Premium Only Content

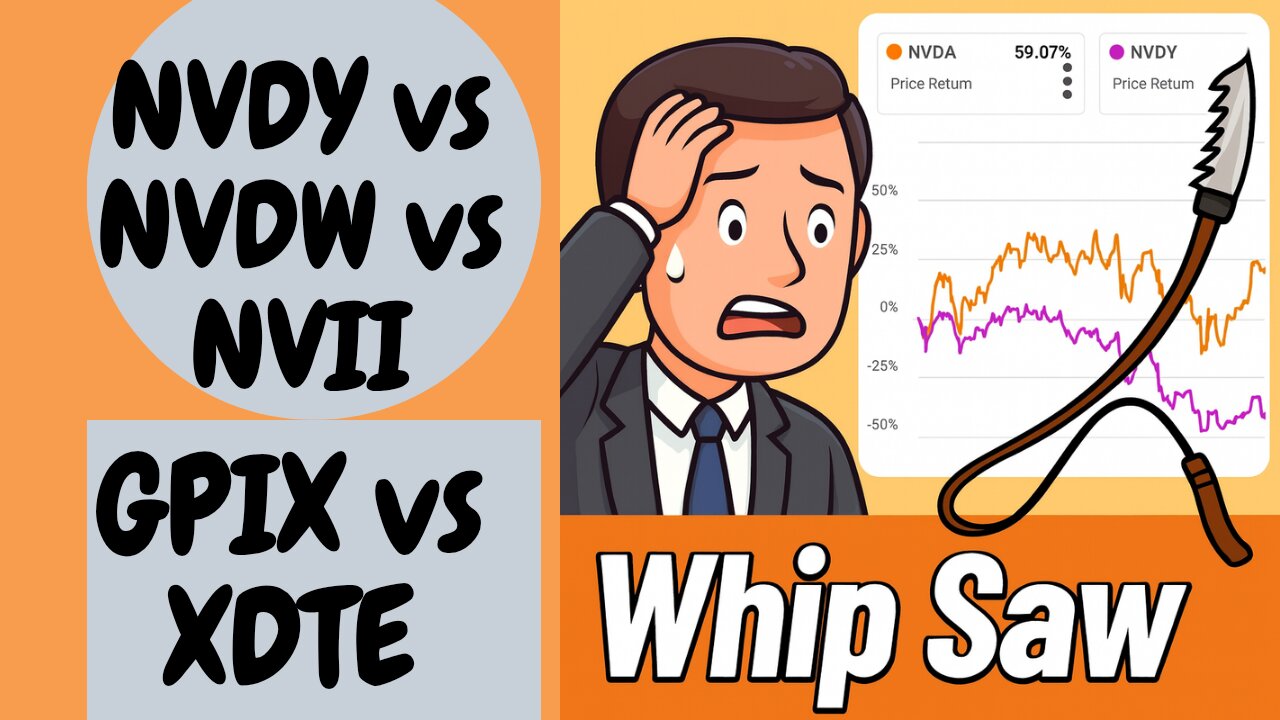

NVDY vs NVDW vs NVII: & GPIX vs. XDTE. Who performs best in a bear market.

Whipsaw can devastate covered call strategies—especially in volatile names like Nvidia. In this breakdown, we compare NVDY, NVDW, and NVII to see which one protected you best. Plus, we pit GPIX vs XDTE in a battle of risk control and upside capture. Who came out on top?

#CoveredCalls #WhipsawProtection #NVDY #NVDW #NVII #GPIX #XDTE #ETFComparison #DividendInvesting

Video on BLOX ETF

https://youtu.be/dtzUi_ait6g

Video on whipsaw:

https://youtu.be/mVh-CZScyok?si=jUnXLnhAfUMuZfHS

VIdeo on Volatility Drag and Path Dependence

https://youtu.be/hiJcpHQ9pnA?si=qgavnoi4Ogvb0d9z

Discord

https://discord.gg/zcp7Z3MtfC

Disclaimer: This is my personal journey, and markets can change, and results can vary drastically. Also, I have only been in these for a short period of time, who is to say it would continue to work out. Disclaimer: I am NOT a financial advisor. This is for entertainment purposes only. Please speak with a financial advisor, accountant, and lawyer and do your own due diligence before making any investment decisions. Please use your own judgment and take your own risks when investing. Past performance is not indicative of future gains.

The content may be incorrect, inaccurate, contain errors, subject to interpretation, situational, or not hold up in the long term.

-

1:52:46

1:52:46

Side Scrollers Podcast

20 hours agoNintendo Fans Are PISSED at Craig + Netflix BUYS Warner Bros + VTube DRAMA + More | Side Scrollers

74.7K5 -

18:43

18:43

Nikko Ortiz

14 hours agoWorst Karen Internet Clips...

8.72K3 -

11:23

11:23

MattMorseTV

15 hours ago $13.37 earnedTrump just RAMPED IT UP.

19.1K55 -

46:36

46:36

MetatronCore

2 days agoHasan Piker at Trigernometry

12.2K2 -

29:01

29:01

The Pascal Show

17 hours ago $2.40 earnedRUNNING SCARED! Candace Owens DESTROYS TPUSA! Are They Backing Out?!

11.6K14 -

6:08:30

6:08:30

Dr Disrespect

19 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - FREE LOADOUT EXPERT

65.5K7 -

2:28:08

2:28:08

PandaSub2000

1 day agoMyst (Part 1) | MIDNIGHT ADVENTURE CLUB (Edited Replay)

32.3K -

21:57

21:57

GritsGG

1 day agoBO7 Warzone Patch Notes! My Thoughts! (Most Wins in 13,000+)

39K -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

699 watching -

7:51

7:51

Comedy Dynamics

6 days agoLife on Lake Erie - Bill Squire stand-up comedy

76.8K3