Premium Only Content

HB 103

"✅ TEXAS JUST PASSED HB 103 — AND FOR ONCE, IT’S A BILL THAT PUTS THE PEOPLE IN THE KNOW, NOT IN THE DARK

We hear a lot about property taxes, bond elections, and local debt—but most Texans have no idea where to look for real answers.

HB 103 changes that.

Here’s what it does:

It creates a statewide database, run by the Texas Comptroller, that shows exactly how much each local taxing unit (like school districts and cities) is taxing, borrowing, and spending—going all the way back to 2015.

You’ll be able to see:

✅ The exact language used in tax and bond elections

✅ How each bond is being paid off

✅ What projects the borrowed money is funding

✅ Whether your school district or city is quietly raising tax rates year over year

✅ How your tax rate compares to what voters actually approved

Why this matters:

For decades, bond transparency in Texas has been a patchwork mess. If you wanted to know how your district spent the last $50 million it borrowed? Good luck digging through agendas or PDFs.

Now? That info will be searchable, sortable, and public—for every taxing entity in the state.

It sounds simple. But here’s why it’s powerful:

📊 You can finally track the real cost of “yes” votes on bond elections.

📉 You can compare adopted tax rates to voter-approved limits.

🧾 You can see whether local governments are paying off debt—or quietly stacking more on top.

🕵️ You can catch when “new projects” are really just bond refinances with no oversight.

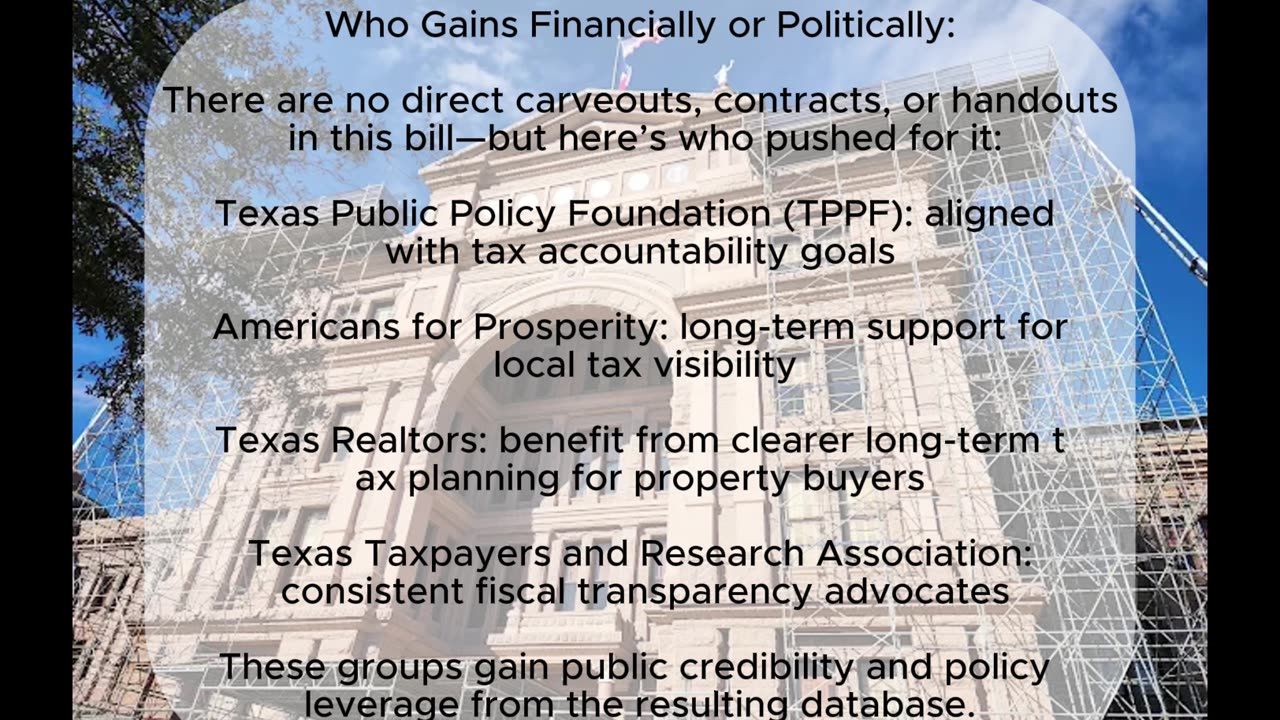

And here’s who pushed for it:

Texas Public Policy Foundation

Americans for Prosperity

Texas Realtors

Texas Taxpayers and Research Association

These aren’t exactly grassroots groups—but for once, their push for fiscal transparency aligns with something the public truly needs.

What Texans get out of it:

🧠 Clarity.

🧮 Context.

🗳️ A better way to vote in local elections—not based on slogans, but on hard numbers.

And here’s the kicker:

The database will include historical data back to 2015, so you can trace how much debt your city, school district, or county has built up over the past decade.

So what’s the catch?

Not much—yet. But we’ll need to watch a few things:

⚠️ Will local governments actually comply, or drag their feet?

⚠️ Will future Legislatures try to use this data to justify blanket tax caps?

⚠️ Will the database stay public and easy to use—or get buried behind tech contracts and budget excuses?

Bottom line:

HB 103 gives regular Texans a chance to understand—and question—the numbers behind local taxes and debt. That’s a win for voters, watchdogs, and anyone trying to hold their local leaders accountable.

Let’s make sure this tool doesn’t get ignored.

✅ #HB103 #TaxTransparency #KnowBeforeYouVote #TexasPolicy"

-

2:28:37

2:28:37

putther

3 hours ago $1.84 earned⭐ Bounty Hunting on GTA⭐

20.8K1 -

LIVE

LIVE

Total Horse Channel

1 day agoAMHA 2025 9/20

540 watching -

1:53:15

1:53:15

I_Came_With_Fire_Podcast

15 hours agoThe Satanic Cults Convincing Kids to Commit Violence

52.5K17 -

![Mr & Mrs X - [DS] Created Antifa To Push An Insurgency In This Country - Ep 8](https://1a-1791.com/video/fww1/f9/s8/1/k/f/O/j/kfOjz.0kob-small-Mr-and-Mrs-X-DS-Created-Ant.jpg) 1:02:13

1:02:13

X22 Report

8 hours agoMr & Mrs X - [DS] Created Antifa To Push An Insurgency In This Country - Ep 8

160K56 -

1:13:24

1:13:24

Wendy Bell Radio

12 hours agoPet Talk With The Pet Doc

58.2K44 -

1:19:30

1:19:30

Game On!

1 day ago $12.04 earnedCollege Football Week 4 Betting Preview!

168K5 -

26:04

26:04

Artur Stone Garage

4 days ago $2.94 earned$500 Civic: Will It EVER Drive Without Breaking Down?

47.8K17 -

31:44

31:44

SouthernbelleReacts

2 days ago $4.58 earned“E.T. Phone Home! 🛸 Emotional Mom Style Reaction to E.T. the Extra-Terrestrial (1982)”

59.6K6 -

20:10

20:10

JohnXSantos

1 day ago $2.17 earnedI Built a FAKE Luxury Brand With $100 In 7 Days

44.8K4 -

25:24

25:24

marcushouse

9 hours ago $3.48 earnedStarship Test Trouble… and Block 3 Finally Unveiled! 🤯

44K10