Premium Only Content

Commercial Real Estate with Carson Jones

Rate Hikes Have Wiped Out Construction: Cash Out or Ride the Wave?

Jerome Powell’s rate hikes have slashed new construction starts by ~60% since 2021, shaking up industrial and multifamily markets. Opportunities await savvy owners.

Multifamily:

Oversupply from 2021–22 projects softens rents, but tightening supply signals rent growth by 2026.

Industrial:

With ~5% Class A vacancy and slowing construction, rent growth looms in 2025.

For under-leveraged owners, now’s the time to act:

• Less competition for tenants

• Stronger rent growth potential

• Stable asset values

Your move?

• Sell: Cash out in high-demand markets.

• Hold: Wait for rent and value gains.

• Reposition: Upgrade to capture higher rents.

Commercial Real Estate with Carson Jones, Nashville Metro Tennessee

-

31:11

31:11

Carson's Corner: Commercial Real Estate

2 months agoCarson's Corner:Chris Maier | Contractors, Closers & Connections (CCC)

41 -

LIVE

LIVE

Grant Cardone

3 hours agoHow to Find Your First $1million Profit In Real Estate

2,531 watching -

54:54

54:54

iCkEdMeL

1 hour ago $16.26 earned🔴 BREAKING: Gunman Opens Fire at Tim Pool’s Home

21.5K18 -

LIVE

LIVE

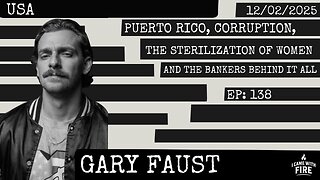

I_Came_With_Fire_Podcast

11 hours agoPuerto Rico, Corruption, Ther Sterilization of Women, and the Bankers Behind it All

536 watching -

![Mr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18](https://1a-1791.com/video/fwe2/96/s8/1/w/U/W/F/wUWFz.0kob-small-Mr-and-Mrs-X-DS-Pushing-Div.jpg) 54:40

54:40

X22 Report

5 hours agoMr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18

96.6K23 -

LIVE

LIVE

ttvglamourx

2 hours ago $1.78 earnedHAPPY SATURDAY !DISCORD

203 watching -

18:53

18:53

Wrestling Flashback

23 days ago $9.41 earned10 WWE Wrestlers Who Ruined Their Bodies Wrestling Too Long

29.3K4 -

LIVE

LIVE

Amarok_X

3 hours ago🟢LIVE WARZONE | LETS SQUAD UP | PREMIUM CREATOR | VETERAN GAMER

177 watching -

27:03

27:03

The Kevin Trudeau Show Limitless

3 days agoThey're Not Hiding Aliens. They're Hiding This.

62.9K88 -

22:17

22:17

MetatronGaming

6 days agoI spent 7 days in the 1980s

25.1K8