Premium Only Content

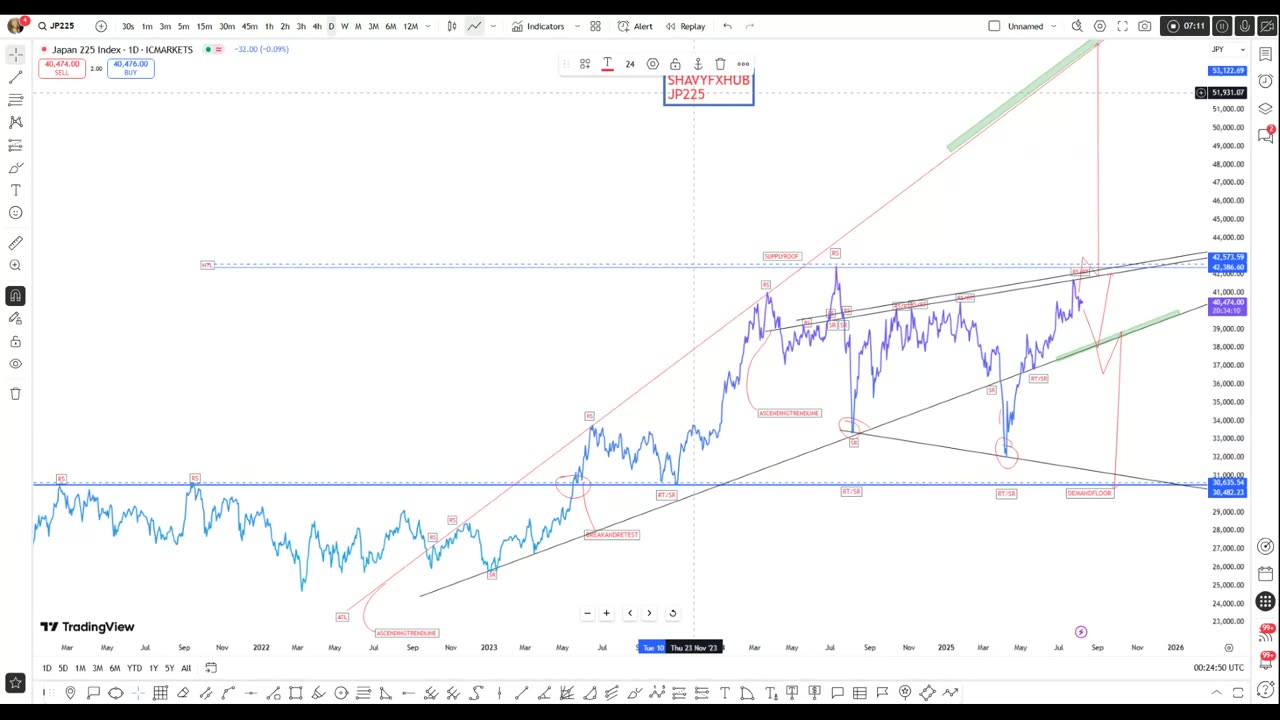

JP225 NIKKEI225

JP225 (Nikkei 225) Iis down by few popints and This recent downturn has been driven by global concerns, especially U.S. tariff escalations, a weaker-than-expected U.S. jobs report, and caution ahead of Bank of Japan policy updates. Major Japanese sectors such as technology, financials, and industrials have seen notable declines.

Despite this short-term dip, the index remains up about 2.5% in the past month and nearly 29% over the past year, reflecting powerful momentum in Japanese equities for 2025. The most recent all-time high was near 42,438 (July 2024), and the index is still trading near historic highs.

Technical and Market Drivers

Recent Volatility: Linked to external (U.S. tariffs, global growth) and internal (BOJ policy, earnings) factors.

Sector Weakness: Tech stocks (e.g., Advantest), financials (Mitsubishi UFJ), and heavyweight exporters (Toyota, Hitachi) have led the latest decline.

Sentiment: Investors are awaiting key signals from the Bank of Japan and further clarity on global trade and monetary policy developments.

Future Outlook for Nikkei 225

Short-Term:

The near-term outlook remains cautious. Analysts and forecasters expect the JP225 could see continued volatility, potentially testing support near 39,000–40,000, especially if global risk sentiment remains weak or BOJ signals tighter policy. However, the underlying fundamental backdrop—strong Japanese corporate earnings, robust foreign investment inflows, and yen weakness supporting exporters—still lends medium-term support.

Medium- and Long-Term:

Forecasts for End-2025: Consensus among strategists suggests potential for new highs by year-end. Some projections see the index reaching 44,000–45,400 or higher, especially if global and regional macroeconomic conditions stabilize and earnings growth persists.

Risks and Catalysts:

Global risk: Further U.S. tariff escalation, slowing global growth, or a sharp downturn in tech could weigh heavily.

Domestic support: Positive corporate governance reforms, sustained share buybacks, tax cut proposals, and improved domestic consumption are likely to underpin strength.

BOJ Policy: Changes in Bank of Japan monetary settings are a key source of both risk and potential upside; continued loose policy would be bullish, while unexpected tightening could trigger corrections.

#jp225 #japan #stocks

-

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

188 watching -

8:04

8:04

Hollywood Exposed

13 hours agoKISS Singer DESTROYS Reporter Over Anti-Trump Question

11.5K7 -

2:13:57

2:13:57

Badlands Media

1 day agoDevolution Power Hour Ep. 419: Fraud Fatigue and the Illusion of Permission

396K29 -

56:04

56:04

Man in America

13 hours agoChina Just Broke the Banking Cartel’s Grip on Silver — Is the Reset Entering Its Finale?

86.1K53 -

1:31:48

1:31:48

Tundra Tactical

16 hours ago $26.59 earned🚨🚨 Live At 9 pm : 5 Years And Over 400 Episodes What Should We Do Next? Favorite Kit Of The Year

59.5K5 -

10:20:57

10:20:57

SpartakusLIVE

14 hours agoGames w/ StevieT || HERDS of NERDS Flock to the #1 King of Content

243K17 -

10:37

10:37

MattMorseTV

17 hours ago $28.37 earnedThe Dems. just got BRUTAL NEWS.

77.8K96 -

3:26:45

3:26:45

megimu32

16 hours agoOFF THE SUBJECT: BODYCAMS + BLITZ BATTLES ⚡

49.5K22 -

22:24

22:24

MYLUNCHBREAK CHANNEL PAGE

1 day agoThe FOIA Request

159K80 -

6:50:55

6:50:55

BSparks Gaming

12 hours ago🔴 LIVE - ARC Raiders Flickering Flames Event GRIND

43.1K5