours agoEpisode 394 - Isaac Butterfield

38.3K1 -

8:02

8:02

China Uncensored

15 hours agoChina Just Took The First Step Towards WAR

48.9K25 -

1:20:04

1:20:04

Flyover Conservatives

1 day agoWhy Did Jesus Really Come? It’s NOT What You Think - Pedro Adao | FOC Show

43.8K4 -

2:18:25

2:18:25

DLDAfterDark

7 hours ago $4.36 earnedYo Homie! Is That My Briefcase?? EDC & Gun Talk - Blue Waffle Giveaway Pre Stream

37.1K4 -

1:34:23

1:34:23

Glenn Greenwald

11 hours agoSydney Shooting Exploited for Pro-Israel Censorship and Anti-Muslim Crackdowns; How Media DEI Was the Opposite of Diversity | SYSTEM UPDATE #559

146K135