Premium Only Content

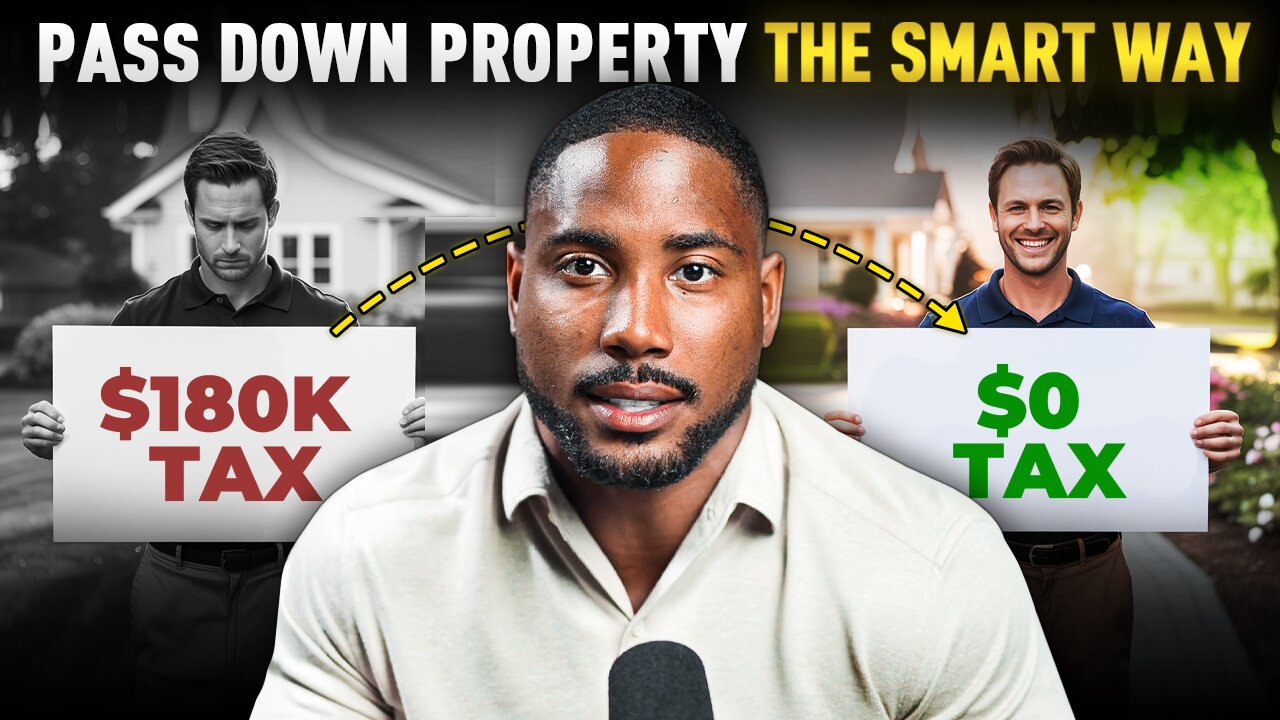

Passing Your Home Down to Your Heirs? Don't Make This Costly Mistake! (Step-Up in Basis Explained)

Book a Professional Tax Assessment Call ▶ https://start.taxalchemy.com/consultation?utm_source=youtube&utm_medium=description&utm_campaign=kd299_passing_home_to_heirs

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator?utm_source=youtube&utm_medium=description&utm_campaign=kd299_passing_home_to_heirs

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube&utm_medium=description&utm_campaign=kd299_passing_home_to_heirs

We earn commissions when you shop through the links below.

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

Discover the smartest way to pass your home to your heirs without costing them a fortune in taxes! In this video, we dive deep into the step-up in basis, a critical tax rule that can save your children or heirs from paying massive capital gains taxes. Learn why gifting your home before you die could be a costly mistake and how waiting until after your passing can slash your heirs’ tax bill to zero.

In this video, tax expert Karlton Dennis explains everything you need to know about how step-up in basis works. He uses an example of a person inheriting a $1 million home to break down the tax differences between gifting now versus inheriting later, showing you how to save nearly $200,000 in taxes.

Whether you own a primary residence or rental property, this video is packed with actionable tips to optimize your estate plan. Considering the fact that understanding how step-up in basis works could literally save your heirs tens or even hundreds of thousands of dollars if you are a homeowner, this is one that you don’t want to miss.

CHAPTERS:

0:00 Intro

0:25 The Homeowner’s Dilemma

1:34 What Is "Step-Up in Basis"

4:06 Passing a $1 Million Home Before Death vs. After Death Example

4:48 Scenario 1: Giving the Home to Jake Before Sarah Dies

5:41 Scenario 2: Jake Inherits the Home After Sarah Dies

6:42 Sarah’s Last Gift to Her Son

7:34 Does Step-Up in Basis Apply to Rental Properties?

7:51 How to Plan Wisely

8:32 Conclusion

9:04 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#stepupinbasis #estateplanning #realestate

-

10:17

10:17

Karlton Dennis

9 days agoThis Oil Rig Can Lower Your Tax Bill! Here's How...

12 -

LIVE

LIVE

LFA TV

3 hours agoLIVE & BREAKING NEWS! | THURSDAY 10/2/25

5,796 watching -

UPCOMING

UPCOMING

Chad Prather

13 hours agoWhen God Delays: Trusting Jesus in the Waiting Room of Life

14.8K5 -

LIVE

LIVE

The Chris Salcedo Show

12 hours agoThe Democrat's Schumer Shutdown

712 watching -

30:32

30:32

Game On!

17 hours ago $2.26 earned20,000 Rumble Followers! Thursday Night Football 49ers vs Rams Preview!

15K3 -

1:26

1:26

WildCreatures

14 days ago $2.17 earnedCow fearlessly grazes in crocodile-infested wetland

14.1K3 -

29:54

29:54

DeVory Darkins

1 day ago $14.95 earnedHegseth drops explosive speech as Democrats painfully meltdown over Trump truth social post

63.7K76 -

19:39

19:39

James Klüg

1 day agoAnti-Trump Protesters Threaten To Pepper Spray Me For Trying To Have Conversations

26.8K25 -

34:54

34:54

MattMorseTV

14 hours ago $27.95 earned🔴Trump just FIRED 154,000 FEDERAL WORKERS. 🔴

82.1K109 -

2:03:32

2:03:32

Side Scrollers Podcast

22 hours agoMASSIVE Netflix Boycott + The TRUTH About Jimmy Kimmel’s Return + BIG Side Scrollers NEWS

45.9K18